- United States

- /

- Biotech

- /

- NasdaqGM:NAMS

Can NewAmsterdam Pharma's (NAMS) Alzheimer’s Findings Reinforce Its Broader Pipeline Ambitions?

Reviewed by Simply Wall St

- Earlier this week, NewAmsterdam Pharma announced that the European Medicines Agency has validated its Marketing Authorization Applications for obicetrapib, both as a 10 mg monotherapy and a combination with ezetimibe, and reported promising BROADWAY trial data showing reduction of Alzheimer's biomarkers.

- These developments highlight obicetrapib's expanding clinical potential, especially with encouraging signs for Alzheimer’s disease treatment emerging alongside its application in cardiovascular care.

- We'll explore how regulatory milestones and Alzheimer’s-related findings shape NewAmsterdam Pharma's investment narrative going forward.

The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

What Is NewAmsterdam Pharma's Investment Narrative?

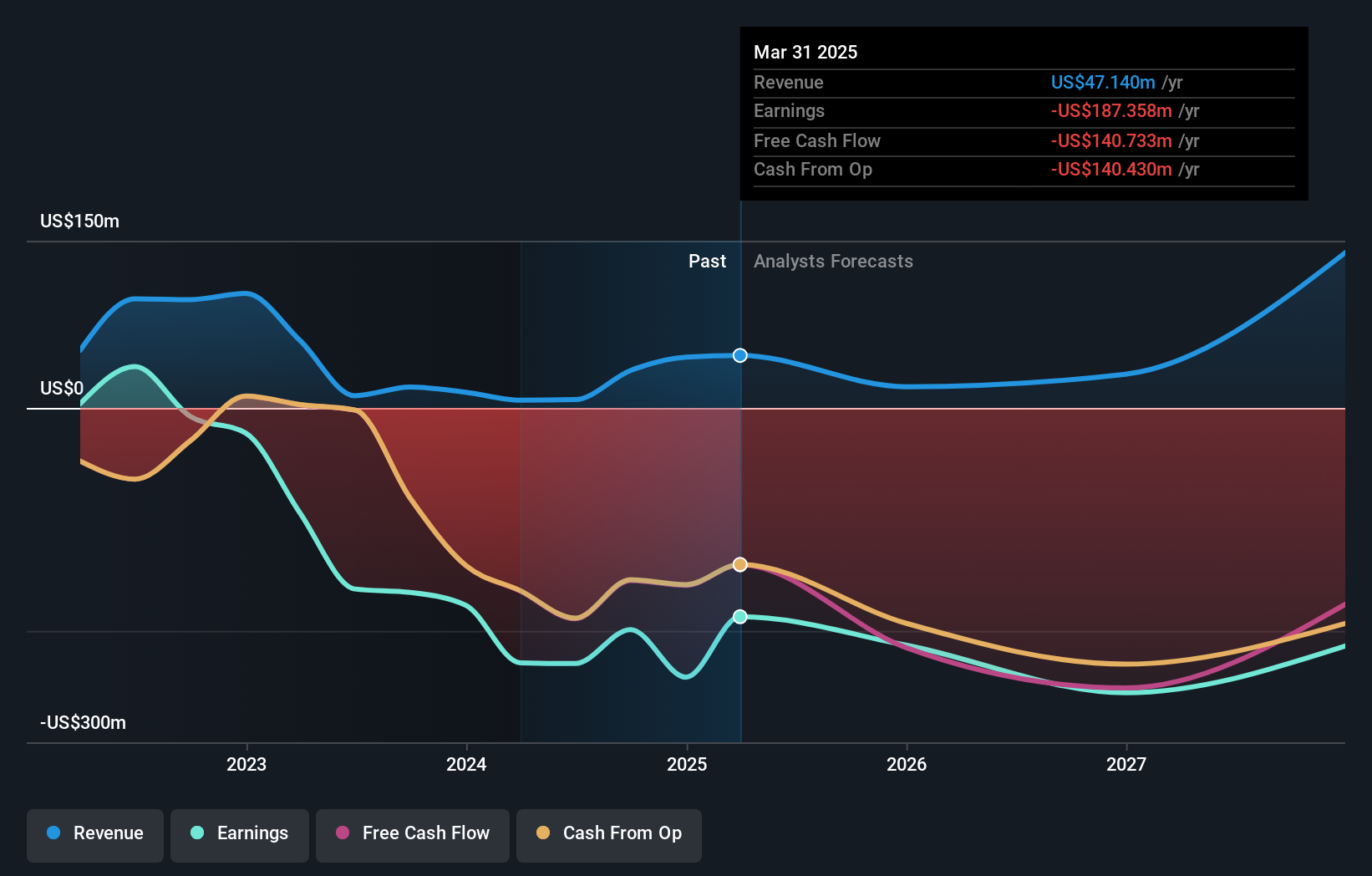

For anyone considering NewAmsterdam Pharma, the recent EMA validation for obicetrapib, especially as both a monotherapy and in combination with ezetimibe, could represent a meaningful inflection point for the company’s investment narrative. With the drug now receiving broader regulatory review, and fresh BROADWAY trial data hinting at utility in both cardiovascular and Alzheimer’s disease, short-term catalysts have become more visible. Previously, analysts mainly highlighted revenue growth and positive Phase 3 data as key drivers, with the biggest risks centered on high cash burn, ongoing unprofitability, and the lack of near-term profitability. Now, these new developments may reduce regulatory risk in the coming quarters and potentially broaden the drug’s commercial scope if Alzheimer’s implications gain traction. However, big-picture risks remain, such as a high price-to-sales ratio, recent insider selling, and the company’s history of shareholder dilution. Overall, the news is promising but doesn’t remove the need for caution around valuation and execution.

Otherwise, recent insider selling is a factor investors should keep an eye on. Despite retreating, NewAmsterdam Pharma's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on NewAmsterdam Pharma - why the stock might be worth just $40.82!

Build Your Own NewAmsterdam Pharma Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NewAmsterdam Pharma research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free NewAmsterdam Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NewAmsterdam Pharma's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewAmsterdam Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NAMS

NewAmsterdam Pharma

A late-stage biopharmaceutical company, develops therapies to enhance patient care in populations with metabolic disease.

Excellent balance sheet with low risk.

Market Insights

Community Narratives