- United States

- /

- Biotech

- /

- NasdaqGS:MLYS

Could Mineralys Therapeutics (MLYS) Trial Progress Hint at a Broader Hypertension Strategy?

Reviewed by Sasha Jovanovic

- Mineralys Therapeutics announced it has completed enrollment in its Phase 2 EXPLORE-OSA trial of lorundrostat in participants with moderate-to-severe obstructive sleep apnea and hypertension, with topline results expected in the first quarter of 2026.

- This milestone highlights ongoing clinical progress to address an unmet need in hypertension treatment, potentially expanding lorundrostat's reach into additional patient populations with related comorbidities.

- We’ll explore how this trial enrollment milestone signals continued progress in expanding lorundrostat's potential use for patients with complex hypertension profiles.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Mineralys Therapeutics' Investment Narrative?

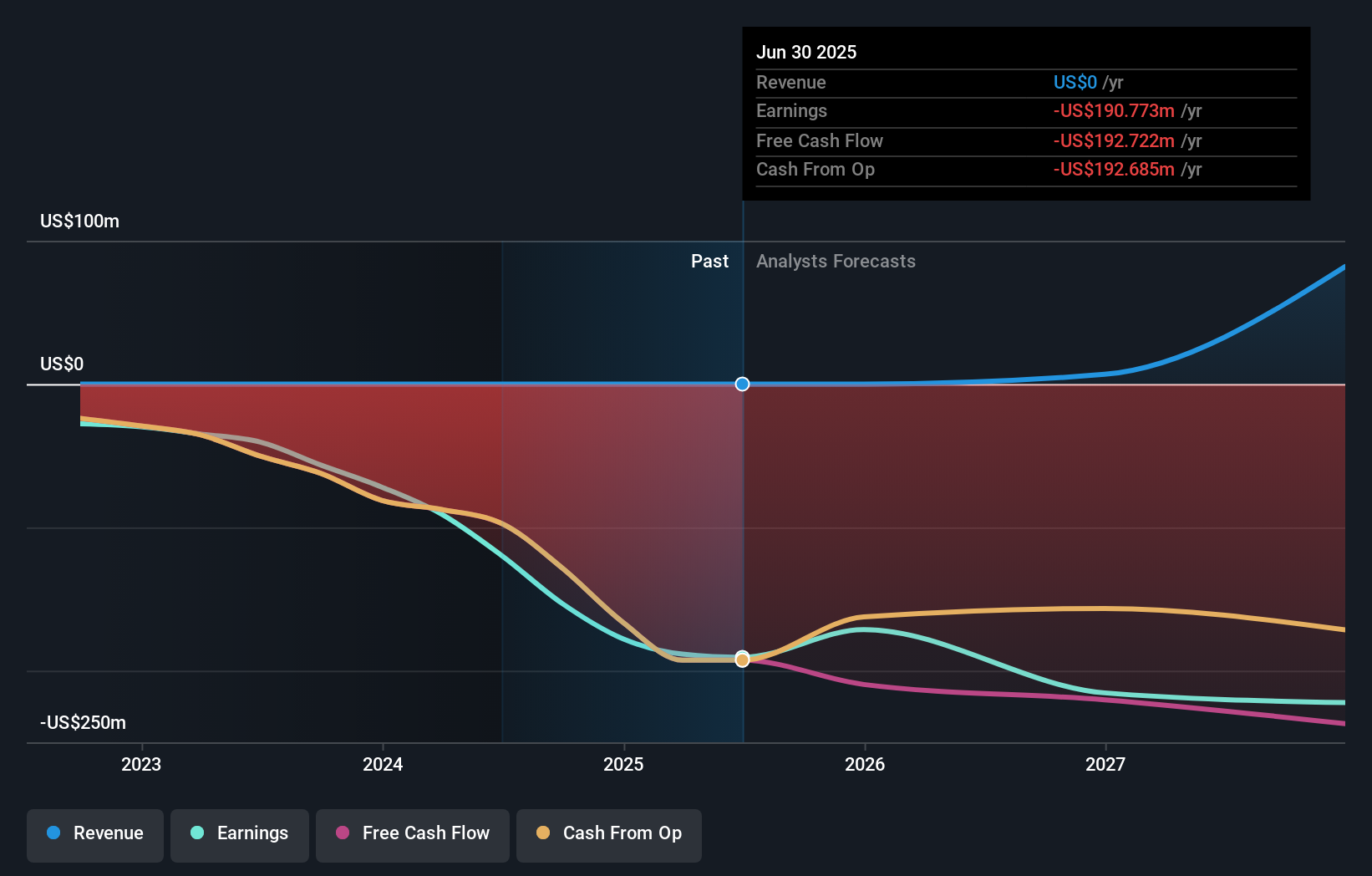

If you’re looking at Mineralys Therapeutics right now, the core belief for investors centers on the potential for lorundrostat to address substantial unmet needs in hypertension, with compelling data from high-profile trials, growing clinical momentum and multiple potential indications as the big drivers. The recent completion of enrollment in the Phase 2 EXPLORE-OSA trial doesn’t immediately change near-term catalysts, as top-line data is still more than a year away. Momentum continues to come from the company’s upcoming pre-NDA meeting, planned New Drug Application filing and previous positive Phase 3 results, which remain the primary short-term inflection points. However, news of enrollment progress adds reassurance on execution, promises to widen lorundrostat’s footprint if positive and could meaningfully shift risk perception if the trial reads out successfully, especially when paired with results from the CKD trial. Still, the company remains unprofitable, has no meaningful revenue, and recent share offerings have caused dilution, so risks remain elevated for those focused on fundamentals and capital structure.

But keep in mind, heavy recent dilution is an important risk that shouldn’t be overlooked. Mineralys Therapeutics' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Mineralys Therapeutics - why the stock might be worth as much as 8% more than the current price!

Build Your Own Mineralys Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mineralys Therapeutics research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Mineralys Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mineralys Therapeutics' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MLYS

Mineralys Therapeutics

A clinical-stage biopharmaceutical company, develops medicines to target diseases driven by dysregulated aldosterone in the United States.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives