- United States

- /

- Biotech

- /

- NasdaqCM:KALA

The Kala Pharmaceuticals, Inc. (NASDAQ:KALA) Analysts Have Been Trimming Their Sales Forecasts

Today is shaping up negative for Kala Pharmaceuticals, Inc. (NASDAQ:KALA) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

After this downgrade, Kala Pharmaceuticals' seven analysts are now forecasting revenues of US$20m in 2021. This would be a major 85% improvement in sales compared to the last 12 months. Losses are expected to be contained, narrowing 15% from last year to US$1.79. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$30m and losses of US$1.64 per share in 2021. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also expecting losses per share to increase.

Check out our latest analysis for Kala Pharmaceuticals

The consensus price target fell 11% to US$17.00, with the analysts clearly concerned about the company following the weaker revenue and earnings outlook. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Kala Pharmaceuticals analyst has a price target of US$43.00 per share, while the most pessimistic values it at US$4.00. With such a wide range in price targets, the analysts are almost certainly betting on widely diverse outcomes for the underlying business. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

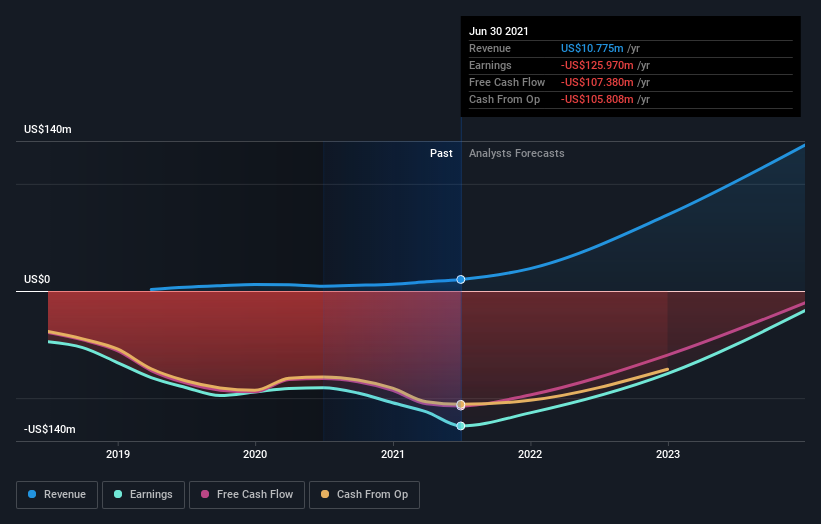

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The analysts are definitely expecting Kala Pharmaceuticals' growth to accelerate, with the forecast 242% annualised growth to the end of 2021 ranking favourably alongside historical growth of 38% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 3.7% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Kala Pharmaceuticals to grow faster than the wider industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at Kala Pharmaceuticals. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of Kala Pharmaceuticals' future valuation. Given the stark change in sentiment, we'd understand if investors became more cautious on Kala Pharmaceuticals after today.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Kala Pharmaceuticals going out to 2023, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading Kala Pharmaceuticals or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KALA BIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:KALA

KALA BIO

A clinical-stage biopharmaceutical company, engages in the research, development, and commercialization of innovative therapies for rare and severe eye diseases in the United States.

Excellent balance sheet moderate.