- United States

- /

- Biotech

- /

- NasdaqGM:NTLA

The Intellia Therapeutics (NASDAQ:NTLA) Share Price Is Down 44% So Some Shareholders Are Getting Worried

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the Intellia Therapeutics, Inc. (NASDAQ:NTLA) share price is down 44% in the last year. That falls noticeably short of the market return of around 6.6%. Notably, shareholders had a tough run over the longer term, too, with a drop of 34% in the last three years. Shareholders have had an even rougher run lately, with the share price down 10% in the last 90 days.

View our latest analysis for Intellia Therapeutics

Intellia Therapeutics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Intellia Therapeutics saw its revenue grow by 22%. We think that is pretty nice growth. Unfortunately that wasn't good enough to stop the share price dropping 44%. You might even wonder if the share price was previously over-hyped. However, that's in the past now, and it's the future that matters most.

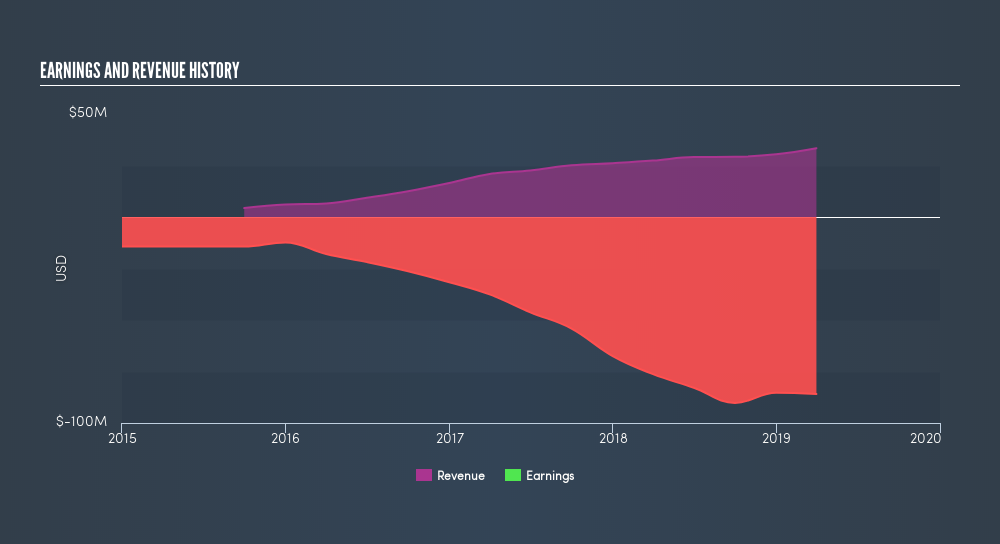

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Intellia Therapeutics stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

The last twelve months weren't great for Intellia Therapeutics shares, which cost holders 44%, while the market was up about 6.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 13% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Intellia Therapeutics by clicking this link.

Intellia Therapeutics is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:NTLA

Intellia Therapeutics

A clinical-stage gene editing company, focuses on the development of curative genome editing treatments.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives