- United States

- /

- Biotech

- /

- NasdaqGM:KYMR

Kymera Therapeutics, Inc.'s (NASDAQ:KYMR) 27% Share Price Surge Not Quite Adding Up

Kymera Therapeutics, Inc. (NASDAQ:KYMR) shareholders have had their patience rewarded with a 27% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 91%.

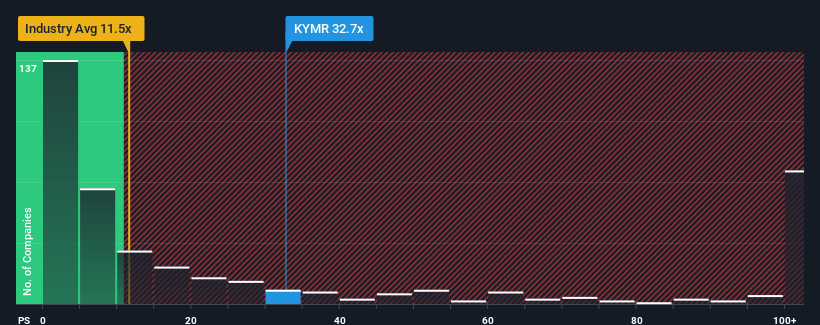

After such a large jump in price, Kymera Therapeutics may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 32.7x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios under 11.5x and even P/S lower than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Kymera Therapeutics

What Does Kymera Therapeutics' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Kymera Therapeutics has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Kymera Therapeutics will help you uncover what's on the horizon.How Is Kymera Therapeutics' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Kymera Therapeutics' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 70% last year. The strong recent performance means it was also able to grow revenue by 61% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 3.6% per annum during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 208% per annum growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Kymera Therapeutics' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Kymera Therapeutics' P/S?

Kymera Therapeutics' P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Kymera Therapeutics trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 4 warning signs for Kymera Therapeutics (1 is a bit concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on Kymera Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kymera Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:KYMR

Kymera Therapeutics

A clinical-stage biopharmaceutical company, focuses on discovering and developing small molecule therapeutics that selectively degrade disease-causing proteins by harnessing the body’s own natural protein degradation system.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives