- United States

- /

- Life Sciences

- /

- NasdaqCM:NOTV

Positive Sentiment Still Eludes Inotiv, Inc. (NASDAQ:NOTV) Following 28% Share Price Slump

Inotiv, Inc. (NASDAQ:NOTV) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The last month has meant the stock is now only up 6.4% during the last year.

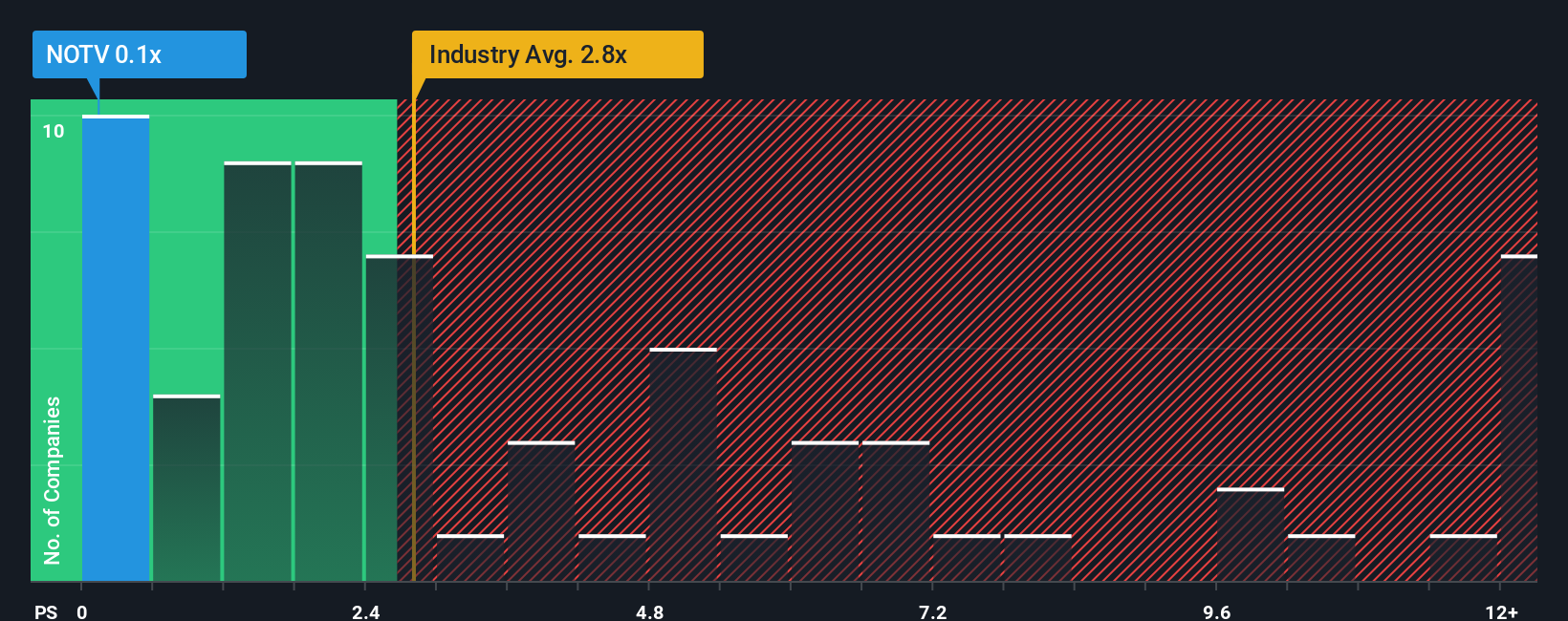

Following the heavy fall in price, Inotiv may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Life Sciences industry in the United States have P/S ratios greater than 2.8x and even P/S higher than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Inotiv

How Has Inotiv Performed Recently?

Inotiv could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Inotiv.How Is Inotiv's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Inotiv's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. Even so, admirably revenue has lifted 73% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 6.6% each year over the next three years. That's shaping up to be similar to the 7.2% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Inotiv's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Inotiv's P/S

Shares in Inotiv have plummeted and its P/S has followed suit. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Inotiv's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 5 warning signs for Inotiv you should be aware of, and 2 of them are concerning.

If you're unsure about the strength of Inotiv's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NOTV

Inotiv

Provides nonclinical and analytical drug discovery and development services to the pharmaceutical and medical device industries in the United States, the Netherlands, and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives