- United States

- /

- Pharma

- /

- NasdaqCM:NKTR

Lacklustre Performance Is Driving Nektar Therapeutics' (NASDAQ:NKTR) 34% Price Drop

To the annoyance of some shareholders, Nektar Therapeutics (NASDAQ:NKTR) shares are down a considerable 34% in the last month, which continues a horrid run for the company. The recent drop has obliterated the annual return, with the share price now down 5.1% over that longer period.

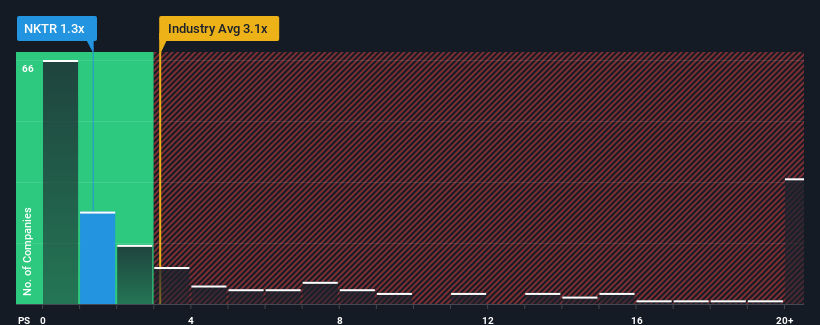

Since its price has dipped substantially, Nektar Therapeutics may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.3x, considering almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 3.1x and even P/S higher than 14x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Nektar Therapeutics

What Does Nektar Therapeutics' P/S Mean For Shareholders?

Nektar Therapeutics could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Nektar Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Nektar Therapeutics' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Nektar Therapeutics' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.5%. However, this wasn't enough as the latest three year period has seen an unpleasant 7.2% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue growth is heading into negative territory, declining 2.3% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 23% per annum.

In light of this, it's understandable that Nektar Therapeutics' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Nektar Therapeutics' P/S

The southerly movements of Nektar Therapeutics' shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Nektar Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 3 warning signs for Nektar Therapeutics (1 is a bit unpleasant!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nektar Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NKTR

Nektar Therapeutics

A biopharmaceutical company, focuses on discovering and developing therapies that selectively modulate the immune system to treat autoimmune disorders.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives