- United States

- /

- Biotech

- /

- NasdaqGS:MLYS

A Fresh Look at Mineralys Therapeutics (MLYS) Valuation Following New Clinical Milestones for Lorundrostat

Reviewed by Kshitija Bhandaru

Mineralys Therapeutics (MLYS) has just wrapped up enrollment in its Phase 2 EXPLORE-OSA study. The study targets patients with both moderate-to-severe obstructive sleep apnea and hypertension, a group that often faces limited treatment options.

See our latest analysis for Mineralys Therapeutics.

Excitement has been building around Mineralys Therapeutics thanks to new trial enrollments and encouraging subgroup data from the Phase 3 Launch-HTN trial, which showcased consistent blood pressure reductions and safety for lorundrostat. These advances coincide with a steadily rising 90-day share price return of nearly 1.8% and a 12-month total shareholder return above 2%, signaling modest but positive momentum as investors weigh the company’s expanding opportunities in hypertension and sleep apnea treatment.

If clinical breakthroughs like these spark your interest, this could be a great time to explore other innovators in the field. See the full list of healthcare leaders with our See the full list for free..

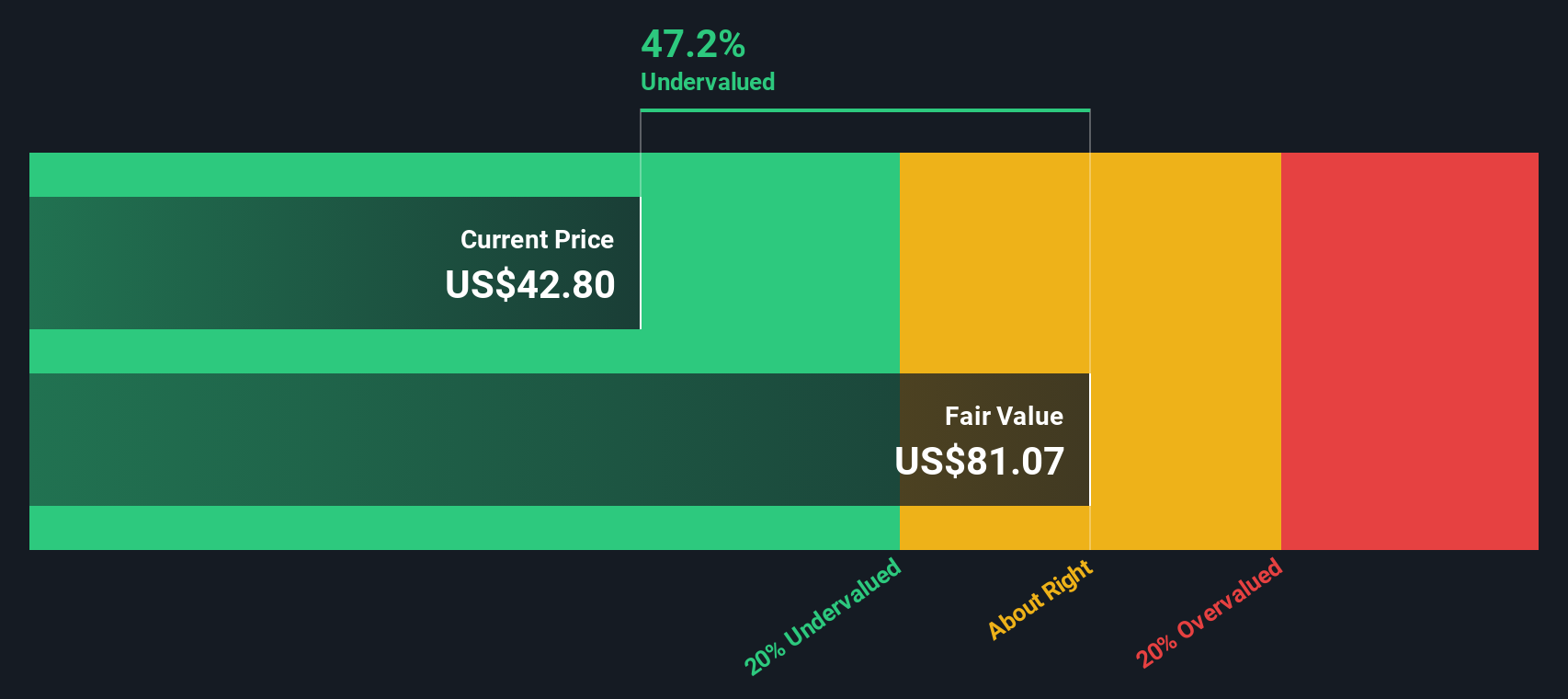

But with shares already climbing on the back of successful trials and upbeat analyst targets, the key question is whether investors are looking at an undervalued opportunity or if future growth is now fully priced in.

Price-to-Book Ratio of 10x: Is it justified?

With Mineralys Therapeutics currently trading at a price-to-book ratio of 10x, investors are paying a much steeper premium than both peer companies and the wider biotech sector. The last close price was $40.46, which places the valuation far above the industry average.

The price-to-book ratio compares a company’s market price to its book value per share. It serves as a checkpoint for how much the market values the company’s net assets. High ratios can indicate strong growth potential, but for unprofitable firms like Mineralys Therapeutics, this often reflects speculative expectations rather than underlying fundamentals.

Mineralys Therapeutics stands out as expensive, with its 10x price-to-book ratio greatly exceeding the US biotech industry average of 2.4x and the peer group average of 8.3x. The market is implying lofty growth or future profitability, but the premium signals that much of the optimism may already be priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 10x (OVERVALUED)

However, ongoing losses and zero current revenue mean that any setback in clinical progress could quickly shift investor sentiment away from optimism.

Find out about the key risks to this Mineralys Therapeutics narrative.

Another View: Discounted Cash Flow Suggests Undervaluation

While the market appears skeptical based on the high price-to-book ratio, our DCF model offers a different perspective. According to this approach, Mineralys Therapeutics is trading about 50% below our estimate of fair value. This sharp difference raises the question: Is the market underestimating the company’s future potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mineralys Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mineralys Therapeutics Narrative

If you see the story differently or want to dive deeper into Mineralys Therapeutics’ data, it’s easy to shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Mineralys Therapeutics research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Set yourself apart from the crowd by tapping into investment opportunities others often overlook. Don’t let your next smart move slip away.

- Zero in on hidden value by scanning these 910 undervalued stocks based on cash flows to capture stocks the market hasn’t fully recognized.

- Boost your portfolio’s growth prospects with these 24 AI penny stocks to get ahead of the curve in AI-driven innovation.

- Strengthen your investments with steady yields through these 19 dividend stocks with yields > 3% featuring companies offering above-average dividend returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MLYS

Mineralys Therapeutics

A clinical-stage biopharmaceutical company, develops medicines to target diseases driven by dysregulated aldosterone in the United States.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives