- United States

- /

- Pharma

- /

- NasdaqCM:JAGX

Jaguar Health, Inc. (NASDAQ:JAGX) Not Doing Enough For Some Investors As Its Shares Slump 39%

Unfortunately for some shareholders, the Jaguar Health, Inc. (NASDAQ:JAGX) share price has dived 39% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 98% share price decline.

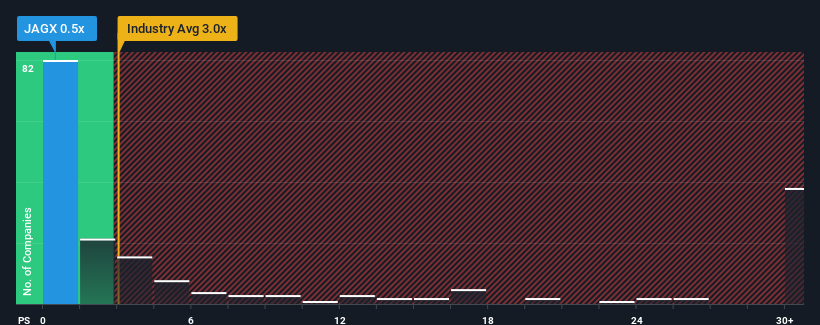

Following the heavy fall in price, Jaguar Health may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 3x and even P/S higher than 18x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Jaguar Health

What Does Jaguar Health's P/S Mean For Shareholders?

It looks like revenue growth has deserted Jaguar Health recently, which is not something to boast about. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jaguar Health will help you shine a light on its historical performance.How Is Jaguar Health's Revenue Growth Trending?

Jaguar Health's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period was better as it's delivered a decent 29% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

This is in contrast to the rest of the industry, which is expected to grow by 26% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Jaguar Health's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Key Takeaway

Shares in Jaguar Health have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

In line with expectations, Jaguar Health maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Jaguar Health that you need to be mindful of.

If you're unsure about the strength of Jaguar Health's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Jaguar Health, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:JAGX

Jaguar Health

A commercial-stage pharmaceuticals company, focuses on developing plant-based prescription medicines for people and animals with gastrointestinal distress.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives