- United States

- /

- Biotech

- /

- NasdaqGM:KYMR

Optimistic Investors Push Kymera Therapeutics, Inc. (NASDAQ:KYMR) Shares Up 39% But Growth Is Lacking

Despite an already strong run, Kymera Therapeutics, Inc. (NASDAQ:KYMR) shares have been powering on, with a gain of 39% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

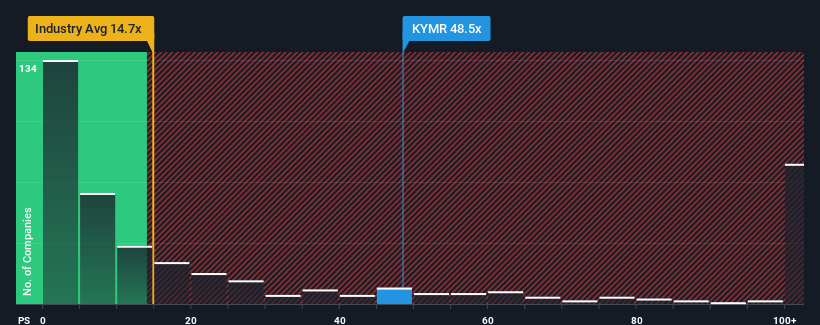

After such a large jump in price, Kymera Therapeutics may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 48.5x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios under 14.7x and even P/S lower than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Kymera Therapeutics

What Does Kymera Therapeutics' P/S Mean For Shareholders?

Recent times haven't been great for Kymera Therapeutics as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kymera Therapeutics.How Is Kymera Therapeutics' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Kymera Therapeutics' to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 103% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Turning to the outlook, the next three years should generate growth of 15% per annum as estimated by the analysts watching the company. With the industry predicted to deliver 254% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Kymera Therapeutics' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Kymera Therapeutics' P/S Mean For Investors?

The strong share price surge has lead to Kymera Therapeutics' P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It comes as a surprise to see Kymera Therapeutics trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 4 warning signs for Kymera Therapeutics (1 doesn't sit too well with us!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kymera Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:KYMR

Kymera Therapeutics

A biopharmaceutical company, focuses on discovering and developing novel small molecule therapeutics that selectively degrade disease-causing proteins by harnessing the body’s own natural protein degradation system.

Flawless balance sheet low.