- United States

- /

- Biotech

- /

- NasdaqGS:LEGN

How Investors May Respond To Legend Biotech (LEGN) After FDA CARVYKTI Update and Q3 Results

Reviewed by Sasha Jovanovic

- Legend Biotech reported third-quarter 2025 earnings, highlighting US$272.33 million in revenue and a net loss of US$39.69 million, alongside improved loss per share compared to the prior year.

- The company received an FDA label update for its CARVYKTI therapy, now including data showing significant survival benefits for patients with relapsed, refractory multiple myeloma, strengthening its clinical positioning.

- We’ll examine how the FDA label update for CARVYKTI, supported by positive survival data, shapes Legend Biotech’s investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Legend Biotech Investment Narrative Recap

For Legend Biotech, the central belief is that CARVYKTI’s clinical strength and expanding access will drive significant market capture in multiple myeloma, transforming robust survival data into meaningful sales growth. The FDA’s recent label update is a material short-term catalyst, reinforcing CARVYKTI’s clinical value and supporting revenue momentum, but it does not reduce the company’s product concentration risk, Legend remains heavily reliant on CARVYKTI’s ongoing performance for its financial prospects.

Among the company’s announcements, the latest FDA label update for CARVYKTI, incorporating new overall survival data from the CARTITUDE-4 study, stands out as most relevant. By confirming survival benefits and expanding CARVYKTI’s use in relapsed, refractory patients, this update aligns directly with Legend’s primary growth catalyst, increasing patient access and uptake in earlier therapy lines, which could influence near-term adoption rates.

However, investors should also be aware that in contrast, the reliance on a single product leaves Legend exposed to any shifts in CARVYKTI's competitive or safety profile...

Read the full narrative on Legend Biotech (it's free!)

Legend Biotech's narrative projects $2.3 billion revenue and $632.7 million earnings by 2028. This requires 42.3% yearly revenue growth and a $958 million earnings increase from current earnings of -$325.3 million.

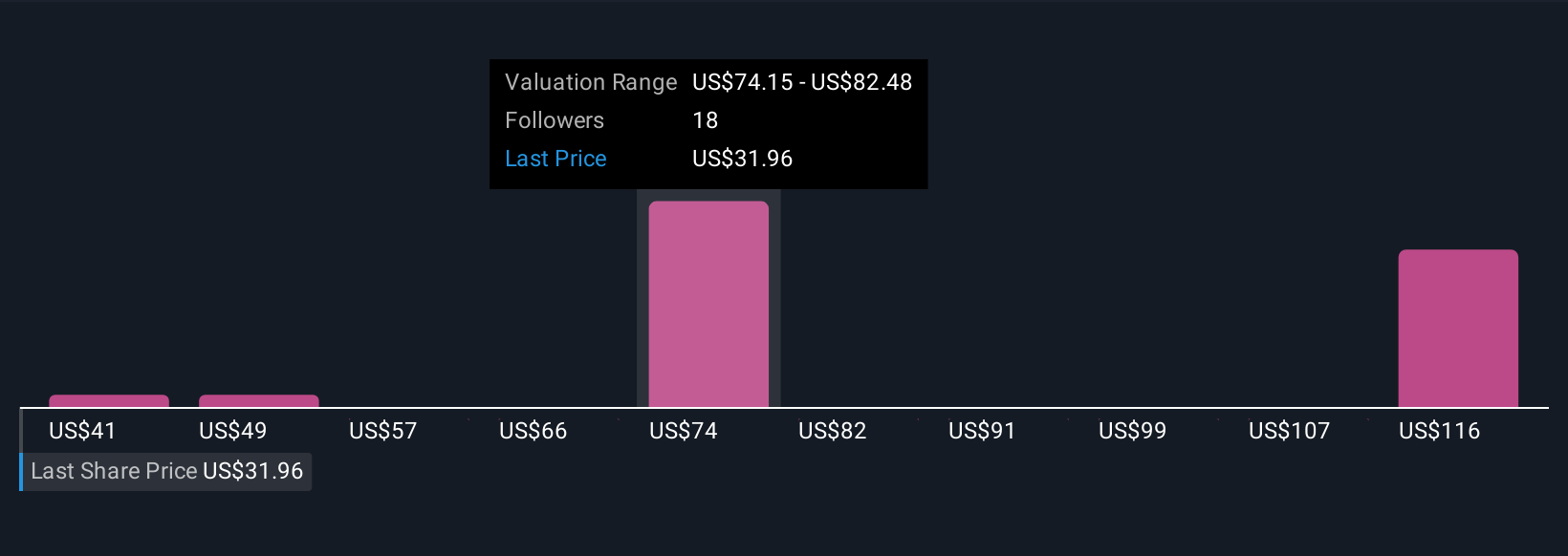

Uncover how Legend Biotech's forecasts yield a $75.06 fair value, a 141% upside to its current price.

Exploring Other Perspectives

Six retail investors in the Simply Wall St Community see Legend’s fair value ranging widely from US$40.82 to US$123.77 per share. While opinions differ, the company’s reliance on CARVYKTI for revenue growth highlights why broader consensus is elusive and invites further investigation.

Explore 6 other fair value estimates on Legend Biotech - why the stock might be worth over 3x more than the current price!

Build Your Own Legend Biotech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Legend Biotech research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Legend Biotech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Legend Biotech's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LEGN

Legend Biotech

Through its subsidiaries, operates as a biopharmaceutical company that discovers, develops, manufactures, and commercializes novel cell therapies for oncology and other indications in the United States, China, and Europe.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives