- United States

- /

- Biotech

- /

- NasdaqGS:NBIX

Strong Earnings and Pipeline Progress Could Be a Game Changer for Neurocrine Biosciences (NBIX)

Reviewed by Simply Wall St

- Neurocrine Biosciences recently reported its second quarter 2025 earnings, posting US$687.5 million in revenue and US$107.5 million in net income, both higher than the same period last year, and announced the termination of a Phase 2 trial for NBI-921352 due to insufficient efficacy.

- Despite this clinical development setback, the company’s lead pipeline programs remain on track and earnings momentum has drawn continued positive attention from industry analysts.

- We'll explore how strong earnings and confidence in Neurocrine Biosciences' pipeline after the Phase 2 trial result reshape the investment narrative.

Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

Neurocrine Biosciences Investment Narrative Recap

To invest in Neurocrine Biosciences, a shareholder needs confidence in the company’s ability to deliver consistent revenue and earnings growth, driven by its lead pipeline programs and continued product adoption. The recent termination of a Phase 2 trial for NBI-921352 is not expected to materially impact the most important near-term catalysts, such as advancing the Phase 3 studies in major depressive disorder and schizophrenia, though it serves as a reminder that clinical trial risks remain significant. Among those risks, regulatory and payer headwinds that affect net margins or patient access continue to be closely watched by the market, but core pipeline progress remains the key short-term driver.

The company’s Q2 2025 earnings release stands out, with revenue reaching US$687.5 million and net income of US$107.5 million, both higher than the prior year. This financial momentum underscores management’s focus on expanding commercial products and aligning R&D investment with the most promising late-stage assets, especially following the recent pipeline update. The ability to generate stronger earnings, even as pipeline adjustments are made, could prove crucial as Neurocrine drives its late-stage programs forward, but investors should keep an eye on...

Read the full narrative on Neurocrine Biosciences (it's free!)

Neurocrine Biosciences is projected to reach $3.6 billion in revenue and $842.9 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 13.9%, with earnings rising by $537.1 million from the current level of $305.8 million.

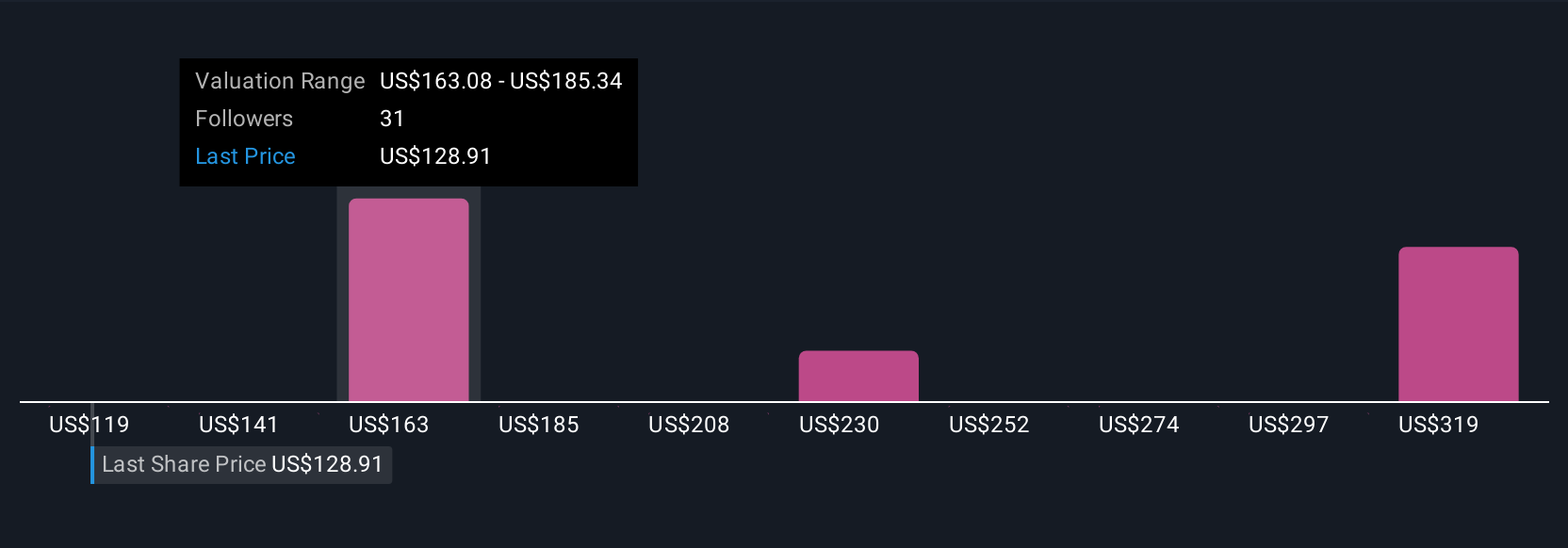

Uncover how Neurocrine Biosciences' forecasts yield a $163.76 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community estimated Neurocrine Biosciences’ fair value between US$118.58 and US$355.47 per share. Revenue growth from pipeline progress remains front of mind, which helps explain why your viewpoint on future clinical milestones could differ greatly from that of other investors.

Explore 7 other fair value estimates on Neurocrine Biosciences - why the stock might be worth 13% less than the current price!

Build Your Own Neurocrine Biosciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Neurocrine Biosciences research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Neurocrine Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Neurocrine Biosciences' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurocrine Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIX

Neurocrine Biosciences

Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives