- United States

- /

- Biotech

- /

- NasdaqGM:KYMR

The Bull Case For Kymera Therapeutics (KYMR) Could Change Following KT-621 Atopic Dermatitis Data Readout

Reviewed by Sasha Jovanovic

- In late November and early December 2025, Kymera Therapeutics highlighted progress for KT-621, its first-in-class oral STAT6 degrader, including completion of the BroADen Phase 1b atopic dermatitis trial and initiation of the BROADEN2 Phase 2b study, while scheduling Phase 1b data release for December 8, 2025.

- This latest update positions KT-621 at the center of Kymera’s effort to move beyond early proof-of-mechanism and potentially build a multi-indication Type 2 inflammation franchise spanning dermatology, respiratory and gastroenterology diseases.

- We’ll now examine how the upcoming KT-621 Phase 1b readout in atopic dermatitis could influence Kymera’s longer-term investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Kymera Therapeutics Investment Narrative Recap

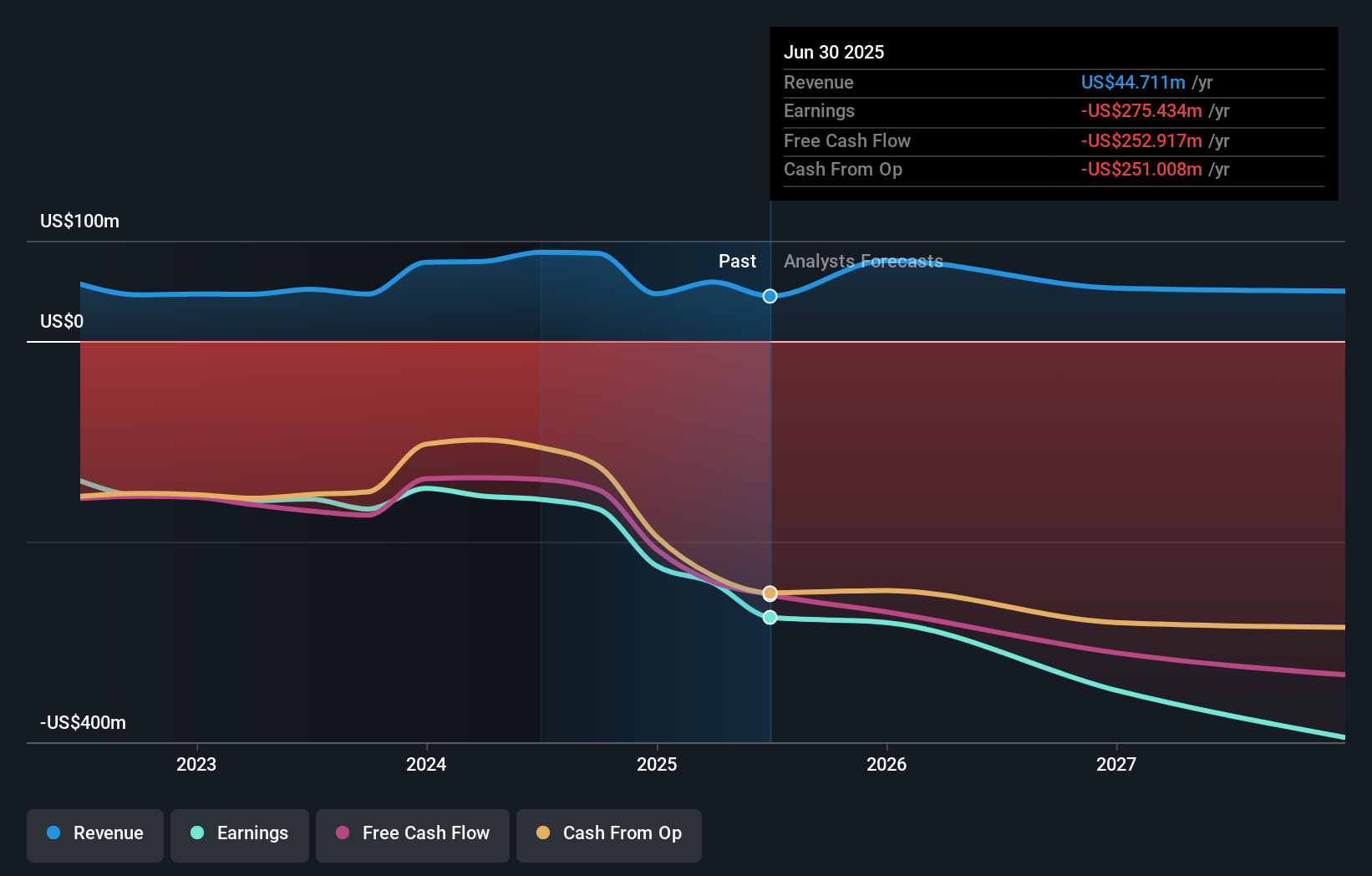

To own Kymera, you have to believe that KT-621 can anchor a broad Type 2 inflammation franchise while the company funds years of loss-making R&D. The upcoming BroADen Phase 1b readout is now the key near term catalyst, with the biggest risk being that expensive trials like BROADEN2 fail to produce data strong enough to justify the current spending trajectory and cash runway.

The November 25 announcement that Kymera has begun dosing in the 200 patient BROADEN2 Phase 2b atopic dermatitis trial is particularly relevant. It shows that management is already committing meaningful capital to KT-621 ahead of the Phase 1b data, tying the stock’s medium term story closely to whether this program can eventually support later stage trials across dermatology, respiratory and gastroenterology indications.

Yet investors should be aware that if high R&D costs persist without KT-621 producing compelling clinical data, the pressure on Kymera’s balance sheet could...

Read the full narrative on Kymera Therapeutics (it's free!)

Kymera Therapeutics' narrative projects $82.2 million revenue and $13.0 million earnings by 2028.

Uncover how Kymera Therapeutics' forecasts yield a $77.59 fair value, a 16% upside to its current price.

Exploring Other Perspectives

The single US$77.59 fair value estimate from 1 Simply Wall St Community member underscores how individual views can cluster tightly around one outcome. You should weigh that against the risk that Kymera’s high R&D spend may not be supported by future KT-621 data, which could influence both sentiment and funding flexibility over time.

Explore another fair value estimate on Kymera Therapeutics - why the stock might be worth as much as 16% more than the current price!

Build Your Own Kymera Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kymera Therapeutics research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Kymera Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kymera Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kymera Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:KYMR

Kymera Therapeutics

A clinical-stage biopharmaceutical company, focuses on discovering and developing small molecule therapeutics that selectively degrade disease-causing proteins by harnessing the body’s own natural protein degradation system.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026