- United States

- /

- Biotech

- /

- NasdaqGS:KPTI

Karyopharm Therapeutics Inc. (NASDAQ:KPTI) Held Back By Insufficient Growth Even After Shares Climb 33%

Despite an already strong run, Karyopharm Therapeutics Inc. (NASDAQ:KPTI) shares have been powering on, with a gain of 33% in the last thirty days. But the last month did very little to improve the 64% share price decline over the last year.

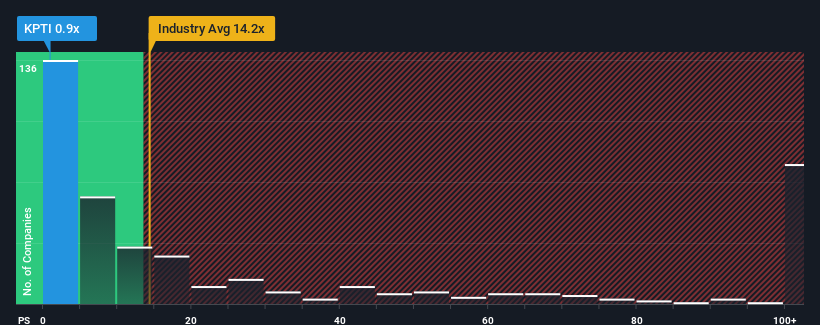

Even after such a large jump in price, Karyopharm Therapeutics may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.9x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 14.2x and even P/S higher than 67x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Karyopharm Therapeutics

How Karyopharm Therapeutics Has Been Performing

Karyopharm Therapeutics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Karyopharm Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Karyopharm Therapeutics' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 42%. Still, the latest three year period has seen an excellent 60% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 17% per year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 271% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Karyopharm Therapeutics' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Karyopharm Therapeutics' P/S Mean For Investors?

Shares in Karyopharm Therapeutics have risen appreciably however, its P/S is still subdued. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Karyopharm Therapeutics' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Karyopharm Therapeutics (2 are a bit concerning!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Karyopharm Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KPTI

Karyopharm Therapeutics

A commercial-stage pharmaceutical company, discovers, develops, and commercializes drugs directed against nuclear export for the treatment of cancer and other diseases in the United States.

Medium-low and fair value.

Similar Companies

Market Insights

Community Narratives