- United States

- /

- Pharma

- /

- NasdaqCM:LQDA

Why Liquidia (LQDA) Is Up 5.2% After Posting Substantial Q3 Revenue Growth and Reduced Losses

Reviewed by Sasha Jovanovic

- Liquidia Corporation recently reported its third quarter 2025 earnings, revealing US$54.34 million in revenue and a net loss of US$3.53 million, compared to US$4.45 million in revenue and a net loss of US$31.03 million in the same quarter last year.

- This sharp increase in revenue and narrowing of net loss highlights a period of significant operational progress for the company.

- We’ll now explore how Liquidia’s substantial revenue growth shapes its broader investment narrative and prospects for operational improvement.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Liquidia's Investment Narrative?

For investors considering Liquidia, the central thesis has long focused on the commercial progress of YUTREPIA and the company's ability to shrink losses amid rapid revenue growth. The latest quarterly report, with US$54.34 million in revenue and a sharply reduced net loss, signals a meaningful step forward, likely shifting near-term attention from funding concerns and legal uncertainties toward how well new product adoption sustains this momentum. Prior to this, key near-term catalysts centered on market traction for YUTREPIA, potential outcomes from ongoing patent litigation, and the company’s ability to achieve profitability targets. With this strong revenue jump, most short-term catalysts become even more dependent on YUTREPIA's continued success, while the biggest risk, unresolved litigation, remains front and center. The news materially moves the needle and heightens the stakes around both growth and these pending legal decisions. In contrast, ongoing patent disputes could still weigh heavily on the outlook.

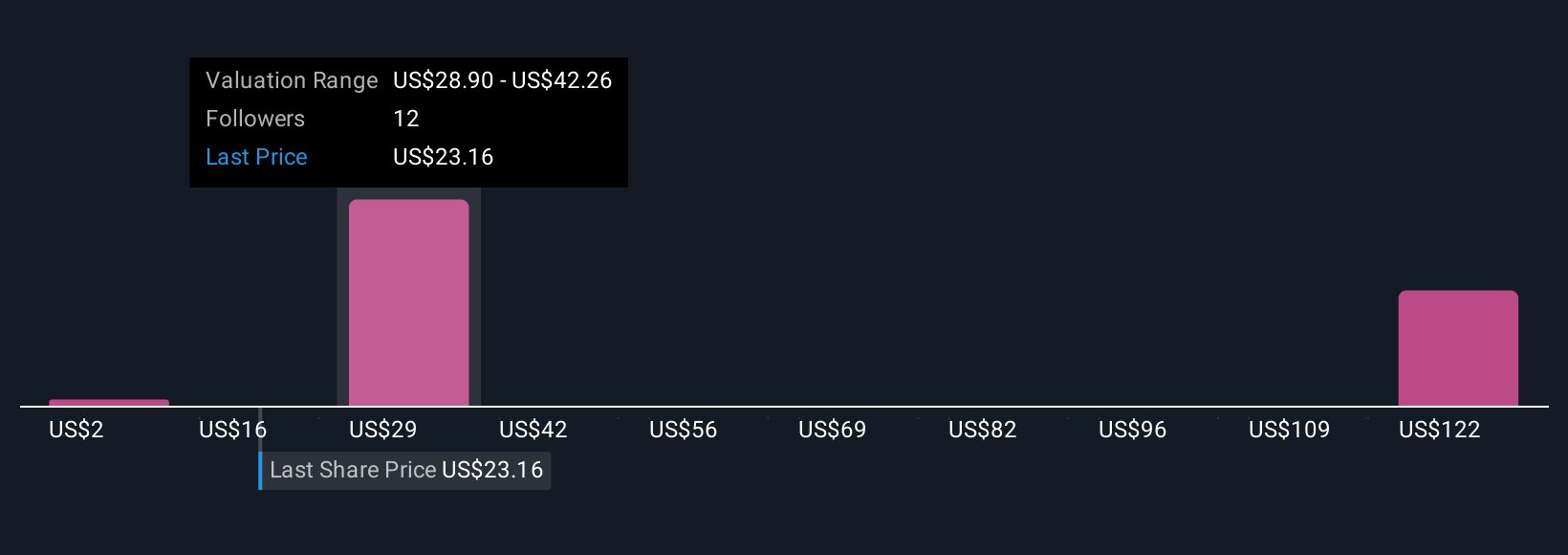

Liquidia's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Liquidia - why the stock might be worth less than half the current price!

Build Your Own Liquidia Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Liquidia research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Liquidia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Liquidia's overall financial health at a glance.

No Opportunity In Liquidia?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LQDA

Liquidia

A biopharmaceutical company, develops, manufactures, and commercializes various products for unmet patient needs in the United States.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives