- United States

- /

- Biotech

- /

- NasdaqGS:MRSN

Mersana Therapeutics, Inc.'s (NASDAQ:MRSN) Price Is Right But Growth Is Lacking After Shares Rocket 25%

Despite an already strong run, Mersana Therapeutics, Inc. (NASDAQ:MRSN) shares have been powering on, with a gain of 25% in the last thirty days. Looking further back, the 20% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

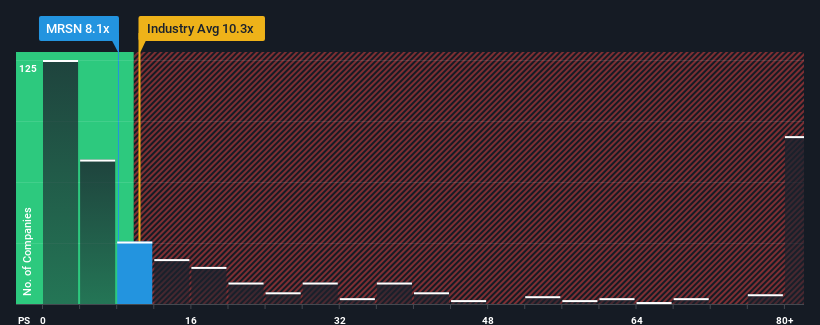

In spite of the firm bounce in price, Mersana Therapeutics may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 8.1x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 10.3x and even P/S higher than 64x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Mersana Therapeutics

How Mersana Therapeutics Has Been Performing

While the industry has experienced revenue growth lately, Mersana Therapeutics' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Mersana Therapeutics.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Mersana Therapeutics' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 2.1% per year as estimated by the ten analysts watching the company. Meanwhile, the broader industry is forecast to expand by 122% each year, which paints a poor picture.

With this in consideration, we find it intriguing that Mersana Therapeutics' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Despite Mersana Therapeutics' share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that Mersana Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Mersana Therapeutics' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Mersana Therapeutics you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MRSN

Mersana Therapeutics

A clinical-stage biopharmaceutical company, develops antibody-drug conjugates (ADC) for cancer patients with unmet needs.

Good value slight.

Market Insights

Community Narratives