- United States

- /

- Biotech

- /

- NasdaqGM:MNOV

3 Penny Stocks With Market Caps Over $80M To Consider

Reviewed by Simply Wall St

As the United States stock market continues to post gains, boosted by strong performances from tech giants like Amazon, investors are exploring diverse opportunities across various sectors. Penny stocks, while often considered a relic of past trading days, still hold relevance as they offer potential growth at lower price points. When backed by solid financials and robust fundamentals, these smaller or newer companies can defy expectations and present significant returns.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.84 | $394.32M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.76 | $636.53M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.045 | $179.57M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $4.835 | $811.03M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.9599 | $56.24M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $2.08 | $25.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.9601 | $6.97M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.39 | $76.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.90 | $11.33M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 363 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Coherus Oncology (CHRS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Coherus Oncology, Inc. is a biopharmaceutical company focused on researching, developing, and commercializing cancer immunotherapies in the United States, with a market cap of approximately $195.26 million.

Operations: The company generates revenue from developing and commercializing biosimilar products, amounting to $272.21 million.

Market Cap: $195.26M

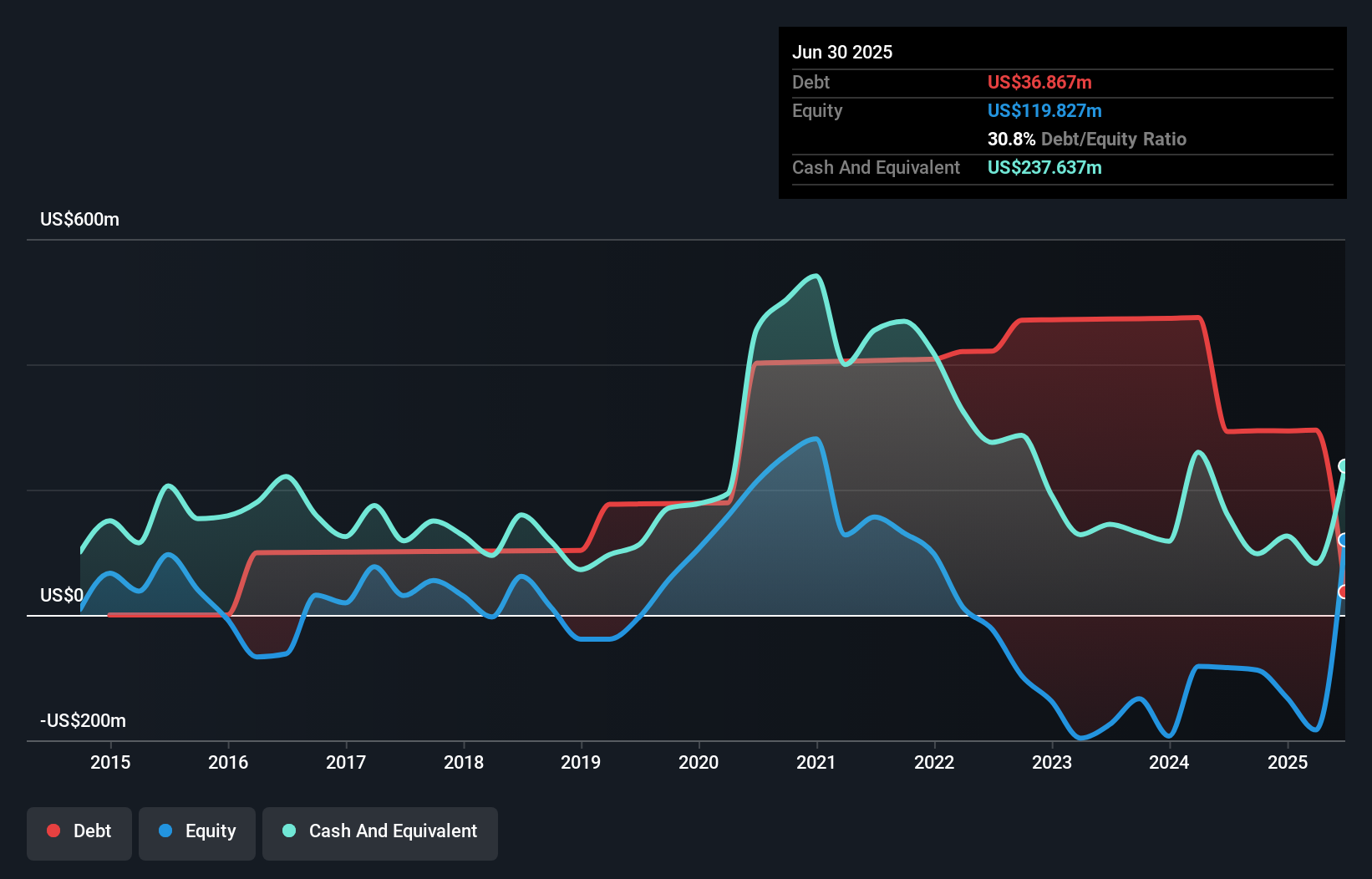

Coherus Oncology, Inc. has recently achieved profitability, reporting a net income of US$297.77 million for Q2 2025, a significant shift from the previous year's loss. Despite this turnaround, earnings are expected to decline by 12.8% annually over the next three years due to large one-off gains impacting recent results. The company trades at a favorable price-to-earnings ratio of 3.3x compared to the broader market and has reduced its debt-to-equity ratio significantly over five years. However, negative operating cash flow suggests challenges in covering debt through internal cash generation remain an issue for investors to consider.

- Unlock comprehensive insights into our analysis of Coherus Oncology stock in this financial health report.

- Examine Coherus Oncology's earnings growth report to understand how analysts expect it to perform.

MediciNova (MNOV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MediciNova, Inc. is a biopharmaceutical company that develops novel and small molecule therapeutics for serious diseases with unmet medical needs in the United States, with a market cap of $81.42 million.

Operations: MediciNova, Inc. currently does not report any revenue segments.

Market Cap: $81.42M

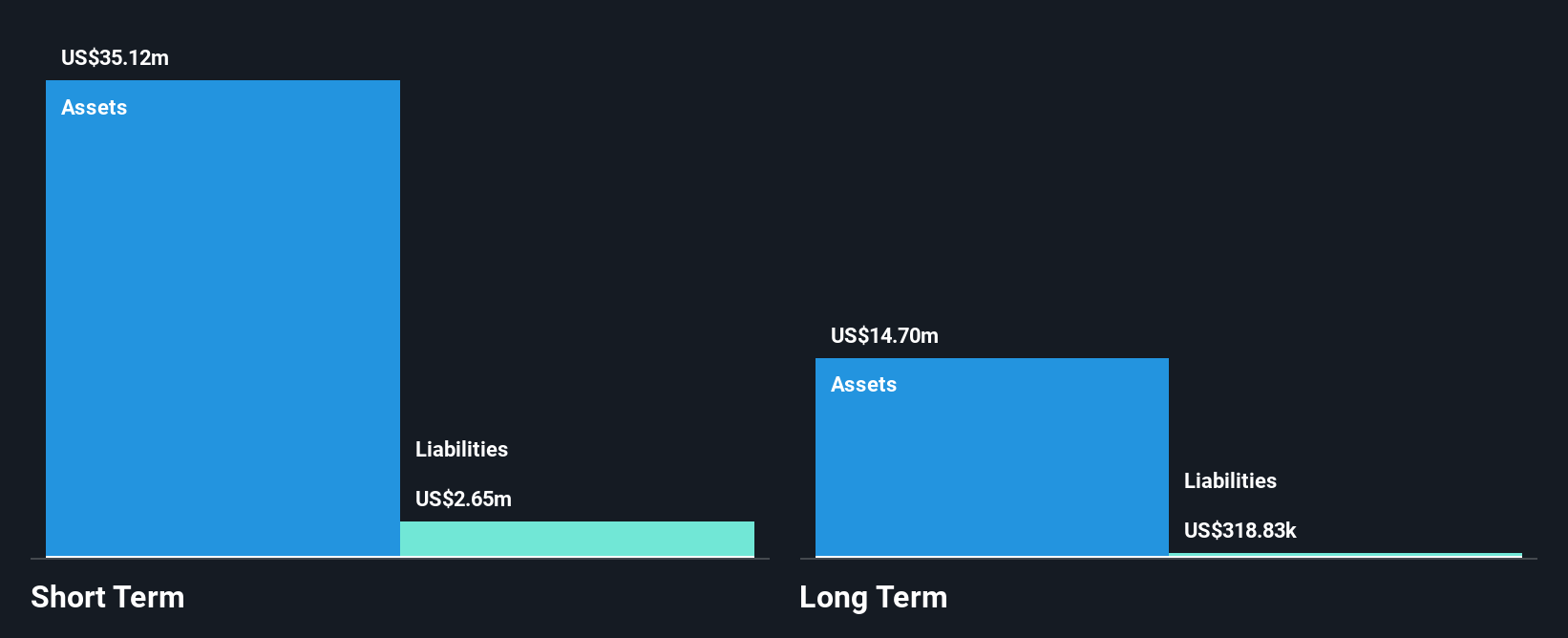

MediciNova, Inc., with a market cap of US$81.42 million, is a pre-revenue biopharmaceutical company focused on developing treatments for serious diseases. The company recently completed patient enrollment for its Phase 2/3 COMBAT-ALS trial evaluating MN-166 (ibudilast) for ALS, with top-line data expected by the end of 2026. Despite being unprofitable and trading at 78.4% below estimated fair value, MediciNova has no debt and boasts a seasoned management team with an average tenure of 9.3 years. Its short-term assets significantly exceed liabilities, providing financial stability in the near term while it continues clinical development efforts.

- Dive into the specifics of MediciNova here with our thorough balance sheet health report.

- Gain insights into MediciNova's future direction by reviewing our growth report.

Valens Semiconductor (VLN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Valens Semiconductor Ltd. develops semiconductor products for the audio-video and automotive sectors across various international markets, with a market cap of approximately $187.54 million.

Operations: The company's revenue is divided into two primary segments: Automotive, generating $20.97 million, and Cross Industry Business (CIB), contributing $45.62 million.

Market Cap: $187.54M

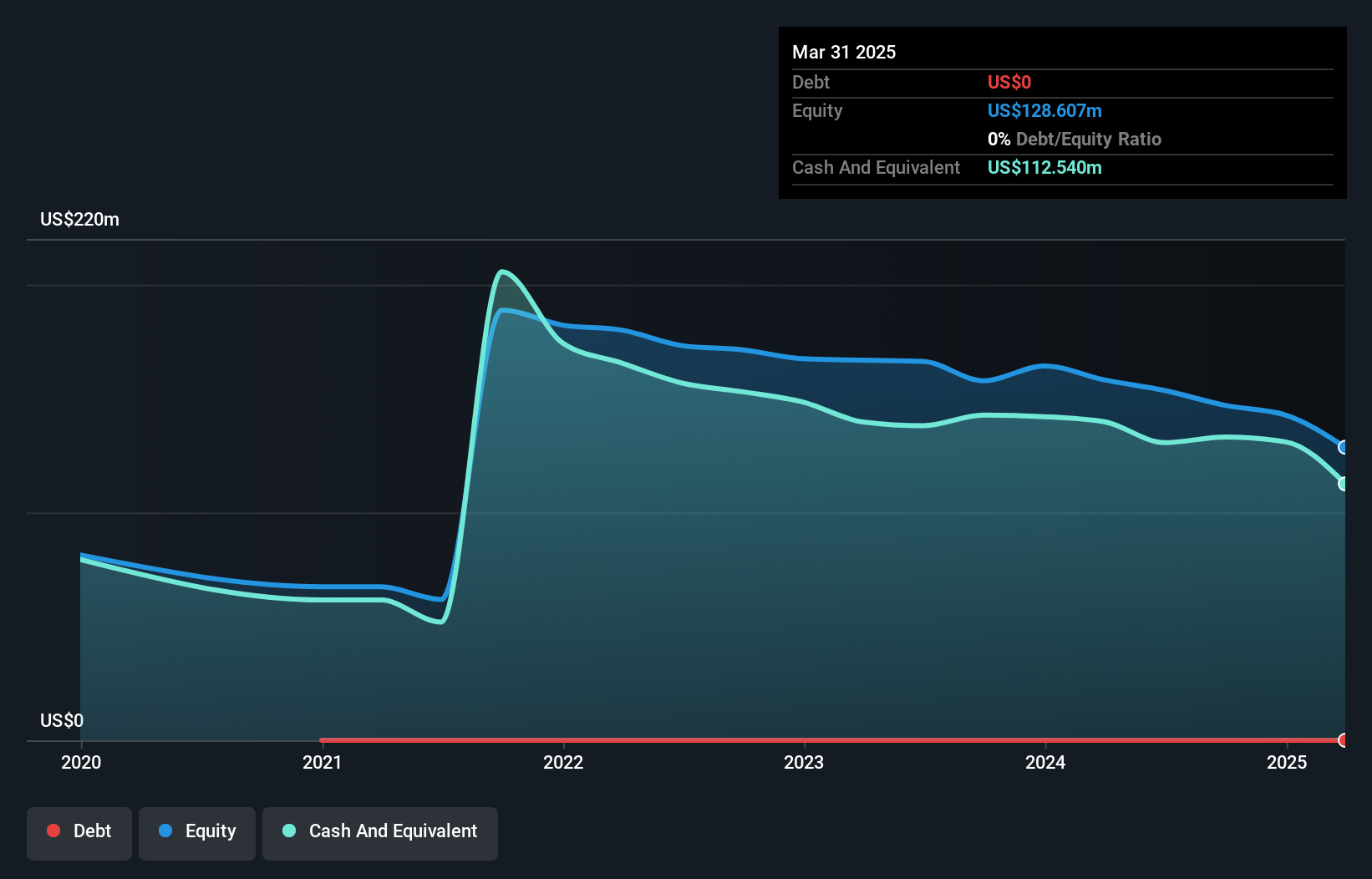

Valens Semiconductor, with a market cap of approximately US$187.54 million, is strategically positioned in the semiconductor industry through its partnerships and innovative products. Despite being unprofitable with a negative return on equity, it has reduced losses over the past five years and maintains a robust cash runway exceeding three years. The company recently updated its revenue guidance for 2025 to US$66-71 million, indicating growth despite lowered expectations due to tariffs. Its collaboration with Samsung on MIPI A-PHY standards highlights Valens' role in advancing automotive connectivity technologies, supported by experienced management and board members enhancing strategic direction.

- Click here and access our complete financial health analysis report to understand the dynamics of Valens Semiconductor.

- Learn about Valens Semiconductor's future growth trajectory here.

Taking Advantage

- Unlock more gems! Our US Penny Stocks screener has unearthed 360 more companies for you to explore.Click here to unveil our expertly curated list of 363 US Penny Stocks.

- Looking For Alternative Opportunities? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MNOV

MediciNova

A biopharmaceutical company, focuses on developing novel and small molecule therapeutics for the treatment of serious diseases with unmet medical needs in the United States.

Flawless balance sheet and good value.

Market Insights

Community Narratives