- United States

- /

- Life Sciences

- /

- NasdaqGS:MRVI

Maravai LifeSciences Holdings, Inc.'s (NASDAQ:MRVI) 29% Jump Shows Its Popularity With Investors

Maravai LifeSciences Holdings, Inc. (NASDAQ:MRVI) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 26% in the last twelve months.

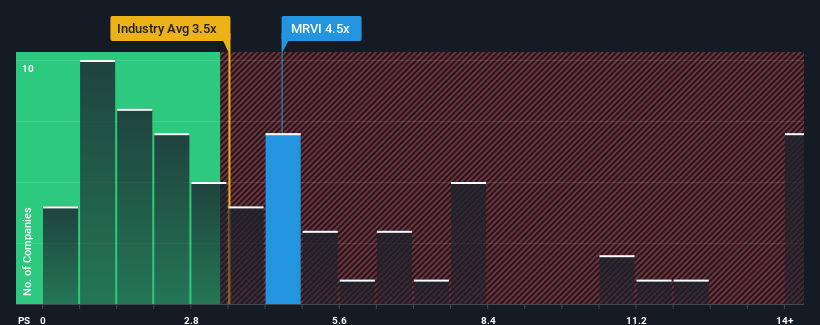

Following the firm bounce in price, given close to half the companies operating in the United States' Life Sciences industry have price-to-sales ratios (or "P/S") below 3.5x, you may consider Maravai LifeSciences Holdings as a stock to potentially avoid with its 4.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Maravai LifeSciences Holdings

What Does Maravai LifeSciences Holdings' P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, Maravai LifeSciences Holdings has been very sluggish. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Maravai LifeSciences Holdings will help you uncover what's on the horizon.How Is Maravai LifeSciences Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Maravai LifeSciences Holdings would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 62%. The last three years don't look nice either as the company has shrunk revenue by 28% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue should grow by 10% per year over the next three years. With the industry only predicted to deliver 6.9% each year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Maravai LifeSciences Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Maravai LifeSciences Holdings' P/S Mean For Investors?

Maravai LifeSciences Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Maravai LifeSciences Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Maravai LifeSciences Holdings with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Maravai LifeSciences Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVI

Maravai LifeSciences Holdings

A life sciences company, provides products that enable the development of drug therapies, vaccines, drug therapies, cell and gene therapies, and diagnostics North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin and Central America.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives