- United States

- /

- Life Sciences

- /

- NasdaqGS:MEDP

Medpace Holdings (MEDP) Valuation: Assessing Fair Value After Raised Outlook and Share Buybacks

Reviewed by Kshitija Bhandaru

Medpace Holdings (MEDP) turned heads this quarter with organic revenue growth in the mid-teens and a 20% jump in operating earnings. Management also bought back nearly 6% of shares and raised projections, which has drawn investor interest.

See our latest analysis for Medpace Holdings.

After Medpace Holdings raised its outlook and bought back shares, investors quickly noticed the momentum. The company’s share price return has surged over 57% year-to-date, while the total shareholder return over the past year clocks in at 48%. In the bigger picture, the stock has delivered impressive long-term results, with a three-year total shareholder return above 230% and over 350% for five years. This suggests that optimism about sustained growth is not fading anytime soon.

If a strong run like this has you searching for your next opportunity, now’s a perfect moment to discover fast growing stocks with high insider ownership

With such robust performance and strong management moves, the key question now is whether Medpace Holdings still offers untapped value, or if all of this positive momentum is already reflected in its current share price.

Most Popular Narrative: 23% Overvalued

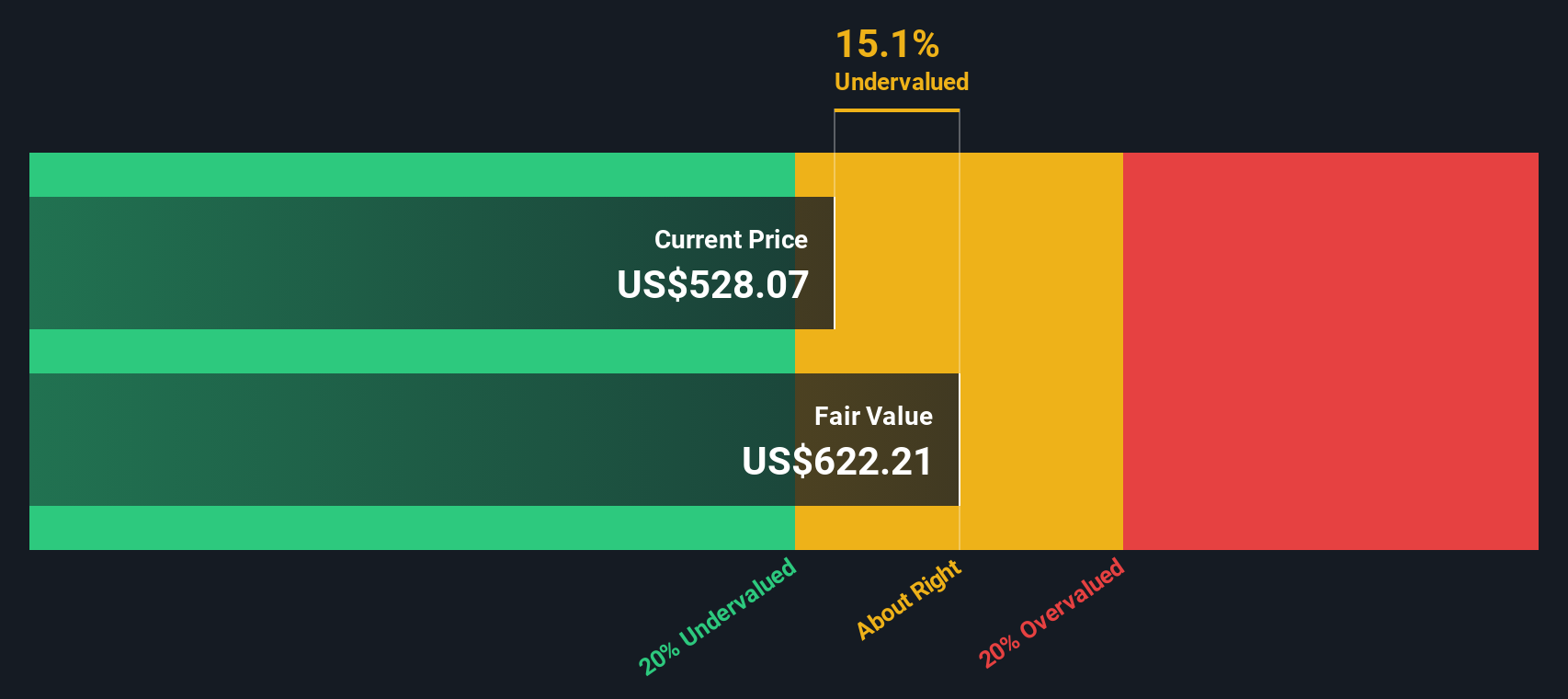

Medpace Holdings’ fair value, as seen through the widest-followed narrative, sits well below the latest closing price of $528.07. This sets up a valuation debate that hinges on the company’s momentum versus analyst caution.

Despite strong topline growth, win rates for new business were down and backlog is declining (down 1.8% year-over-year), suggesting competitive pressures and a lack of large contract wins may negatively impact future bookings and limit revenue and earnings visibility beyond 2025.

Ready to see the factors that could tip Medpace’s valuation one way or the other? The story behind the numbers features punchy assumptions about growth, margins, and shrinking share counts. What could analysts be counting on or missing in their projections? Unpack the details behind this valuation in the full narrative.

Result: Fair Value of $428.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent strength in clinical trial demand or a surge in new bookings could quickly reverse this valuation narrative and drive renewed upside for Medpace.

Find out about the key risks to this Medpace Holdings narrative.

Another View: SWS DCF Model Shows Upside

While analysts see Medpace Holdings as overvalued using their earnings estimate and price targets, our SWS DCF model actually suggests the shares are trading 15% below fair value at $622.21. This method assumes future cash flows better capture what the business could be worth. Which approach tells the real story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Medpace Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Medpace Holdings Narrative

If you see the story differently or want to dig deeper into the numbers yourself, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Medpace Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

You’ve seen what’s driving Medpace Holdings, but the market is packed with other smart opportunities that could boost your portfolio’s growth or income. Don’t wait on the sidelines while others get ahead. Act now and find your next winner with these powerful tools:

- Unlock potential gains by identifying undervalued businesses when you access these 878 undervalued stocks based on cash flows, helping you spot strong candidates others might overlook.

- Amplify your portfolio’s growth with targeted exposure to healthcare’s AI breakthroughs by using these 33 healthcare AI stocks to find companies at the forefront of this medical revolution.

- Seize higher yields by tapping into stable companies with compelling payouts through these 18 dividend stocks with yields > 3%, designed to connect you with income opportunities exceeding 3% yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MEDP

Medpace Holdings

Provides clinical research-based drug and medical device development services in North America, Europe, and Asia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives