- United States

- /

- Pharma

- /

- NasdaqCM:JAGX

Jaguar Health, Inc. (NASDAQ:JAGX) Might Not Be As Mispriced As It Looks After Plunging 49%

Jaguar Health, Inc. (NASDAQ:JAGX) shares have retraced a considerable 49% in the last month, reversing a fair amount of their solid recent performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 87% loss during that time.

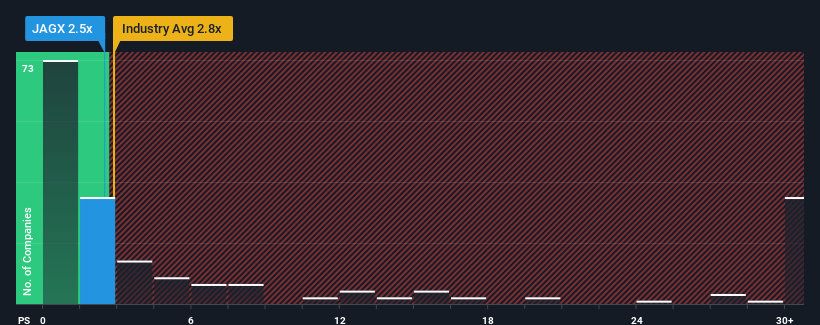

Although its price has dipped substantially, there still wouldn't be many who think Jaguar Health's price-to-sales (or "P/S") ratio of 2.5x is worth a mention when the median P/S in the United States' Pharmaceuticals industry is similar at about 2.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Jaguar Health

What Does Jaguar Health's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Jaguar Health's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Jaguar Health will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Jaguar Health?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Jaguar Health's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 10%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 67% as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 17% growth forecast for the broader industry.

With this information, we find it interesting that Jaguar Health is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Following Jaguar Health's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Jaguar Health currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Jaguar Health (3 make us uncomfortable) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Jaguar Health, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:JAGX

Jaguar Health

A commercial-stage pharmaceuticals company, focuses on developing plant-based prescription medicines for people and animals with gastrointestinal distress.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives