- United States

- /

- Biotech

- /

- NasdaqGS:MLYS

Mineralys Therapeutics (MLYS): Evaluating Valuation Following Positive Phase 3 Blood Pressure Trial Results

Reviewed by Kshitija Bhandaru

Price-to-Book of 9.6x: Is it justified?

Mineralys Therapeutics trades at a price-to-book (P/B) ratio of 9.6x, putting it in roughly the same range as its immediate peers but well above the typical US biotech sector average.

The price-to-book ratio measures how a company's current share price compares to its net asset value. It is a popular benchmark for asset-heavy, early-stage biotech firms where profitability is not yet achieved. For companies in this space, a high P/B often signals investor optimism about future breakthroughs or commercial opportunities. In contrast, a lower P/B suggests skepticism or less confidence in near-term catalysts.

Given that Mineralys is trading nearly in line with peer average valuations but well above the broader sector, investors appear to be reflecting heightened expectations around its drug pipeline and potential approval timelines. However, this premium could be difficult to justify unless the company's future performance meets or exceeds current hopes.

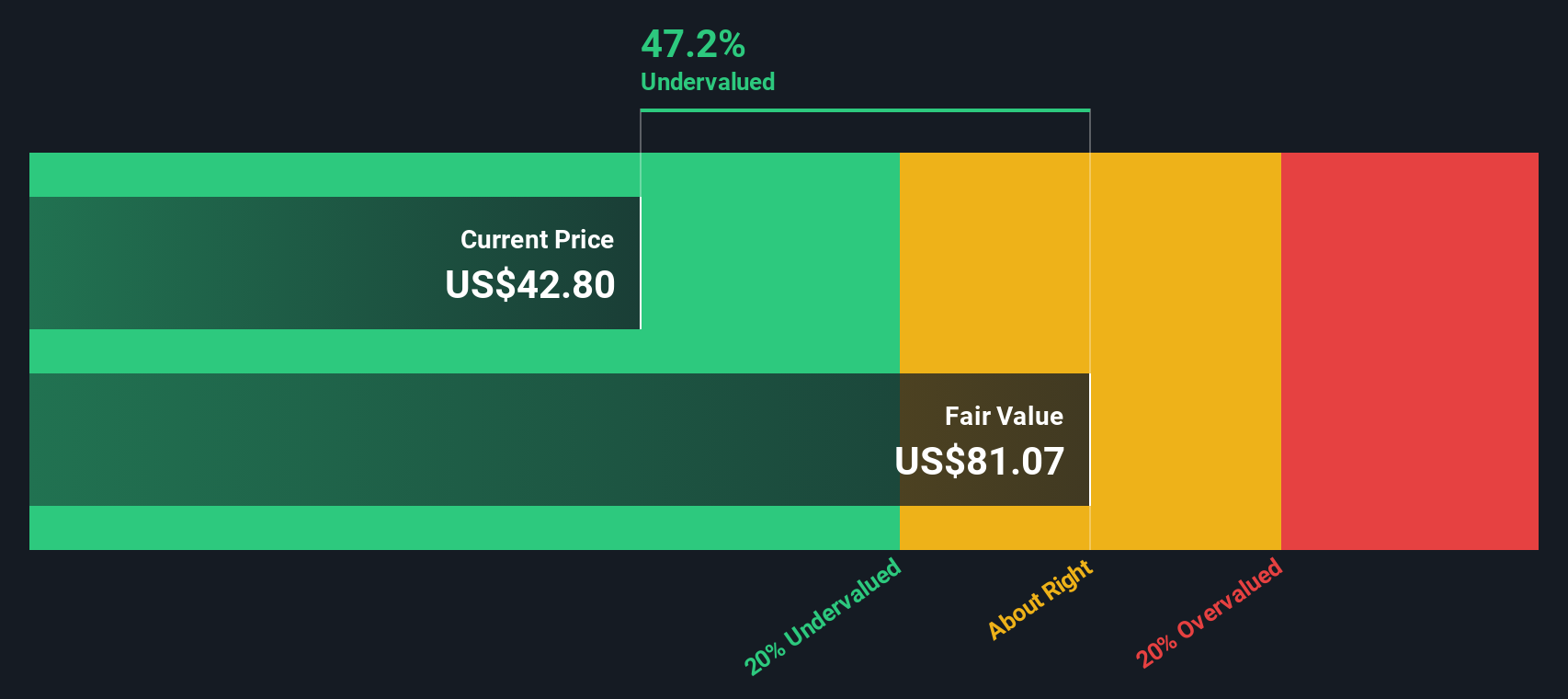

Result: Fair Value of $81.39 (UNDERVALUED)

See our latest analysis for Mineralys Therapeutics.However, disappointing regulatory feedback or slower than expected commercial uptake could quickly dampen current optimism around Mineralys Therapeutics’ trajectory.

Find out about the key risks to this Mineralys Therapeutics narrative.Another View: Discounted Cash Flow Puts the Spotlight on Value

While the market’s focus is on how Mineralys Therapeutics trades versus sector averages, our DCF model presents a different perspective. It suggests the shares are undervalued, which challenges assumptions that may be built into the share price. Could the fundamentals offer more potential than the market currently recognizes?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Mineralys Therapeutics Narrative

If you have a different take or want to dive into the numbers yourself, you can build your own narrative in just a few minutes: Do it your way.

A great starting point for your Mineralys Therapeutics research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit themselves to just one opportunity. Make the most of your research by targeting standout stocks best suited to your goals with these hand-picked strategies:

- Unlock steady income potential by checking out companies offering consistent yields above 3% with the power of dividend stocks with yields > 3%.

- Position yourself ahead of market shifts with emerging companies showing value based on future cash flows, all highlighted in undervalued stocks based on cash flows.

- Ride the wave of artificial intelligence breakthroughs and uncover businesses harnessing cutting-edge tech through our AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MLYS

Mineralys Therapeutics

A clinical-stage biopharmaceutical company, develops medicines to target diseases driven by dysregulated aldosterone in the United States.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives