- United States

- /

- Life Sciences

- /

- NasdaqGS:MEDP

Is Medpace Still Attractive After a 65.6% Surge and New Digital Health Partnership?

Reviewed by Bailey Pemberton

Thinking about Medpace Holdings and wondering if there is still room for your investment dollar? You are not alone. Over the past year, Medpace has been quite the standout, handing its shareholders a robust 65.6% return, with 63.3% gains year-to-date. The past month alone has seen shares climb another 9.8%, capping a remarkable run that even seasoned investors have had a hard time ignoring.

What is driving this momentum? Beyond sector trends in clinical research outsourcing, Medpace recently announced expansions to its clinical trial capabilities and a new partnership with a digital health leader. These moves have sparked further excitement around its long-term growth plans. Unlike quick sentiment swings, these developments highlight a sense that the market is taking a second look at the company's future prospects. This is reflected in the stock’s three-year gain of 146.8% and a 388% surge over five years, both suggesting a business that has delivered notable performance over time.

But with all this growth, is Medpace still a bargain or is the stock running ahead of itself? On paper, its valuation score sits at just 1 out of 6, indicating that by most traditional metrics, the company may not look especially undervalued at this point. Still, valuation is more than just a single number or checklist, and that is where our deep dive begins. Let us break down the major valuation approaches, then explore what might truly move the needle for Medpace investors.

Medpace Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Medpace Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used approach that estimates a company's intrinsic value by projecting its future free cash flows and then discounting those flows back to their present value. This approach allows investors to gauge what the business is fundamentally worth today, based on optimistic but realistic financial assumptions.

For Medpace Holdings, the current Free Cash Flow stands at $574.3 million. Analysts have provided estimates for the next five years, predicting Free Cash Flow to rise steadily, and by 2029 the projection reaches $758.25 million. Beyond that, Simply Wall St extrapolates further growth, with Free Cash Flow expected to continue on a positive path in the years that follow.

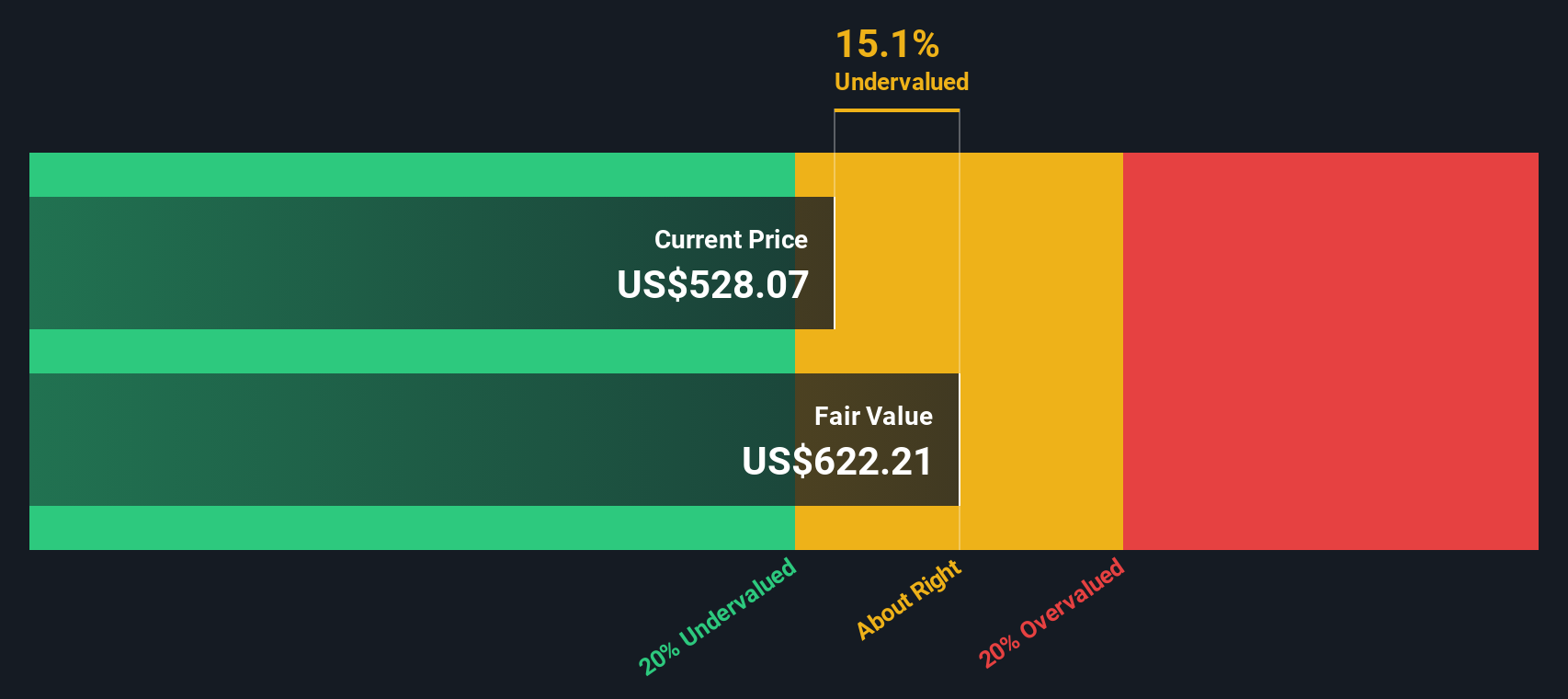

The DCF calculation for Medpace uses a 2 Stage Free Cash Flow to Equity model and results in an estimated intrinsic value of $620.68 per share. With Medpace’s current share price reflecting an implied discount of 11.9%, the model suggests that the stock is currently undervalued based on long-term cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Medpace Holdings is undervalued by 11.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Medpace Holdings Price vs Earnings

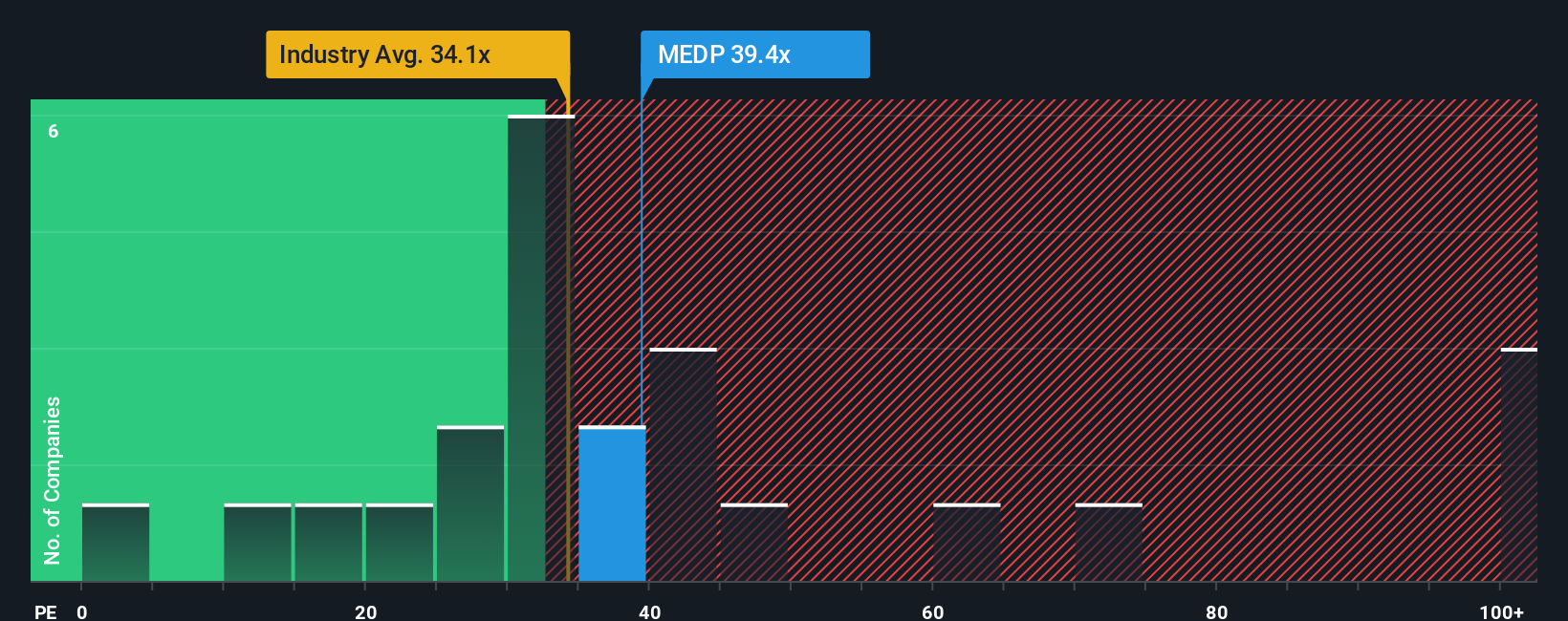

For profitable companies like Medpace Holdings, the Price-to-Earnings (PE) ratio is one of the most widely recognized metrics for valuing stocks. It essentially shows how much investors are willing to pay for each dollar of earnings. A higher PE can indicate strong growth expectations or lower perceived risk. In contrast, a lower PE may signal limited growth prospects or greater risk compared to peers.

Medpace currently trades at a PE ratio of 36.7x. This is above both the Life Sciences industry average of 33.5x and the average of close peer companies, which stands at 25.7x. On the surface, this could suggest that Medpace is a bit pricier than its sector. However, raw comparisons rarely tell the full story because they do not account for differences in growth rates or company-specific risks.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio, at 25.4x for Medpace, is calculated by considering not just the company’s historical and expected earnings growth, but also its profit margins, industry dynamics, market cap, and risk factors. Unlike a simple industry average or peer comparison, the Fair Ratio provides a more tailored benchmark for what PE multiple the stock deserves in light of its unique profile.

Comparing Medpace’s actual PE of 36.7x to its Fair Ratio of 25.4x shows the stock is trading noticeably above what would be considered fair value based on these comprehensive factors, indicating that the shares may be overvalued at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Medpace Holdings Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your investment story; it connects what you believe about Medpace Holdings’ business and industry outlook to a customized forecast for revenue, earnings, and profit margins, which then calculates a fair value for the shares. Narratives go beyond the numbers, letting you bring your perspective and assumptions to life, and tie them directly to a financial result.

On Simply Wall St’s popular Community page, millions of investors use Narratives to structure their thinking and keep pace with new information, whether it comes from headlines or quarterly earnings updates. Narratives make it easy for you to compare your estimated fair value to the current share price, helping you decide whether to buy, hold, or sell. Your Narrative automatically adjusts as new data emerges. For example, some Medpace investors believe the company deserves its high valuation thanks to continued sector demand, disciplined execution, and strong long-term growth, resulting in a fair value estimate as high as $510 per share. Others, focused on rising operational risks and slower revenue expansion, see fair value as low as $305. It is your story, your forecast, your decision.

Do you think there's more to the story for Medpace Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MEDP

Medpace Holdings

Provides clinical research-based drug and medical device development services in North America, Europe, and Asia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives