- United States

- /

- Pharma

- /

- NasdaqGM:LGND

Ligand Pharmaceuticals (LGND): Evaluating Valuation After Recent 11% Share Price Gain

Reviewed by Simply Wall St

See our latest analysis for Ligand Pharmaceuticals.

Ligand Pharmaceuticals’ 1-year total shareholder return stands at nearly 80%, and momentum has picked up considerably in 2024 as optimism about its business model and pipeline builds. The 30% share price gain over the past three months points to renewed investor interest. This year’s bullish trend has outpaced its longer-term averages.

If you’re curious what other biotech names are seeing similar interest, take the opportunity to discover See the full list for free.

With shares trading around $200 and a recent rally that still leaves them below analysts’ price targets, the question now is whether Ligand Pharmaceuticals remains undervalued or if the market is already factoring in the company’s future growth.

Most Popular Narrative: 2.6% Undervalued

With Ligand Pharmaceuticals closing at $200.86 and the narrative assigning a fair value of $206.25, the valuation signals a modest upside. The narrative’s fair value suggests investors are pricing in both solid fundamentals and future growth prospects.

Ongoing expansion into new disease categories, first-in-class therapeutics, and underpenetrated markets (e.g., the Pelthos/Zelsuvmi pediatric dermatology launch and Merck's global rollout of O2vir) creates meaningful optionality and potential upside for both royalty income and long-term net margins.

Which breakthrough product, surprising margin leap, or global trend is the real driver here? The narrative calculation hinges on ambitious growth and profitability assumptions. Are you ready to spot what sets this price apart?

Result: Fair Value of $206.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained pricing pressure or setbacks in key royalty assets could quickly undermine these bullish projections and challenge Ligand Pharmaceuticals' path to continued outperformance.

Find out about the key risks to this Ligand Pharmaceuticals narrative.

Another View: How Do Multiples Stack Up?

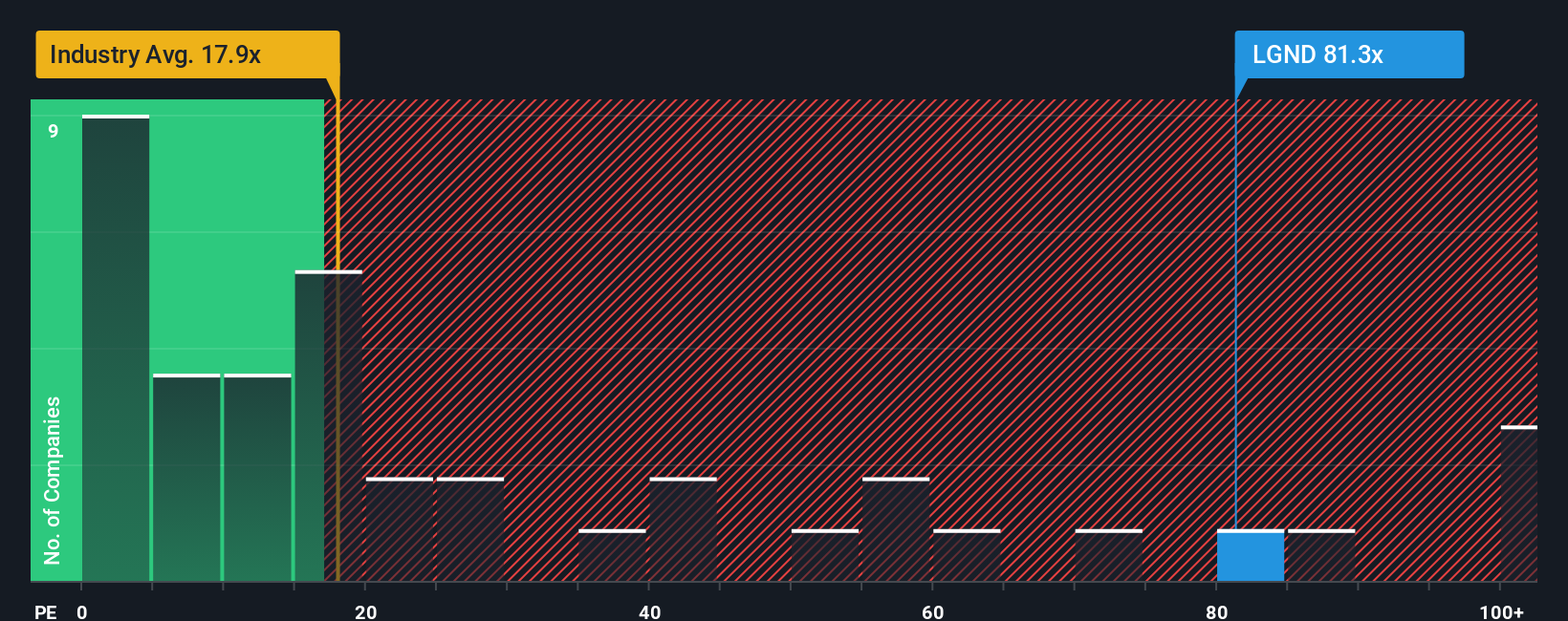

While narrative models point to a fair value slightly above current levels, the company’s price-to-earnings ratio stands at 81.4x, which is much higher than the U.S. Pharmaceuticals industry average of 18.8x and the peer average of 19x. Even compared to the fair ratio of 21.1x, shares look steep. This gap could suggest valuation risk if expectations shift. But do current fundamentals really justify such a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ligand Pharmaceuticals Narrative

If you see the story differently or would rather investigate first-hand, you can craft your perspective in just a few minutes: Do it your way

A great starting point for your Ligand Pharmaceuticals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let compelling opportunities slip away. Take action to uncover unique stocks beyond Ligand Pharmaceuticals using Simply Wall Street’s tailored screeners designed to match your interests.

- Amplify your returns by uncovering hidden gems among these 906 undervalued stocks based on cash flows with real promise based on strong cash flows and proven financial health.

- Seize an edge in emerging technology by targeting next-generation leaders with these 26 AI penny stocks who are pushing the boundaries of artificial intelligence innovation.

- Secure consistent income for your portfolio by focusing on these 16 dividend stocks with yields > 3% that offer attractive yields and robust fundamentals for long-term investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LGND

Ligand Pharmaceuticals

A biopharmaceutical company, develops and licenses biopharmaceutical assets worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives