- United States

- /

- Biotech

- /

- NasdaqGS:NBIX

Neurocrine Biosciences (NBIX): Assessing Valuation Following New Long-Term INGREZZA Data Release

Reviewed by Kshitija Bhandaru

Neurocrine Biosciences (NBIX) has just released results from a post-hoc analysis of the Phase 3 KINECT 4 study, highlighting 48 weeks of sustained symptom improvements for tardive dyskinesia patients treated with INGREZZA 40 mg capsules.

See our latest analysis for Neurocrine Biosciences.

On the heels of positive long-term data for INGREZZA, Neurocrine Biosciences has also made leadership changes and presented new Huntington’s chorea results, signaling steady progress this year. While the latest share price sits at $140.09, momentum has been building, with a 6.1% three-month share price return and a robust 18.7% total shareholder return over the past year. This performance clearly outpaces many sector peers and suggests growing investor confidence in the company’s pipeline and commercial execution.

If you’re interested in uncovering more healthcare stocks with breakout potential, see the full list for free in our handpicked screener: See the full list for free.

With NBIX shares running ahead of many peers and still trading about 21% below the average analyst price target, the question for investors is clear: does the stock remain undervalued, or is the market already pricing in the next stage of growth?

Most Popular Narrative: 42.8% Undervalued

With Neurocrine Biosciences trading at $140.09 and a narrative fair value of $244.80, the stage is set for a significant re-rating if the narrative’s forecast materializes.

“PipelineCrenessity@CRENESSITY Capsule 50/100 MG $766.66 packaging 50 MG 60u $45,999.60 packaging 100 MG 30u. Starts at approximately $21,338.71 USD for a monthly supply Ingrezza@Ingrezza (valbenazine) As of July 2025, the average pharmacy acquisition cost for Ingrezza capsules in the U.S. is approximately:

- $274.54 per capsule for the 60 mg and 80 mg strengths

- $250.16 per capsule for the 40 mg strength Other Products: Tetrabenazine Tablet 12.5 MG $62.52 Austedo Tablet 6 MG $100.06 Austedo XR Tablet 6 MG $100.06 Xenazine Tablet 12.5 MG $227.88 Assumptions Risks

There is a bold thesis behind this valuation, with explosive growth expectations and an aggressive profit multiple that rivals optimistic tech projections. What is driving such confidence? See the revenue and earnings story that could justify this premium fair value calculation.

Result: Fair Value of $244.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory uncertainties and potential delays in clinical development could shift market sentiment quickly if Neurocrine faces unexpected setbacks.

Find out about the key risks to this Neurocrine Biosciences narrative.

Another View: Market Ratios Challenge the Narrative

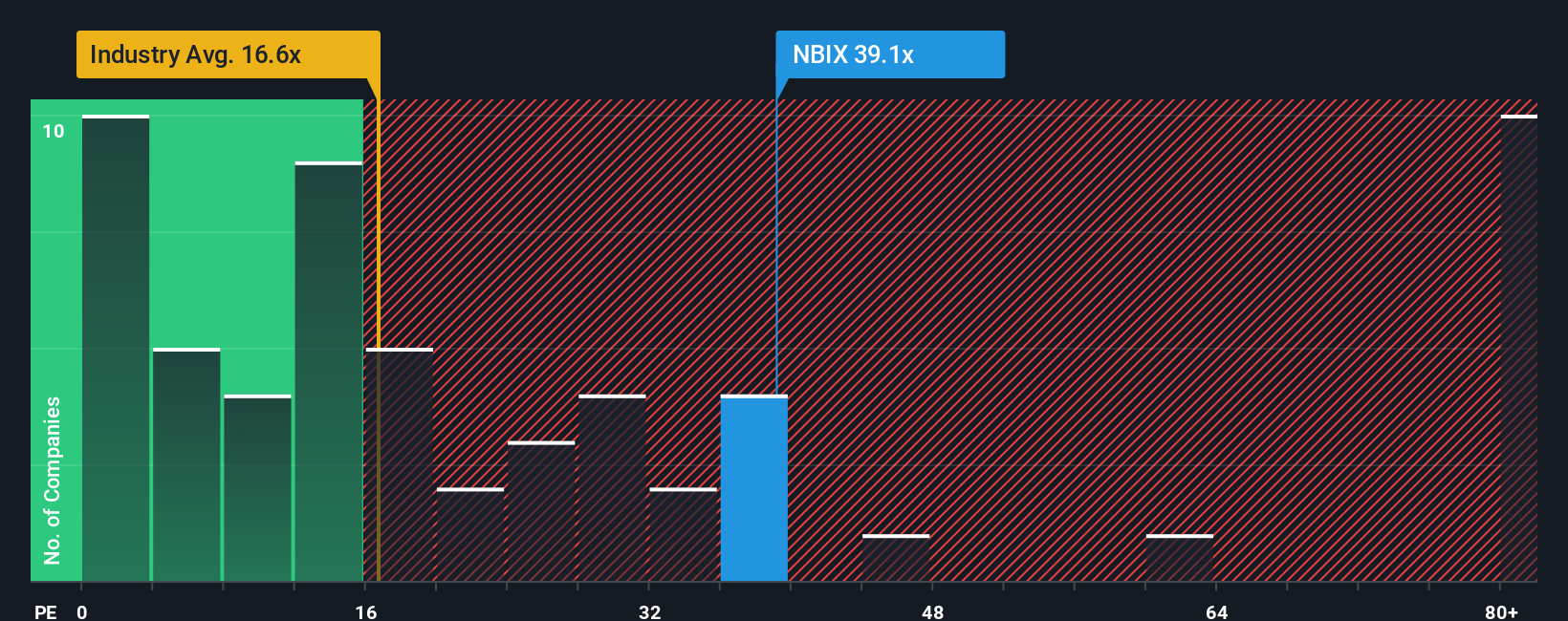

While the narrative approach suggests Neurocrine Biosciences is deeply undervalued, traditional market ratios paint a very different picture. The company’s current price-to-earnings ratio stands at 39.9x, significantly higher than the US Biotechs industry average of 16.4x and even tops the peer average of 17.1x. This figure is also well above the fair ratio of 23.7x, indicating the stock is expensive compared to logical historical benchmarks. For investors, the key question becomes whether current optimism already assumes future growth or if there remains further room for upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Neurocrine Biosciences Narrative

If this perspective doesn't align with your own, or you'd rather dive into the numbers firsthand, you can quickly shape a personalized view of Neurocrine Biosciences in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Neurocrine Biosciences.

Looking for More Smart Investment Ideas?

Unlock richer opportunities by checking out winning stocks highlighted by other savvy investors, all at your fingertips with the Simply Wall Street Screener.

- Capture untapped upside by reviewing these 878 undervalued stocks based on cash flows that trade below their intrinsic value and could reward you before the crowd catches on.

- Power your portfolio with future-ready innovation by selecting these 24 AI penny stocks that are pushing the envelope in artificial intelligence and reshaping entire industries.

- Grow your passive income stream by targeting these 18 dividend stocks with yields > 3% with robust yields above 3 percent and solid fundamentals to strengthen your returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurocrine Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIX

Neurocrine Biosciences

Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives