- United States

- /

- Life Sciences

- /

- NasdaqGS:MEDP

Medpace Holdings (MEDP): Evaluating Valuation After Barclays Downgrade Versus Upgraded Outlook

Reviewed by Kshitija Bhandaru

See our latest analysis for Medpace Holdings.

Even with Barclays’ downgrade creating short-term volatility, Medpace Holdings has continued to build momentum overall, as underscored by solid quarterly growth and an upgraded outlook. The company’s one-year total shareholder return stands at 59%, highlighting strong long-term performance in a dynamic market backdrop.

Curious to spot more companies with steady growth and investor confidence? Take the next step and check out fast growing stocks with high insider ownership.

With Medpace shares recently outperforming over multiple years, yet trading well above the latest analyst price targets, investors are left to wonder: are current fundamentals undervalued, or is everything already priced in for future growth?

Most Popular Narrative: 27% Overvalued

The narrative consensus places Medpace Holdings’ fair value at $423.64, meaning the last close price sits far above what’s seen as justified by underlying financials. This contrast sets the stage for a valuation driven by ambitious growth forecasts and margin assumptions.

The rapid revenue acceleration in 2025 is heavily influenced by a therapeutic mix shift toward faster-burning studies (such as metabolic trials) with higher reimbursable costs, increasing "pass-through" revenue that is less margin-accretive. This could result in lower underlying revenue and EBITDA growth once this project mix normalizes. Funding for many clients, especially small biotech, remains fragile. Low cancellations have driven recent upside, but if improved funding or reduced cancellations reverse (as seen in previous quarters), revenue and earnings growth could sharply decelerate, indicating that the current growth levels may not be sustainable.

What hidden levers power this bold valuation call? The narrative’s price tag is built on assumptions about future profitability and revenue pathways. Details you will not want to miss. Will this company’s outlook withstand scrutiny, or is there a surprising twist in store? See what numbers are at the heart of this tension.

Result: Fair Value of $423.64 (OVERVALUE)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent demand for clinical trials and disciplined capital allocation could quickly shift the outlook and support Medpace’s continued revenue and margin growth.

Find out about the key risks to this Medpace Holdings narrative.

Another View: Discounted Cash Flow Signals Undervaluation

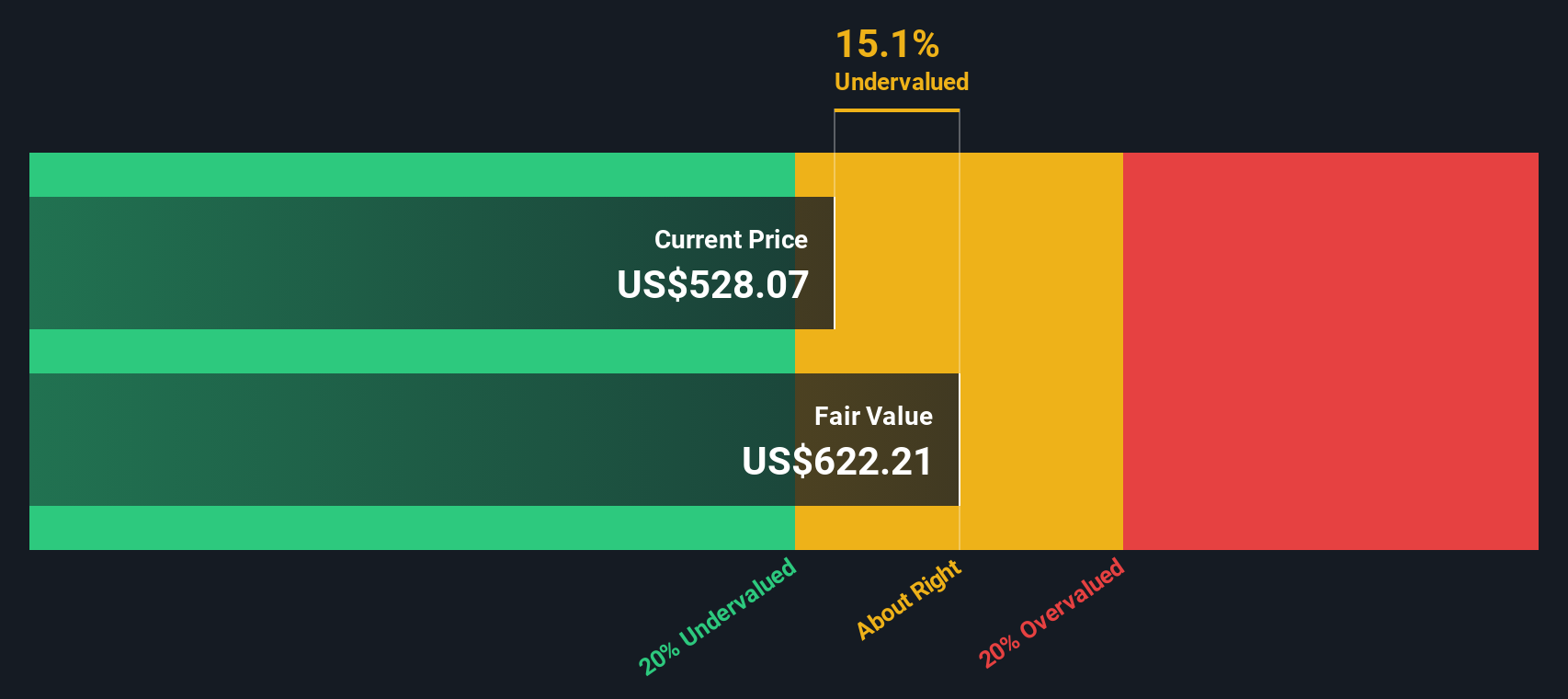

While analysts see Medpace as overvalued when comparing the share price to earnings projections, the Simply Wall St DCF model offers a contrasting perspective. It estimates Medpace's fair value is actually higher than today’s price, suggesting the market could be underestimating long-term cash flows. Which view will prove correct as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Medpace Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Medpace Holdings Narrative

If the current narrative does not align with your perspective or you'd rather analyze the figures on your own, you can build your take in just a few minutes. Do it your way.

A great starting point for your Medpace Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity slip by while others take the lead. Level up your investing with these hand-picked routes to stocks most investors overlook.

- Unlock reliable income streams by uncovering these 19 dividend stocks with yields > 3% with attractive yields and a strong track record of shareholder returns.

- Supercharge your watchlist with cutting-edge technology by checking out these 26 quantum computing stocks that are paving the way in tomorrow’s computing landscape.

- Get an edge on the market by exploring these 900 undervalued stocks based on cash flows which may be trading below their true worth based on rigorous cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MEDP

Medpace Holdings

Provides clinical research-based drug and medical device development services in North America, Europe, and Asia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives