- United States

- /

- Pharma

- /

- NasdaqGS:MNMD

Why Mind Medicine (MNMD) Is Up 11.4% After FDA Breakthrough for LSD Anxiety Therapy and What’s Next

Reviewed by Sasha Jovanovic

- Mind Medicine (MindMed) recently announced that its lead drug MM120, a proprietary LSD-based therapy for generalized anxiety disorder, delivered groundbreaking Phase 2b results and received FDA Breakthrough Therapy designation.

- This combination of positive clinical outcomes and regulatory recognition positions MindMed as a prominent player within the growing psychedelic medicine sector.

- We'll explore how the FDA Breakthrough Therapy designation and Phase 3 trial launches strengthen MindMed's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Mind Medicine (MindMed)'s Investment Narrative?

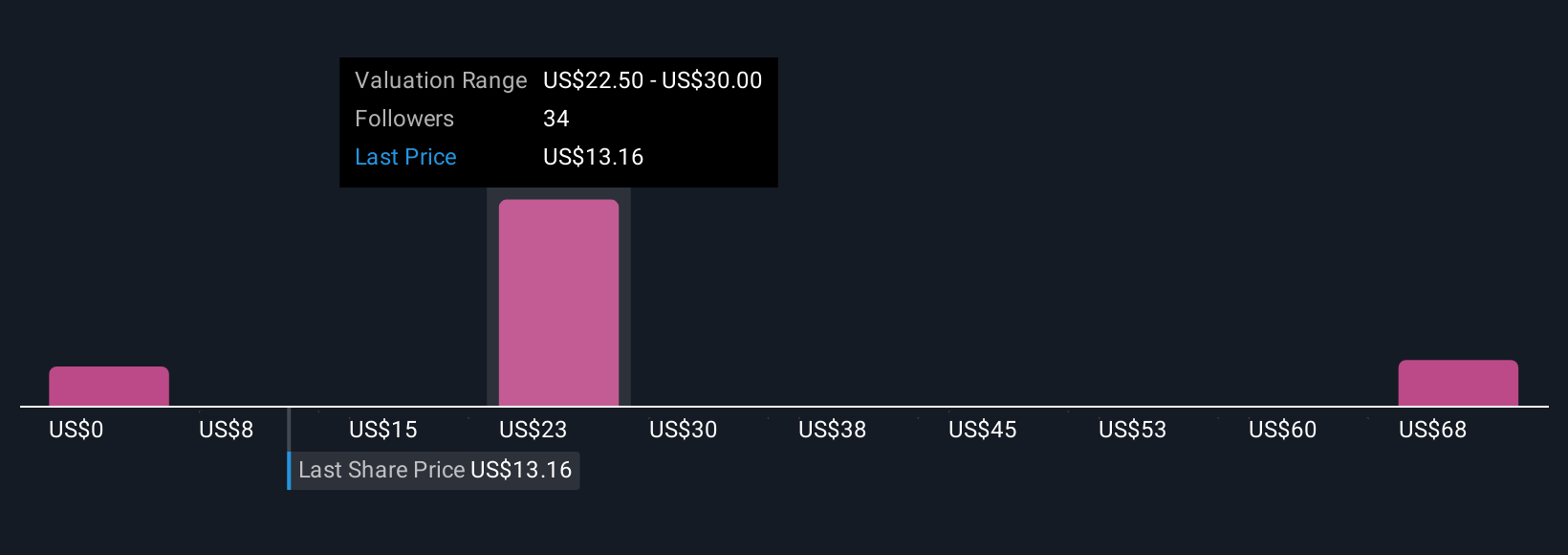

For investors considering Mind Medicine (MindMed), the story hinges on belief in psychedelics as a breakthrough in mental health and confidence in timely clinical and regulatory execution. The recent FDA Breakthrough Therapy designation and the solid Phase 2b results are meaningful events, potentially accelerating MM120's path to market and reducing regulatory uncertainty in the near term. These milestones push the FDA's formal recognition of MM120 as a potential treatment, which may reshape short-term catalysts, making successful Phase 3 trial outcomes the center of attention from here. While analyst optimism and the jump in share price reflect increased investor enthusiasm, MindMed is still unprofitable and has no revenue, and its valuation remains high compared to peers despite steep historical losses. The biggest ongoing risks are its cash burn rate and the make-or-break nature of late-stage clinical trials, which still need to deliver on efficacy and safety.

On the other hand, the company’s high cash burn and lack of revenue remain critical points investors should watch. Mind Medicine (MindMed)'s shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 11 other fair value estimates on Mind Medicine (MindMed) - why the stock might be worth less than half the current price!

Build Your Own Mind Medicine (MindMed) Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mind Medicine (MindMed) research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Mind Medicine (MindMed) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mind Medicine (MindMed)'s overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNMD

Mind Medicine (MindMed)

A clinical stage biopharmaceutical company, develops novel products to treat brain health disorders.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives