- United States

- /

- Biotech

- /

- NasdaqCM:MDXG

MiMedx (MDXG): Fresh Clinical Evidence Spurs a Closer Look at the Stock’s Valuation and Long-Term Upside Potential

Reviewed by Simply Wall St

MiMedx Group (MDXG) just added fresh peer reviewed backing for its placental allograft products, with a new Journal of Inflammation study underscoring their immunomodulatory role in complex wound healing and longer term competitive positioning.

See our latest analysis for MiMedx Group.

Even with this new clinical validation, MiMedx Group’s $7.05 share price sits well below its highs, with a year-to-date share price return of negative 24.03 percent and a powerful three-year total shareholder return of 154.51 percent suggesting longer term momentum is still very much intact.

If this kind of evidence driven growth story has your attention, it is worth widening the lens and seeing which other healthcare stocks are quietly building similar momentum.

With shares still trading at a steep discount to analyst targets despite double digit revenue and profit growth, the key question now is whether MiMedx is genuinely undervalued or if the market is already pricing in its next leg of expansion.

Most Popular Narrative Narrative: 42.2% Undervalued

With MiMedx Group’s fair value set well above the recent 7.05 close, the most followed narrative leans firmly toward a compelling long term opportunity.

The company's strong clinical evidence base and focus on product efficacy position it to gain market share as Medicare reimbursement reforms shift the market away from price competition and toward clinical and cost effectiveness, likely supporting revenue and protecting/increasing net margins.

Curious how sustained double digit growth, rising margins and a premium future earnings multiple can all align under a single discount rate story? Click through.

Result: Fair Value of $12.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming Medicare reimbursement shifts and potential market contraction for skin substitutes could quickly challenge the growth and valuation assumptions behind this bullish case.

Find out about the key risks to this MiMedx Group narrative.

Another View: Valuation Signals Clash

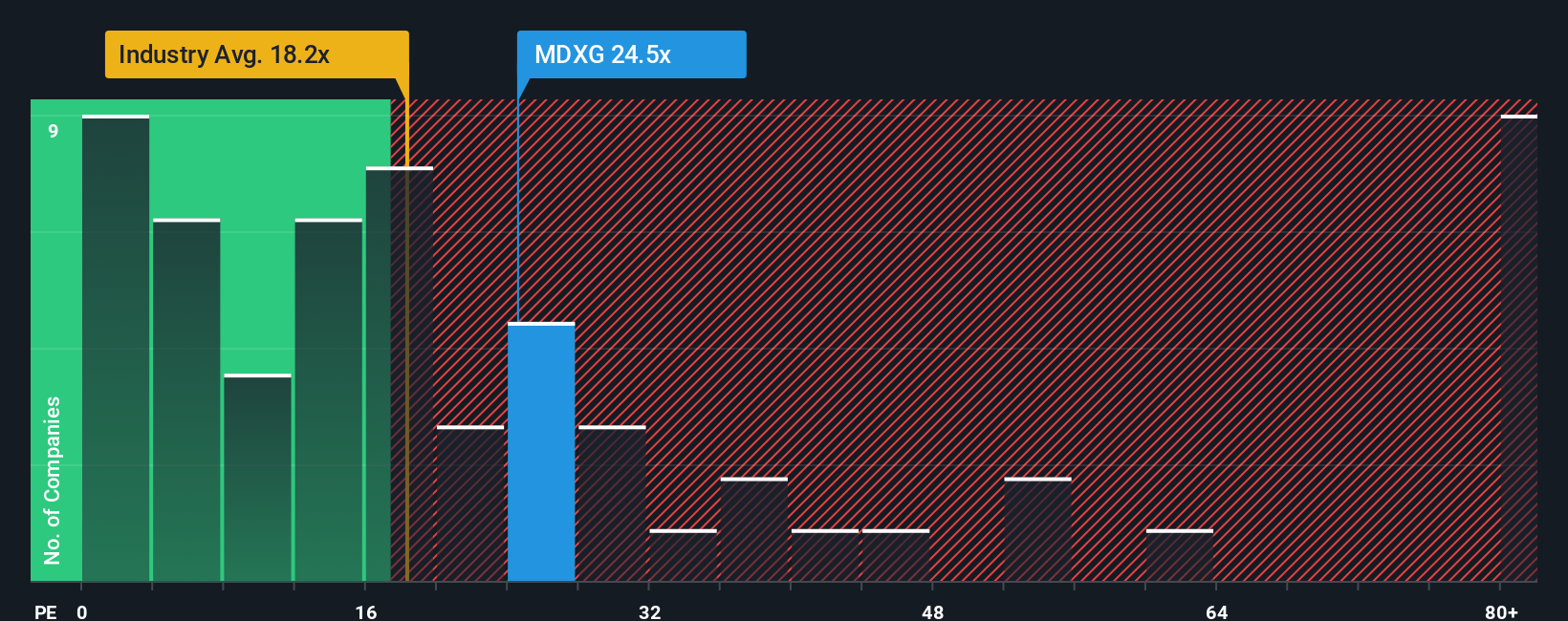

Despite the narrative pointing to a fair value of 12.20, the earnings based lens sends a very different message. At 25.6 times earnings versus a fair ratio of 18.2 times and an industry average of 20.7 times, MiMedx screens expensive, raising the question of who is right: the story or the multiple.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MiMedx Group Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a complete narrative in under three minutes: Do it your way.

A great starting point for your MiMedx Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street’s powerful screener to work so you do not miss the next wave of high conviction opportunities beyond MiMedx.

- Capture early stage potential by reviewing these 3633 penny stocks with strong financials that pair smaller market caps with surprisingly resilient financial profiles.

- Position your portfolio for the next productivity surge by targeting these 24 AI penny stocks reshaping industries with real world artificial intelligence applications.

- Focus on these 12 dividend stocks with yields > 3% that provide consistent cash payouts if you are seeking income and stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MDXG

MiMedx Group

Develops and distributes placental tissue allografts for various sectors of healthcare.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion