- United States

- /

- Biotech

- /

- NasdaqCM:MDXG

How New Immunomodulation Data on Placental Allografts Will Impact MiMedx Group (MDXG) Investors

Reviewed by Sasha Jovanovic

- MiMedx Group recently published new peer-reviewed data in the Journal of Inflammation showing that its Purion-processed DHACM and LHACM placental allografts exert multifactorial immunomodulatory effects on key inflammatory cells involved in wound healing.

- The findings that these allografts both temper inflammatory monocyte and macrophage activity and enhance pro-reparative functions such as efferocytosis and cell survival could strengthen the medical community’s confidence in MiMedx’s products for complex, chronic wounds.

- We’ll now examine how this fresh peer-reviewed evidence on DHACM and LHACM’s immunomodulatory effects may influence MiMedx Group’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

MiMedx Group Investment Narrative Recap

To own MiMedx, you need to believe its placental allografts can convert strong clinical evidence into durable reimbursement support and share gains in chronic wound care. This new immunomodulatory data helps reinforce that evidence story but does not materially change the key near term catalyst of Medicare reimbursement reform or the main risk that pricing and volume pressure could still compress the overall skin substitute market.

The recent launch of EPIXPRESS, a PURION processed lyophilized placental allograft for chronic and hard to heal wounds, looks especially relevant here because it extends MiMedx’s lyophilized portfolio alongside LHACM. Together with the new Journal of Inflammation data, it underpins the idea that a broader, clinically supported product suite may help the company compete on outcomes rather than discounts as reimbursement changes take effect.

Yet, even with growing clinical validation, investors should be aware that upcoming fixed Medicare reimbursement for skin substitutes could still...

Read the full narrative on MiMedx Group (it's free!)

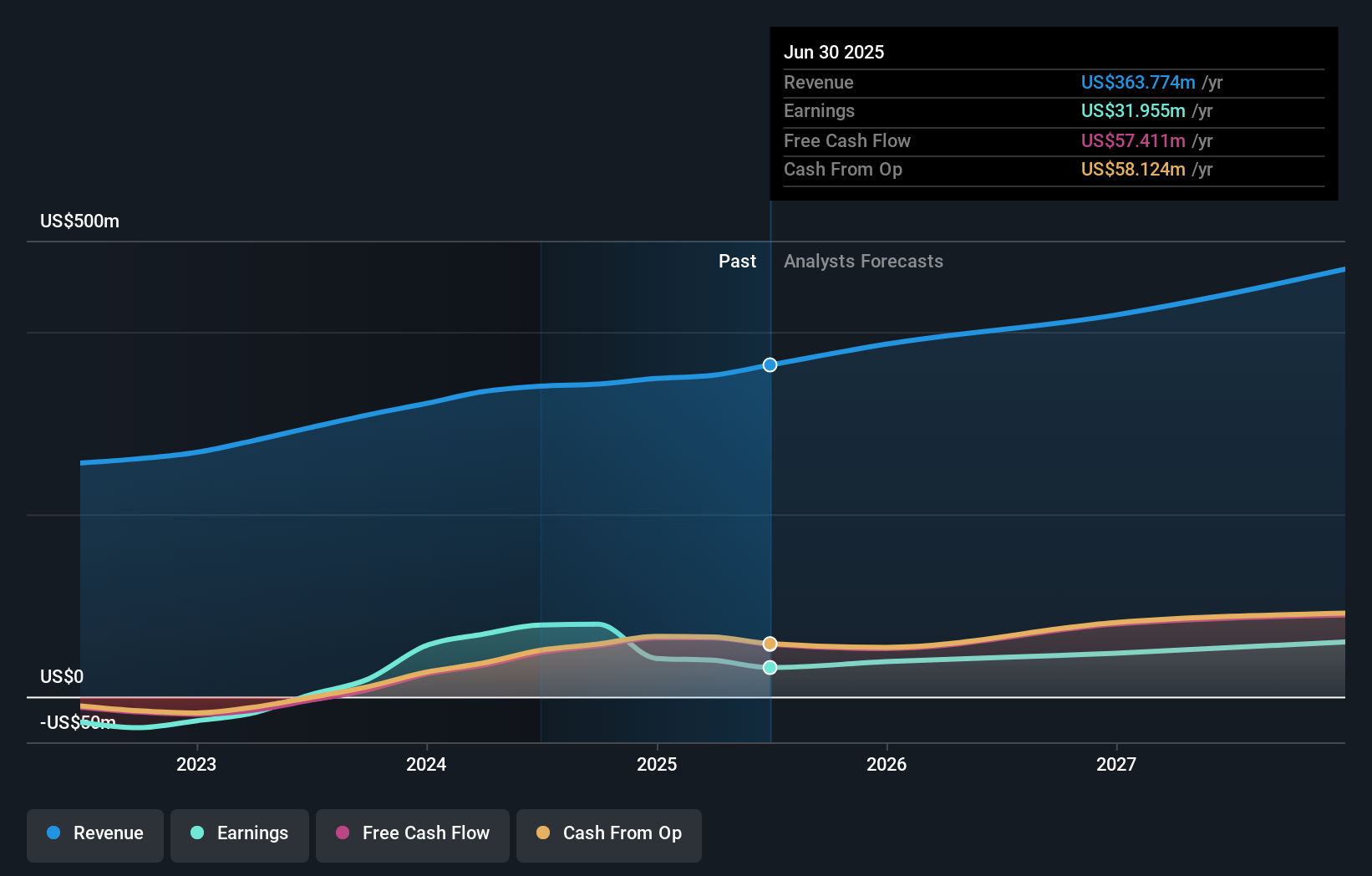

MiMedx Group's narrative projects $487.0 million revenue and $67.0 million earnings by 2028.

Uncover how MiMedx Group's forecasts yield a $12.20 fair value, a 68% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community valuations cluster between about US$12.20 and US$17.49 per share, showing how far opinions on MiMedx can spread. Against that range, the looming shift to fixed Medicare skin substitute reimbursement could be a key factor that shapes which of these scenarios feels more realistic, so it is worth weighing several different viewpoints before deciding how this stock might fit your portfolio.

Explore 2 other fair value estimates on MiMedx Group - why the stock might be worth just $12.20!

Build Your Own MiMedx Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MiMedx Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MiMedx Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MiMedx Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MDXG

MiMedx Group

Develops and distributes placental tissue allografts for various sectors of healthcare.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion