- United States

- /

- Biotech

- /

- NasdaqGS:KNSA

How FDA Orphan Drug Status for KPL-387 at Kiniksa (KNSA) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Kiniksa Pharmaceuticals announced that the U.S. FDA granted Orphan Drug Designation to its investigational monoclonal antibody KPL-387 for the treatment of pericarditis, including recurrent pericarditis.

- This regulatory milestone marks progress in Kiniksa’s cardiovascular pipeline, with KPL-387 being positioned for convenient monthly self-injections for patients facing recurring inflammation of the heart’s lining.

- We’ll explore how the FDA’s Orphan Drug Designation for KPL-387 could impact Kiniksa’s pipeline momentum and competitive outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Kiniksa Pharmaceuticals International Investment Narrative Recap

Investors attracted to Kiniksa Pharmaceuticals are often focused on the company's ability to expand ARCALYST’s market reach and diversify its portfolio with pipeline assets like KPL-387. The recent FDA Orphan Drug Designation for KPL-387 signals progress toward pipeline diversification, but the key near-term catalyst remains ARCALYST’s revenue growth, this designation does not materially change that revenue driver or the main risk of concentrated sales dependence.

Of the recent updates, the company’s raised 2025 revenue guidance to US$625 million to US$640 million is most relevant because it underscores current commercial momentum that relies largely on ARCALYST. Despite pipeline advancements highlighted by the KPL-387 news, this higher revenue outlook reinforces the ongoing importance of ARCALYST performance as both a catalyst and risk for the business.

However, investors should also be mindful of what happens if ARCALYST’s market expansion slows or new competitors enter the scene...

Read the full narrative on Kiniksa Pharmaceuticals International (it's free!)

Kiniksa Pharmaceuticals International is projected to reach $992.0 million in revenue and $189.0 million in earnings by 2028. This forecast is based on analysts' assumptions of a 23.3% annual revenue growth rate and a $184.2 million increase in earnings from the current $4.8 million.

Uncover how Kiniksa Pharmaceuticals International's forecasts yield a $48.86 fair value, a 26% upside to its current price.

Exploring Other Perspectives

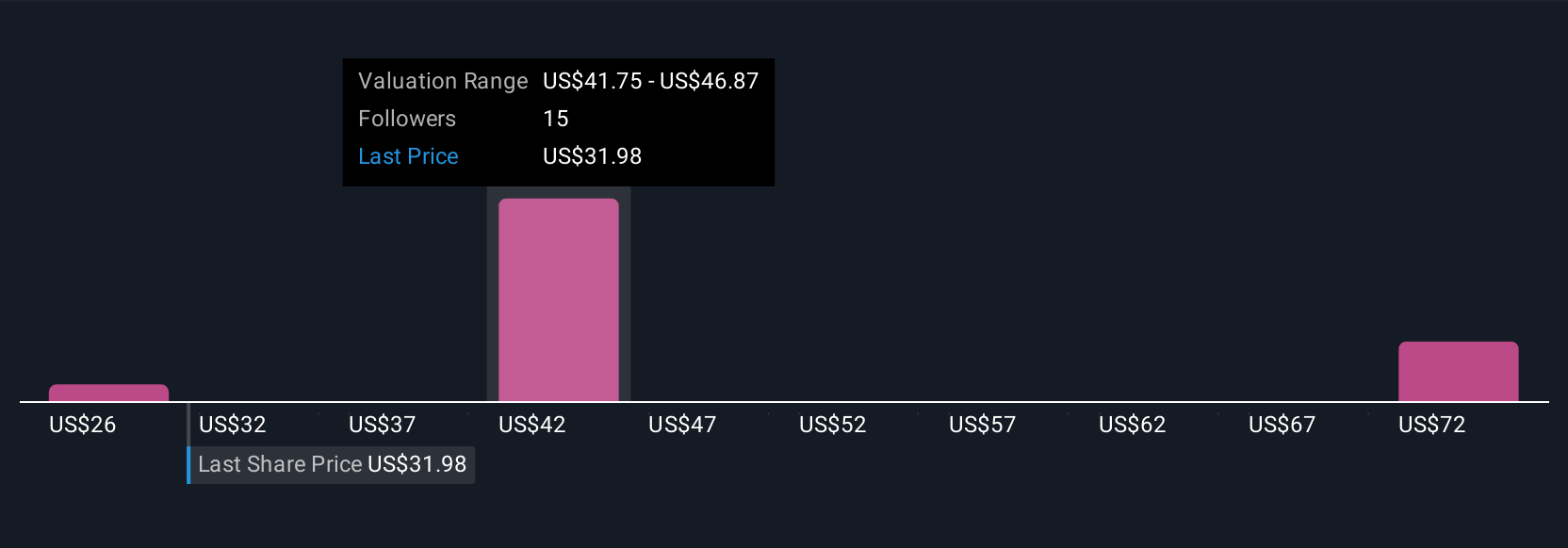

Five Simply Wall St Community members estimate Kiniksa’s fair value between US$26.39 and US$149.77. While current revenue momentum is backed by ARCALYST, shifts in market share or payer coverage may significantly affect future company performance.

Explore 5 other fair value estimates on Kiniksa Pharmaceuticals International - why the stock might be worth over 3x more than the current price!

Build Your Own Kiniksa Pharmaceuticals International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kiniksa Pharmaceuticals International research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Kiniksa Pharmaceuticals International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kiniksa Pharmaceuticals International's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kiniksa Pharmaceuticals International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KNSA

Kiniksa Pharmaceuticals International

A biopharmaceutical company, developing and commercializing novel therapies for diseases with unmet need and focuses on cardiovascular indications worldwide.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives