- United States

- /

- Biotech

- /

- NasdaqGS:KNSA

Will Kiniksa’s 92% 2024 Surge Continue After Strong Cash Flow Growth?

Reviewed by Bailey Pemberton

If you’re eyeing Kiniksa Pharmaceuticals International, you’re not alone. Investors are buzzing about whether this stock still has room to run, or if it’s best to lock in gains. Over the last year, shares have soared 53.7%, and since the start of 2024, they’ve surged an impressive 92.1%. Even zooming out over five years, Kiniksa has delivered a healthy 97.4% return, more than doubling investors’ money. There’s been a minor dip of 0.9% in the last week, but that comes after a solid 4.8% jump over the last month. Brief breathers like this can actually signal renewed opportunity rather than trouble.

Market chatter points to evolving therapeutic opportunities and positive sentiment toward Kiniksa’s product pipeline as big drivers behind these price moves. The company seems to have shaken off previous doubts around risk, with investors responding by bidding shares higher and higher. All this action begs a key question: is the stock overrun or is there more upside waiting?

Valuation is the lens through which to answer that. Kiniksa sports a robust value score of 5 out of 6, meaning it checks almost every box for being undervalued right now. This can be an encouraging signal for anyone concerned about buying at the peak. But as with any investment, it’s critical to dig into how these valuation metrics are calculated and whether they give the full picture. Next, let’s break down these approaches, and later, I’ll share an even sharper way to judge real value that most investors overlook.

Approach 1: Kiniksa Pharmaceuticals International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting all future cash flows it can produce and then discounting those values back to today. This approach gives investors a sense of the current worth of all expected profits. The DCF model is especially useful for biotechs like Kiniksa Pharmaceuticals International, where future revenues play a significant role in the company's valuation.

Currently, Kiniksa’s Free Cash Flow is $66.6 million, and analyst estimates see solid growth in the next few years. By 2029, projections point to annual cash flow of about $323.5 million. Analysts generate forecasts for up to five years, and numbers beyond that are extrapolated by Simply Wall St. For example, Free Cash Flow is anticipated to climb each year, reflecting strong confidence in Kiniksa’s pipeline and potential market expansion.

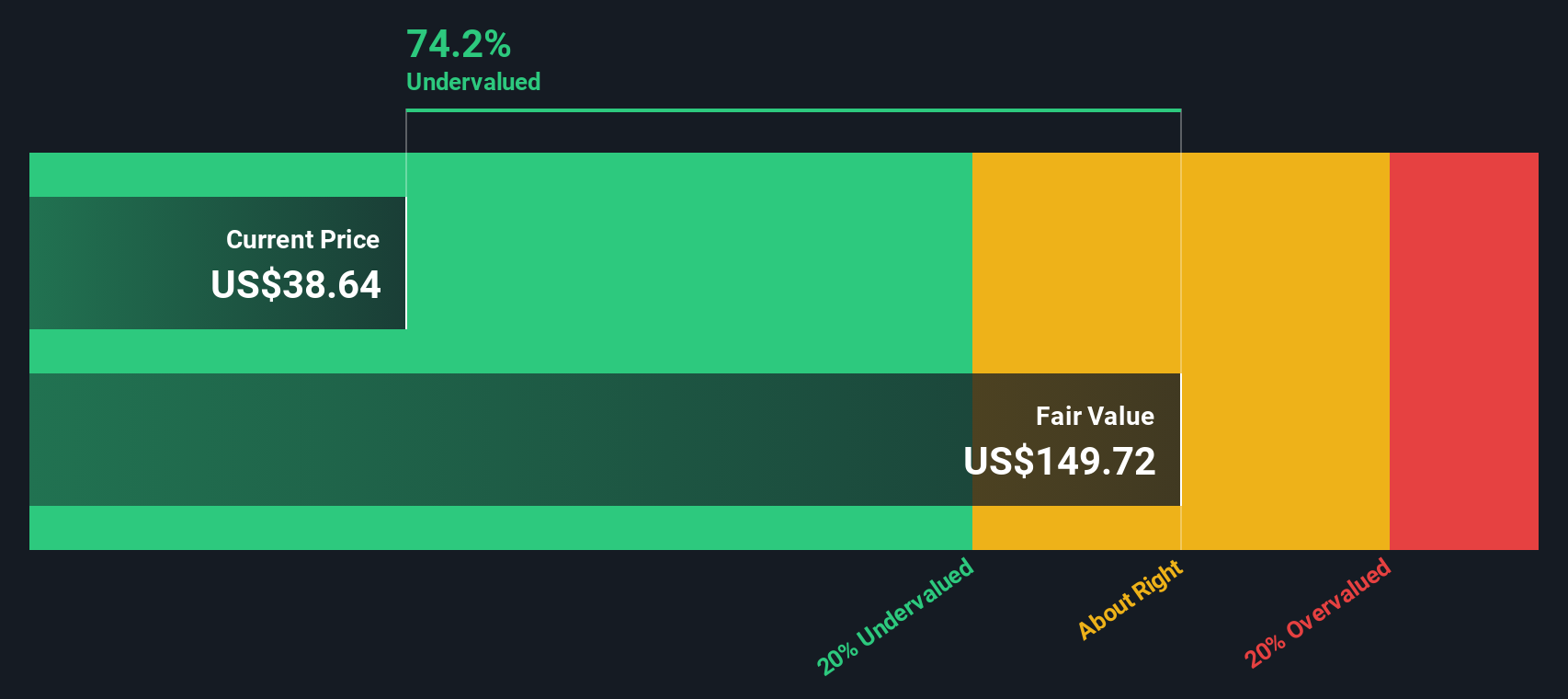

Based on the DCF model, the estimated intrinsic value for Kiniksa shares is $151.48. Compared to the current market price, this model suggests Kiniksa is trading at a 74.7% discount, indicating it is significantly undervalued in the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kiniksa Pharmaceuticals International is undervalued by 74.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Kiniksa Pharmaceuticals International Price vs Sales

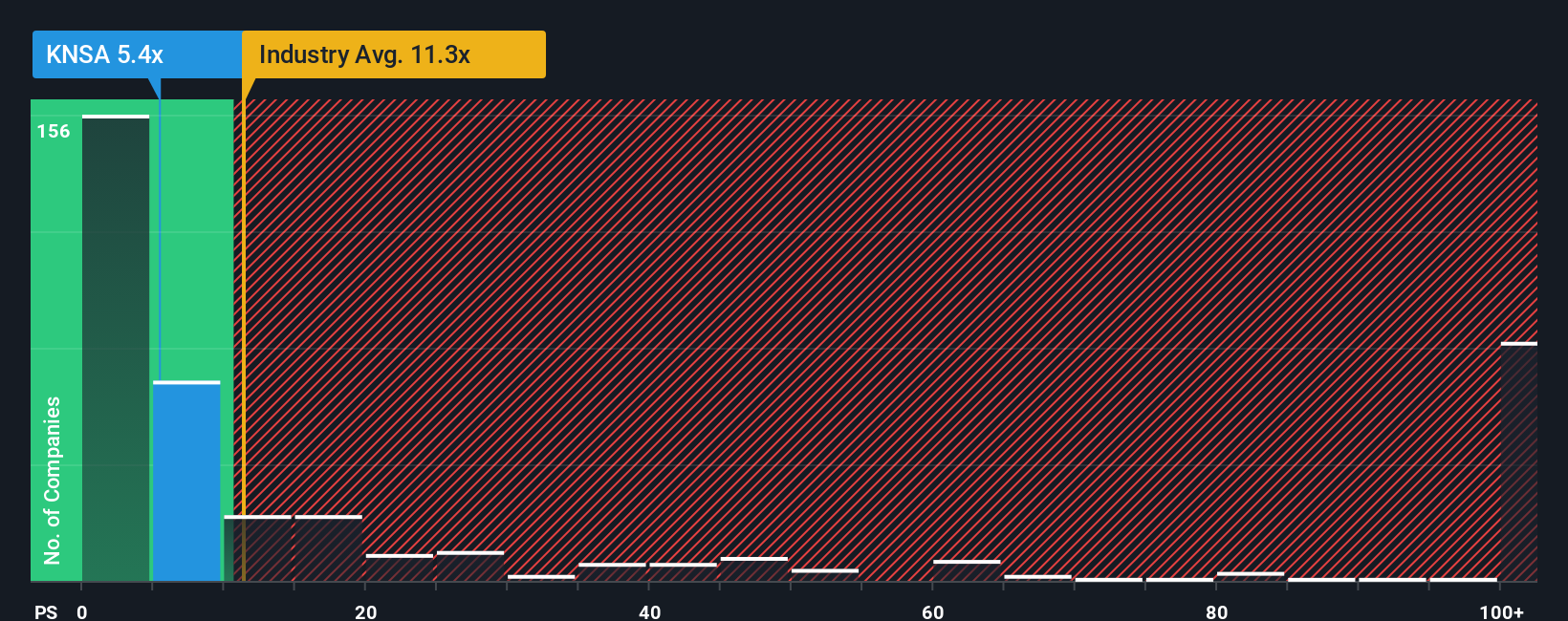

For biotech companies like Kiniksa Pharmaceuticals International, the Price-to-Sales (P/S) ratio is a widely used valuation tool. This is because many biotechs reinvest heavily in research and may not yet be consistently profitable, so revenue becomes a more reliable gauge of company growth and investor expectations. The P/S ratio compares how much investors are paying for each dollar of sales, offering perspective on how the market values Kiniksa’s revenue potential.

Generally, a company with high revenue growth and lower risk can justify a higher P/S ratio. By contrast, riskier or slower-growing firms trade at lower multiples. These expectations play a key role in what is considered a “normal” or “fair” P/S for any given biotech name.

Kiniksa’s current P/S ratio is 5.36x. When measured against the biotech industry average of 10.51x and the peer average of 18.33x, Kiniksa appears to be trading at a notable discount. This could catch the eye of value-focused investors. Instead of relying solely on generic industry or peer benchmarks, the Fair Ratio from Simply Wall St provides a tailored reference point. It calculates what the company’s P/S should be, taking into account growth prospects, operational margins, market size, and unique risk factors.

This individualized Fair Ratio for Kiniksa lands at 4.70x. Since this is very close to the actual P/S ratio, it suggests the market price is reflecting the company’s profile with impressive accuracy. This approach gives a much clearer perspective than raw peer or industry comparisons, as it dynamically weighs the factors that truly affect company value.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kiniksa Pharmaceuticals International Narrative

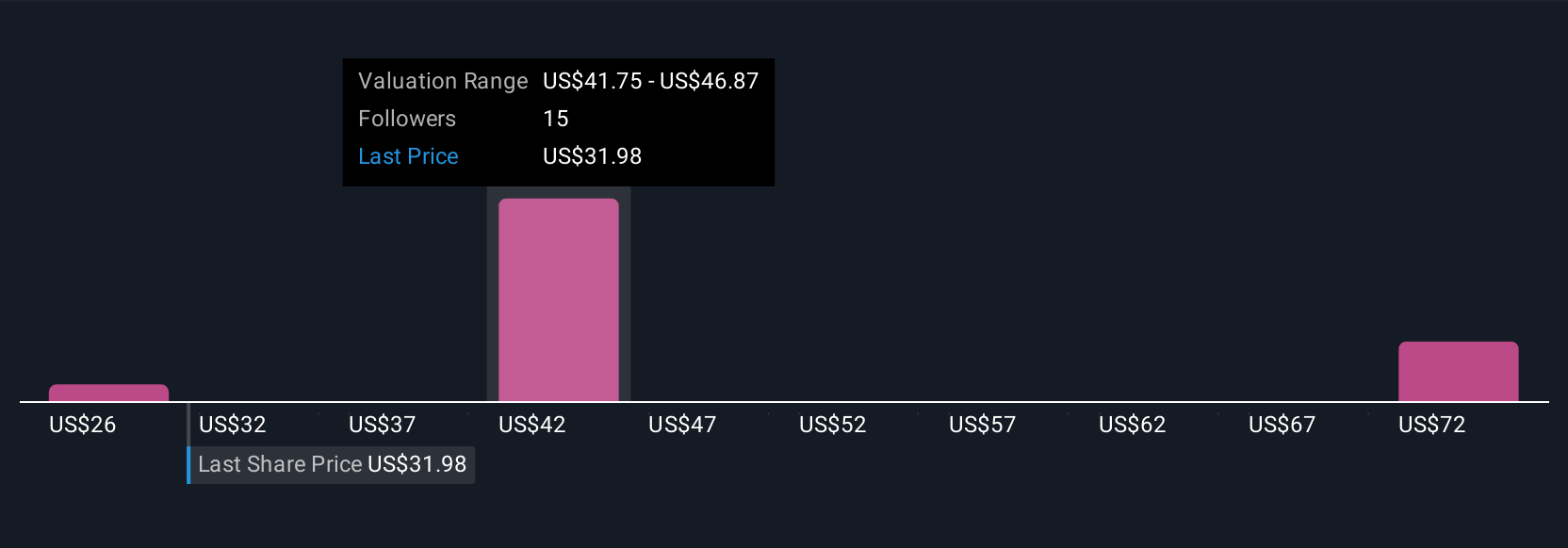

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a concise story that reflects your personal perspective on a company, connecting what you believe about its business, industry outlook, revenue growth, and profit margins to a clear financial forecast and a fair value estimate for its shares.

Narratives go beyond just the numbers, allowing you to express why you think Kiniksa Pharmaceuticals International is undervalued, fairly priced, or overhyped, and to update your view as new information (like earnings or drug approvals) emerges. On Simply Wall St’s Community page, you’ll find millions of investors using Narratives as an easy, accessible tool to clarify their thinking and instantly see whether the current share price stacks up against their expectation of fair value.

For example, one investor might see huge potential in ARCALYST adoption and forecast rapid margin expansion, arriving at a bullish fair value above $55 per share. Another, more cautious investor might highlight dependency risks and intense competition, pointing to a conservative target closer to $38. By comparing your Narrative to others and watching it update as new financials arrive, you have a dynamic edge. This helps you decide not just what the market thinks, but whether now is the right time to buy, hold, or sell.

Do you think there's more to the story for Kiniksa Pharmaceuticals International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kiniksa Pharmaceuticals International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KNSA

Kiniksa Pharmaceuticals International

A biopharmaceutical company, developing and commercializing novel therapies for diseases with unmet need and focuses on cardiovascular indications worldwide.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives