- United States

- /

- Pharma

- /

- NasdaqGM:LGND

How FDA Approval of Lasix ONYU Expands Ligand Pharmaceuticals' (LGND) Royalty Pipeline and Revenue Potential

Reviewed by Sasha Jovanovic

- Ligand Pharmaceuticals' partner SQ Innovation Inc. has received FDA approval for Lasix® ONYU, a novel drug-device combination enabling at-home subcutaneous treatment of edema in adults with chronic heart failure.

- This milestone presents a significant opportunity for Ligand by adding a new royalty stream and addressing a key patient need for home-based care.

- We'll examine how this FDA approval broadens Ligand's royalty pipeline and supports its recurring revenue and margin expansion story.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Ligand Pharmaceuticals Investment Narrative Recap

To be a Ligand Pharmaceuticals shareholder, you need to believe in the resilience and long-term visibility of its royalty model, underpinned by new launches and expanding healthcare partnerships. The recent FDA approval for Lasix ONYU adds an incremental royalty stream and answers a major patient need, but as a single asset it does not materially shift the biggest near-term catalyst, the commercial scaling of key assets like ZELSUVMI, or address the core risk of revenue concentration in just a few products.

The July 2025 launch of ZELSUVMI is closely related, as it similarly opened a new royalty stream for Ligand and demonstrated the company's business model: securing recurring revenue from external commercialization events. Like the Lasix ONYU approval, these developments support Ligand’s drive for growth through portfolio expansion, but ZELSUVMI’s continued market rollout is still the highest-impact event for revenue diversification in the short run. However, while catalysts stack up, investors should recognize that...

Read the full narrative on Ligand Pharmaceuticals (it's free!)

Ligand Pharmaceuticals is projected to reach $315.6 million in revenue and $121.1 million in earnings by 2028. Achieving these targets would require 18.9% annual revenue growth and an earnings increase of $197 million from the current earnings of $-75.9 million.

Uncover how Ligand Pharmaceuticals' forecasts yield a $183.12 fair value, in line with its current price.

Exploring Other Perspectives

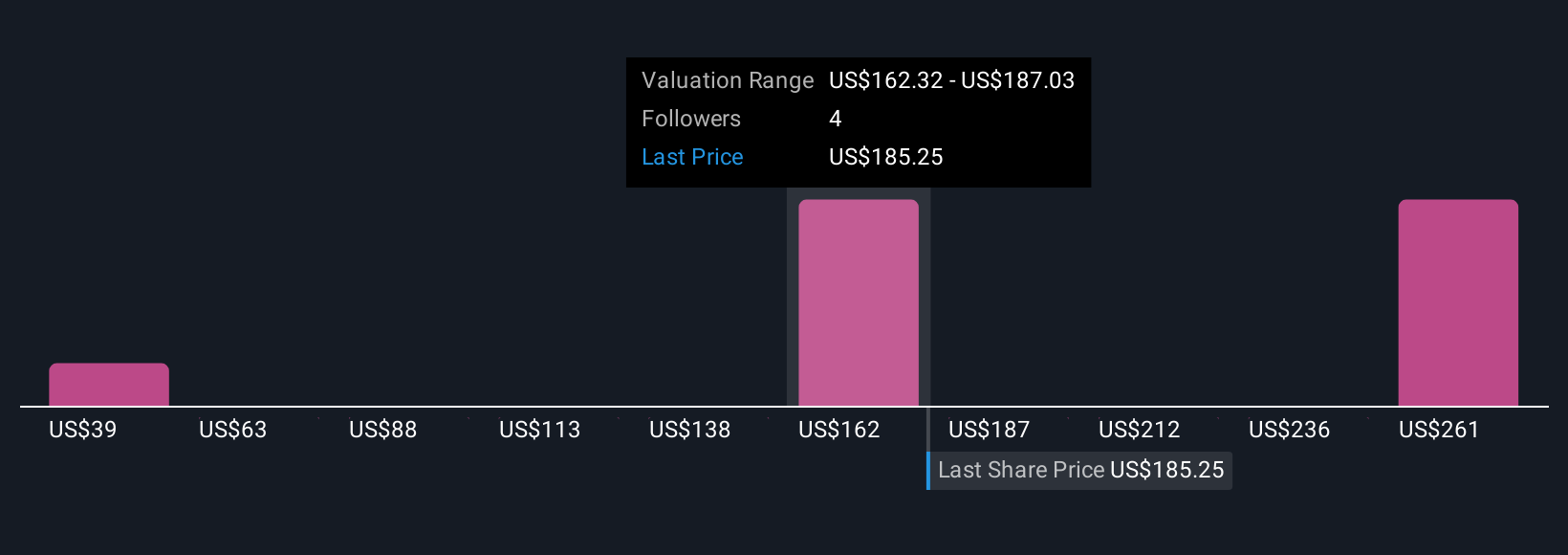

Three members of the Simply Wall St Community assigned fair values to Ligand from US$38.77 to US$285.86, showing views range more than sixfold. Yet, the over-reliance risk on just a few royalty assets continues to shape expectations for Ligand’s future performance, see what others are watching and form your own view.

Explore 3 other fair value estimates on Ligand Pharmaceuticals - why the stock might be worth as much as 55% more than the current price!

Build Your Own Ligand Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ligand Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ligand Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ligand Pharmaceuticals' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LGND

Ligand Pharmaceuticals

A biopharmaceutical company, develops and licenses biopharmaceutical assets worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives