- United States

- /

- Life Sciences

- /

- NasdaqGS:MEDP

A Fresh Look at Medpace Holdings (MEDP) Valuation After Earnings Surprises, Buybacks, and Rapid Share Gains

Reviewed by Kshitija Bhandaru

Medpace Holdings (MEDP) heads into its upcoming earnings report with plenty of eyes on it, thanks to a steady track record of beating earnings, rising estimates, and a surge in share price that has outpaced its sector peers.

See our latest analysis for Medpace Holdings.

After a stellar run over the past several months, Medpace Holdings’ share price is up nearly 50% year-to-date and has delivered a massive 227% total shareholder return over three years. This reflects the momentum building behind the stock even as broader market jitters led to a modest one-week dip. Recent events, including a significant share buyback and updated revenue guidance for 2025, have kept investors’ focus firmly on its growth prospects. The current trading price above many valuation benchmarks suggests the market is betting on further outperformance.

If you’re interested in uncovering other fast movers with insider skin in the game, now’s the perfect chance to check out fast growing stocks with high insider ownership

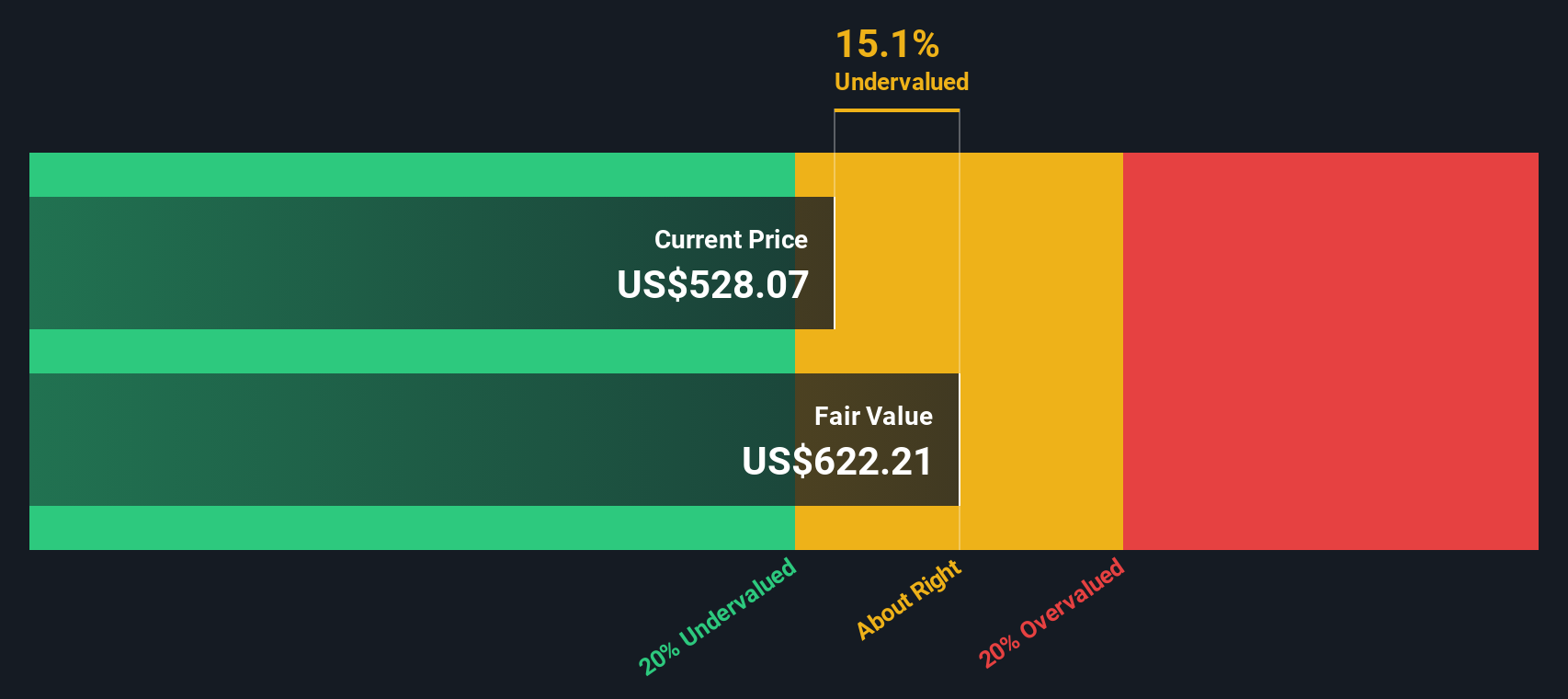

With shares trading well above analyst targets and traditional metrics suggesting a premium, the question now is whether Medpace remains undervalued by some measures or if expectations have already run far ahead of reality, leaving little room for upside.

Most Popular Narrative: 17% Overvalued

Medpace Holdings last closed at $501.22, which sits well above the narrative's $428 fair value estimate. The setup for this valuation highlights high expectations from recent momentum, but the narrative signals that there are legitimate doubts about whether current growth levels can persist.

Despite strong topline growth, win rates for new business were down and backlog is declining (down 1.8% year-over-year), suggesting competitive pressures and a lack of large contract wins may negatively impact future bookings and limit revenue and earnings visibility beyond 2025.

Curious what’s driving analysts to peg Medpace’s fair value below the current price? Unpack the surprising blend of revenue growth forecasts, shrinking margins, and future profit multiples that power this bold valuation narrative. There is a twist in the projections; find out what could sway the consensus either way if you dig deeper.

Result: Fair Value of $428 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent demand for clinical trials or unexpectedly strong bookings could quickly turn sentiment and challenge the current view that the stock is overvalued.

Find out about the key risks to this Medpace Holdings narrative.

Another View: SWS DCF Model Points to Undervaluation

While traditional valuation metrics signal Medpace Holdings may be expensive, our DCF model brings a different angle. It estimates the company's fair value closer to $623, which is well above the current price. This suggests the market might be overly focused on short-term risks and discounting potential long-term growth.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Medpace Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Medpace Holdings Narrative

If you have a different perspective or want to dig into the numbers yourself, you can build your own view of Medpace Holdings in just a few minutes, Do it your way

A great starting point for your Medpace Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself an edge by confidently pursuing fresh opportunities. These unique collections reflect powerful market trends and help you pinpoint promising stocks worth your attention.

- Spot new breakthroughs in artificial intelligence and transform your watchlist by checking out these 24 AI penny stocks, which show exceptional potential in this game-changing field.

- Capitalize on robust cash flow fundamentals and valuation opportunities when you scan these 899 undervalued stocks based on cash flows, as these stocks consistently price below their true worth.

- Pursue long-term growth and collect reliable income with these 19 dividend stocks with yields > 3% offering strong yields above 3% from standout businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MEDP

Medpace Holdings

Provides clinical research-based drug and medical device development services in North America, Europe, and Asia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives