- United States

- /

- Pharma

- /

- NasdaqCM:NKTR

Nektar Therapeutics (NKTR) Is Up 8.6% After Late-Breaking ACAAI Presentation for Rezpegaldesleukin – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Nektar Therapeutics announced that new data from the ongoing REZOLVE-AD Phase 2b study of rezpegaldesleukin in atopic dermatitis was accepted for a late-breaking oral presentation at the American College of Allergy, Asthma & Immunology (ACAAI) 2025 Annual Scientific Meeting in Orlando, which will take place in November 2025.

- This recognition highlights rezpegaldesleukin's potential as a first-in-class therapy and comes after the asset received FDA Fast Track designation for both atopic dermatitis and severe alopecia areata earlier in 2025.

- We'll examine how this late-breaking scientific recognition for rezpegaldesleukin may alter Nektar's investment narrative and future outlook.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Nektar Therapeutics Investment Narrative Recap

To hold Nektar Therapeutics stock, I believe you have to be confident in the company’s ability to successfully bring rezpegaldesleukin to market, despite being pre-commercial and consistently loss-making. While the acceptance of new REZOLVE-AD data for late-breaking presentation boosts scientific and industry validation, it does not materially reduce the central risk: near-term cash burn and ongoing dependence on future fundraising, partnerships, or out-licensing remain the key issues for shareholders right now.

The most relevant recent announcement is the FDA’s Fast Track designation for rezpegaldesleukin in both atopic dermatitis and severe alopecia areata, which aligns directly with REZOLVE-AD’s clinical milestones. This regulatory pathway may accelerate timelines and support upcoming data releases, representing a critical catalyst for eventual commercial viability and ongoing investor interest.

However, it’s important to remember that even high-profile scientific recognition won’t offset the challenge of limited cash reserves and funding risk if pipeline progress slows or...

Read the full narrative on Nektar Therapeutics (it's free!)

Nektar Therapeutics’ outlook anticipates $40.9 million in revenue and $9.5 million in earnings by 2028. This projection reflects an annual revenue decline of 18.3% and an earnings increase of $131.8 million from current earnings of -$122.3 million.

Uncover how Nektar Therapeutics' forecasts yield a $93.86 fair value, a 52% upside to its current price.

Exploring Other Perspectives

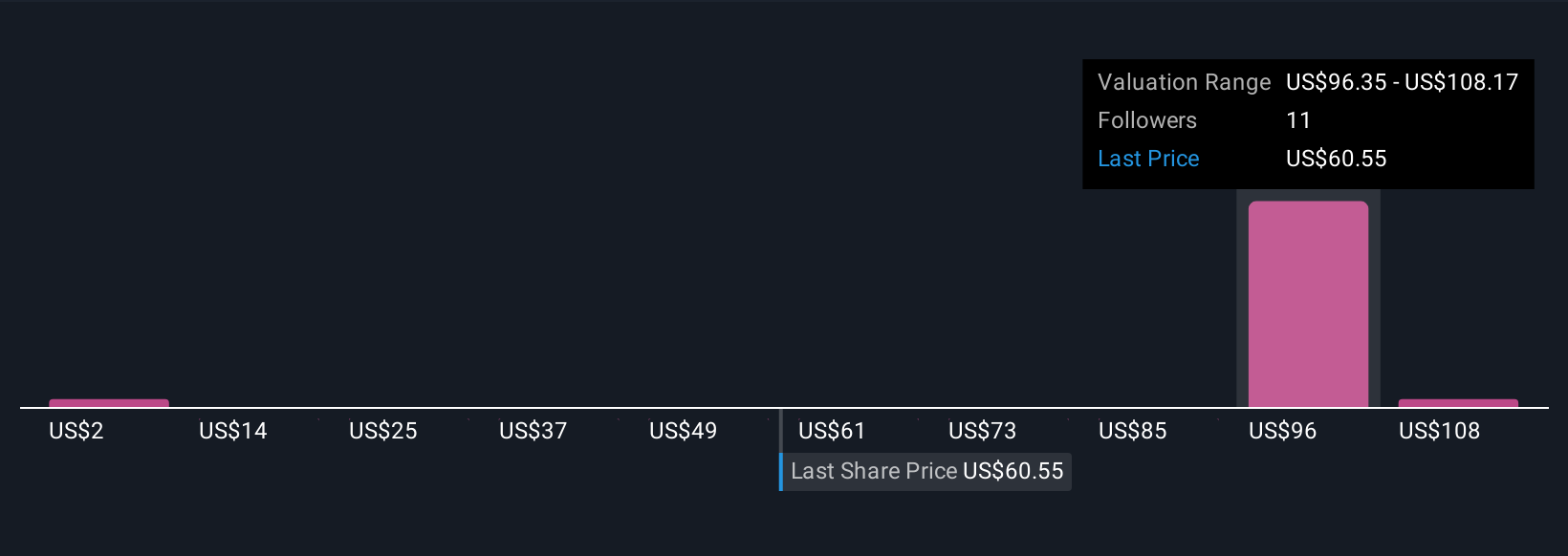

Four individual fair value estimates from the Simply Wall St Community range widely, from just US$1.74 to US$120 per share. While rezpegaldesleukin’s Fast Track status stands out as a positive catalyst, financial pressures and high development costs keep weighing on long-term performance, so it’s worth reviewing alternative opinions before forming your own view.

Explore 4 other fair value estimates on Nektar Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Nektar Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nektar Therapeutics research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

- Our free Nektar Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nektar Therapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nektar Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NKTR

Nektar Therapeutics

A biopharmaceutical company, focuses on discovering and developing therapies that selectively modulate the immune system to treat autoimmune disorders in the United States and internationally.

Medium-low risk with concerning outlook.

Similar Companies

Market Insights

Community Narratives