- United States

- /

- Biotech

- /

- NasdaqGM:MNKD

Assessing MannKind’s Share Price After FDA Clears Pediatric Use for Afrezza in 2025

Reviewed by Bailey Pemberton

If you are watching MannKind right now, you are definitely not alone. The company’s stock has been on quite the journey, stirring up questions about whether it is time to buy, sell, or simply stay patient. Maybe you have noticed those numbers, too. MannKind’s 3% gain over the past week comes after a dip of 4.4% in the past month, and while the stock is still down nearly 17% year to date, the long-term performance is impressive with an increase of 70% over three years and 187.4% over five years. That kind of volatility is hard to ignore.

What is driving these swings? Recent developments in the broader biotech sector have certainly played a role, as investors assess both the promise and risks of companies making real advances in inhaled therapeutics. While day-to-day moves can seem random, it all comes down to valuation and whether the current price makes sense compared to MannKind’s true worth.

To help make sense of this, I will walk you through a valuation score developed by comparing MannKind against six standard benchmarks. Right now, the company scores a 2, meaning it is considered undervalued in 2 out of 6 checks. This detail may catch your eye whether you are looking for bargains or just clarity in a noisy market.

Let us dive into how those valuation scores are built, and more importantly, see whether they tell the whole story about MannKind’s potential. Stick around because by the end, I will share a perspective on valuation that goes beyond the usual metrics.

MannKind scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: MannKind Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those amounts to today’s dollars. This approach gives investors a sense of what the business is really worth based on its ability to generate cash over time.

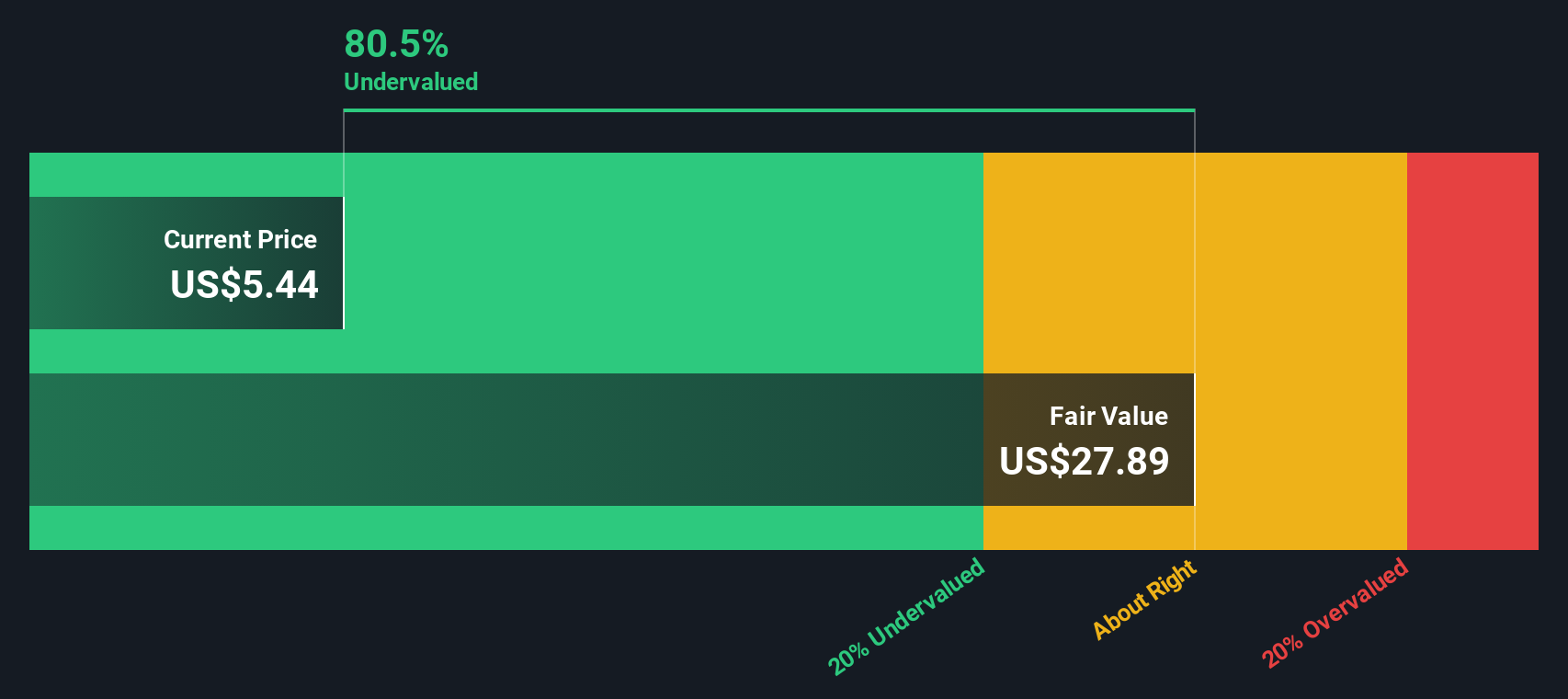

MannKind’s most recent Free Cash Flow (FCF) stands at $9.43 million, and analyst expectations see this figure rising significantly in the years ahead. By 2029, projections show FCF reaching $192.05 million. While analyst estimates only cover several years, further projections are carefully extrapolated by independent sources based on trend growth rates. This suggests continued expansion even after that point.

Pulled together, the DCF model arrives at an intrinsic fair value of $19.88 per share for MannKind. With the current share price trading at a 72.4% discount to this estimated value, the stock appears meaningfully undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MannKind is undervalued by 72.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: MannKind Price vs Earnings

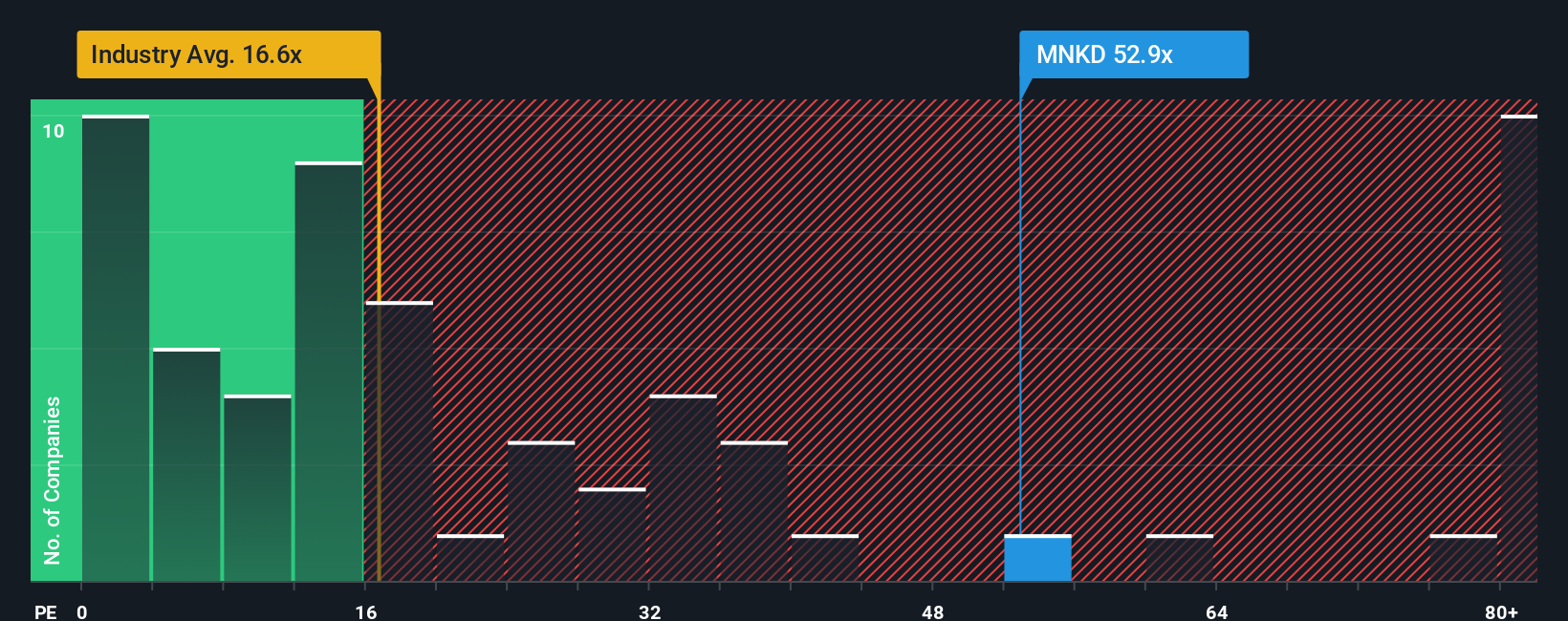

When analyzing profitable companies like MannKind, the Price-to-Earnings (PE) ratio is a popular and effective valuation metric. The PE ratio helps investors understand how much they are paying for each dollar of earnings, making it useful for comparing companies within the same sector. Typically, a higher PE signals more rapid growth expectations or lower perceived risk, while a lower PE might indicate lower growth prospects or more uncertainty.

MannKind currently trades at a PE ratio of 51.36x. For context, the average PE for the biotech industry is 16.60x, while MannKind’s peer group averages 14.21x. While MannKind’s valuation is clearly above these benchmarks, it is important to recognize that a company’s growth outlook, market position, profit margin, and risk profile may justify a higher multiple.

This is where the Simply Wall St Fair Ratio comes in. This proprietary metric is designed to pinpoint the PE multiple that fairly balances MannKind’s expected earnings growth, industry conditions, profit margin, market cap, and unique risks. Unlike a straight peer or industry comparison, the Fair Ratio provides a tailored yardstick for MannKind’s specific story. In MannKind's case, the Fair Ratio is 21.32x, which is notably lower than its current PE ratio. This suggests that, given everything known about the company’s fundamentals and future outlook, the stock may be trading at a premium relative to its fair value on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MannKind Narrative

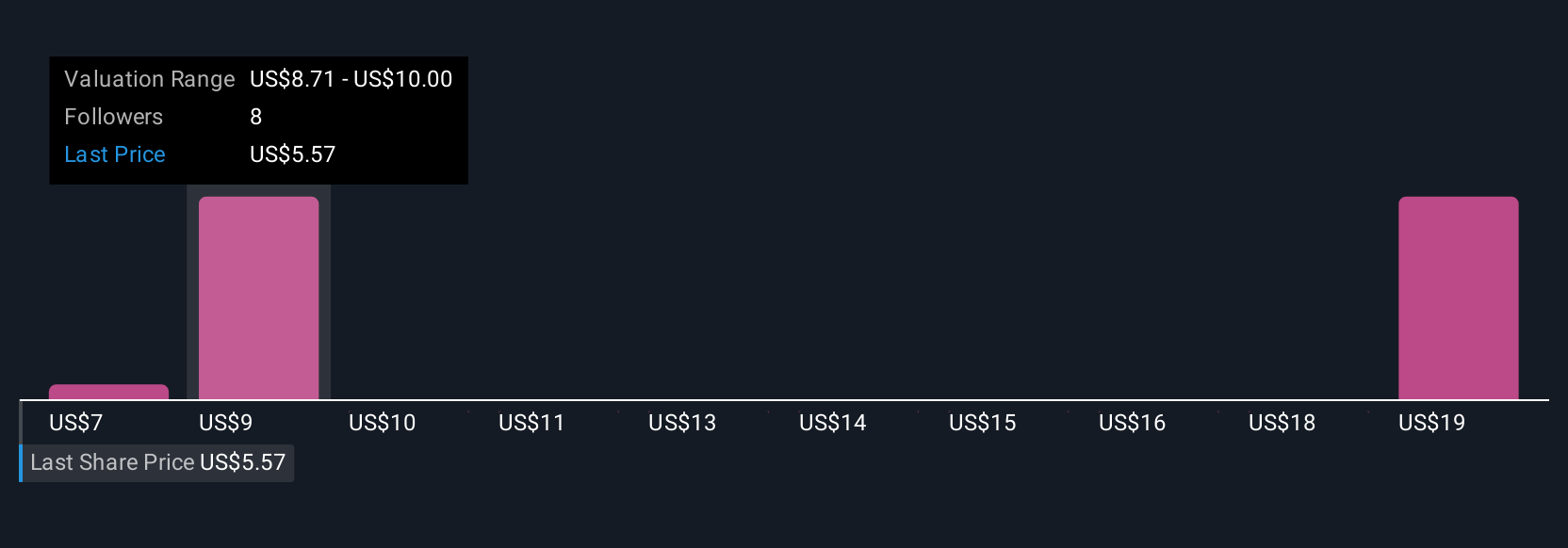

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a powerful yet intuitive tool that lets you create your own story around a company, connecting what you believe about MannKind’s future to a set of real financial forecasts and a fair value estimate. A Narrative is more than just numbers; it captures your perspective on things like revenue growth, margins, and business risks, and translates them into a financial model you can share with other investors.

Narratives serve as a bridge between a company’s potential and its valuation, making it easier to see exactly how your views or assumptions might impact fair value, all while comparing it instantly to the current share price. Available right inside Simply Wall St’s Community page, Narratives are updated dynamically as soon as new news or earnings are released, helping you stay current and make data-driven buy or sell decisions with confidence.

For example, one investor might see MannKind’s international expansion and pipeline progress and set a Narrative fair value as high as $15.00. A more cautious view could justify a value closer to $8.00. It all depends on their outlook and expectations for future growth. With Narratives, every perspective is welcome, letting you make investing decisions that genuinely reflect your own analysis.

Do you think there's more to the story for MannKind? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MNKD

MannKind

A biopharmaceutical company, focuses on the development and commercialization of therapeutic products and services for endocrine and orphan lung diseases in the United States.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives