- United States

- /

- Pharma

- /

- NasdaqCM:NKTR

Why Nektar Therapeutics (NKTR) Is Up 8.8% After Positive Phase 2b Rezpegaldesleukin Data at EADV

Reviewed by Sasha Jovanovic

- Nektar Therapeutics recently unveiled new data from the ongoing REZOLVE-AD Phase 2b study of rezpegaldesleukin, an IL-2 pathway agonist and Treg proliferator, at the 2025 European Academy of Dermatology and Venereology Congress in Paris, following this year's multiple FDA Fast Track designations for the therapy in atopic dermatitis and alopecia areata populations aged 12 and older.

- This combination of positive mid-stage clinical results and regulatory milestones highlights growing momentum for Nektar's leading immunology asset at major scientific forums, potentially enhancing its profile among prescribers, patients, and potential partners.

- We'll examine how the new positive Phase 2b data for rezpegaldesleukin presented at EADV affects Nektar Therapeutics' investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

Nektar Therapeutics Investment Narrative Recap

Owning shares in Nektar Therapeutics means believing that rezpegaldesleukin will achieve clinical and regulatory success in immunology, opening a path to a major commercial market. The newly released positive Phase 2b data at EADV offers incremental validation for this thesis, yet does not materially resolve Nektar’s most urgent catalyst, a late-stage partnership, out-licensing, or funding deal to address its persistent high operating losses and limited cash runway, which remains the largest risk for the company right now.

Among recent milestones, the FDA's Fast Track designations for rezpegaldesleukin in both atopic dermatitis and severe alopecia areata stand out as most relevant to the EADV data. These designations offer a potentially faster approval process, directly linking positive clinical developments like the new Phase 2b results to Nektar’s hopes for quicker commercialization and enhanced near-term investor confidence.

However, while momentum is building, investors should contrast the excitement of new trial data with the ongoing pressure from...

Read the full narrative on Nektar Therapeutics (it's free!)

Nektar Therapeutics' outlook forecasts $40.9 million in revenue and $9.5 million in earnings by 2028. This scenario assumes an annual revenue decline of 18.3% and an earnings increase of $131.8 million from current earnings of -$122.3 million.

Uncover how Nektar Therapeutics' forecasts yield a $101.17 fair value, a 67% upside to its current price.

Exploring Other Perspectives

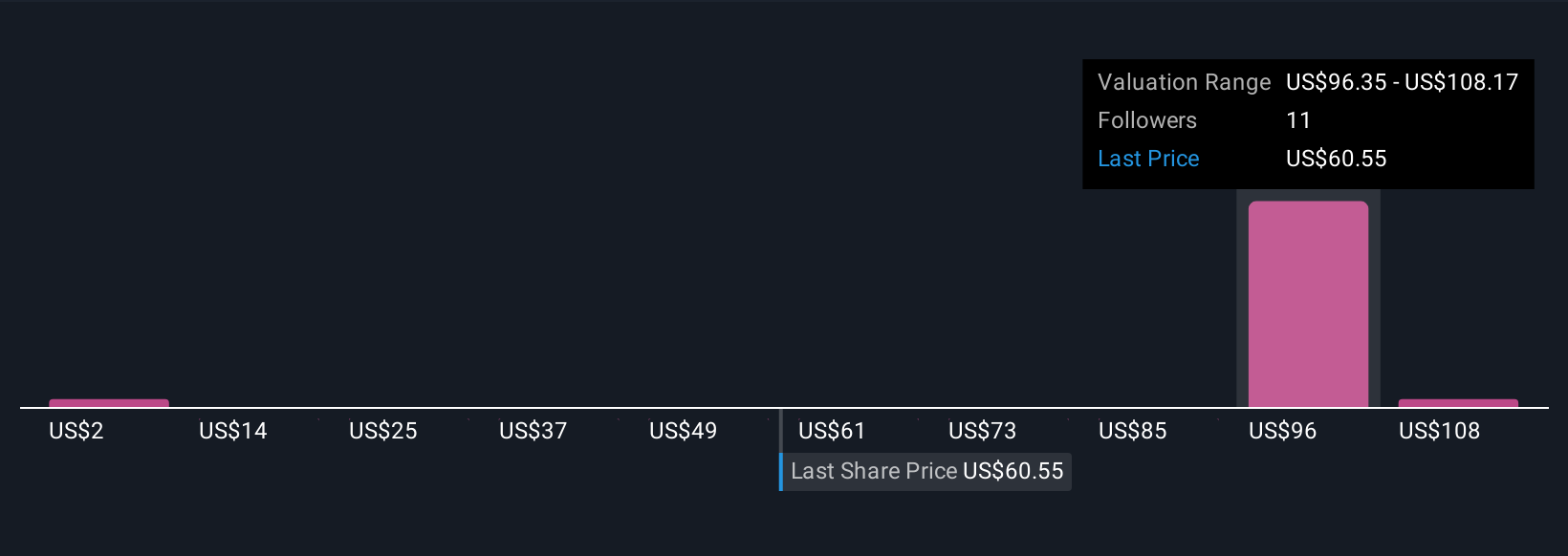

The Simply Wall St Community shared four fair value estimates for Nektar Therapeutics, ranging from US$1.74 to US$120 per share. Your view on the company’s long-term viability may be shaped by ongoing high cash burn and the need for new funding, see how others' perspectives compare before making up your mind.

Explore 4 other fair value estimates on Nektar Therapeutics - why the stock might be worth as much as 98% more than the current price!

Build Your Own Nektar Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nektar Therapeutics research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

- Our free Nektar Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nektar Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nektar Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NKTR

Nektar Therapeutics

A biopharmaceutical company, focuses on discovering and developing therapies that selectively modulate the immune system to treat autoimmune disorders in the United States and internationally.

Medium-low risk and overvalued.

Similar Companies

Market Insights

Community Narratives