- United States

- /

- Life Sciences

- /

- NasdaqGS:MRVI

Maravai LifeSciences Holdings, Inc.'s (NASDAQ:MRVI) 29% Jump Shows Its Popularity With Investors

Maravai LifeSciences Holdings, Inc. (NASDAQ:MRVI) shares have continued their recent momentum with a 29% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 27% over that time.

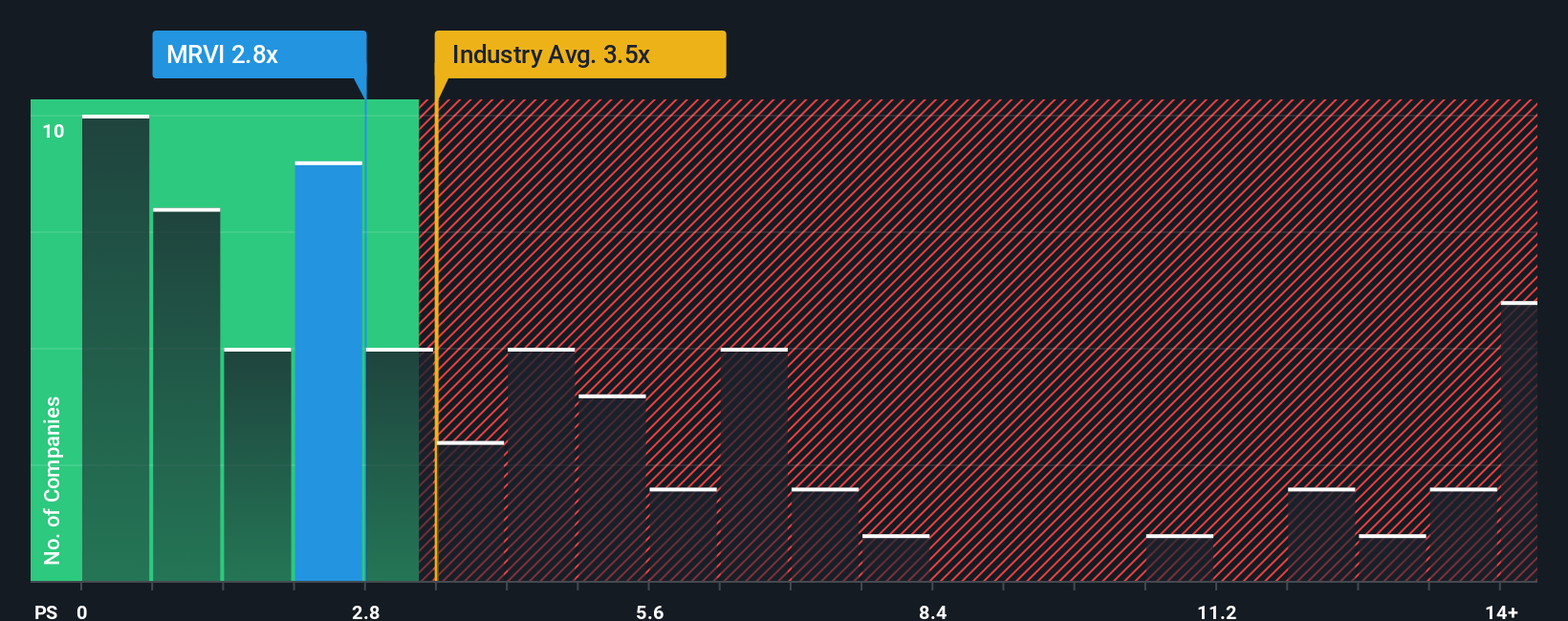

In spite of the firm bounce in price, there still wouldn't be many who think Maravai LifeSciences Holdings' price-to-sales (or "P/S") ratio of 2.8x is worth a mention when the median P/S in the United States' Life Sciences industry is similar at about 3.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Maravai LifeSciences Holdings

What Does Maravai LifeSciences Holdings' P/S Mean For Shareholders?

Maravai LifeSciences Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Maravai LifeSciences Holdings will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Maravai LifeSciences Holdings?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Maravai LifeSciences Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 79% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 5.4% each year during the coming three years according to the eleven analysts following the company. With the industry predicted to deliver 6.6% growth each year, the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Maravai LifeSciences Holdings' P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Maravai LifeSciences Holdings' P/S

Its shares have lifted substantially and now Maravai LifeSciences Holdings' P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Maravai LifeSciences Holdings' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Maravai LifeSciences Holdings with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MRVI

Maravai LifeSciences Holdings

A life sciences company, provides products that enable the development of drug therapies, vaccines, drug therapies, cell and gene therapies, and diagnostics North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin and Central America.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026