- United States

- /

- Biotech

- /

- NasdaqGM:IVVD

Invivyd (IVVD) Is Up 48.3% After Revenue Jump and FDA Progress on Key Drug – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Invivyd, Inc. recently reported its third-quarter 2025 results, showing revenue growth to US$13.13 million and a substantial reduction in net loss to US$10.47 million compared to the same period last year.

- The improvement in financial performance was further supported by the FDA's clearance of the Investigational New Drug application for VYD2311, highlighting progress in Invivyd's drug development pipeline.

- We'll look at how Invivyd's revenue growth and pipeline milestones shape its investment narrative following these financial and regulatory updates.

Find companies with promising cash flow potential yet trading below their fair value.

Invivyd Investment Narrative Recap

To be a shareholder in Invivyd, you need to believe that the company can sustain its recent revenue growth and keep progressing in its drug pipeline beyond COVID-19. The latest financials and FDA clearance for VYD2311 provide added optimism for near-term pipeline advancement, but the most important short-term catalyst remains successful development and commercialization of new assets, while persistent regulatory risk is still present. The updates offer positive signals, yet have not fundamentally changed the risk of heavy product concentration or regulatory hurdles.

Among the latest announcements, the FDA's clearance of the Investigational New Drug application for VYD2311 stands out as most relevant. This milestone supports Invivyd's efforts to diversify beyond their leading COVID-19 monoclonal antibody, marking progress toward new pipeline catalysts that could address some concentration risks if development timelines are met.

By contrast, investors should also be aware that even with expanding opportunities, regulatory uncertainty still looms as a key risk if pathway requirements change...

Read the full narrative on Invivyd (it's free!)

Invivyd's outlook anticipates $349.7 million in revenue and $100.0 million in earnings by 2028. This is based on analysts' expectations of 96.3% annual revenue growth and a $210 million increase in earnings from the current level of -$110.1 million.

Uncover how Invivyd's forecasts yield a $7.33 fair value, a 212% upside to its current price.

Exploring Other Perspectives

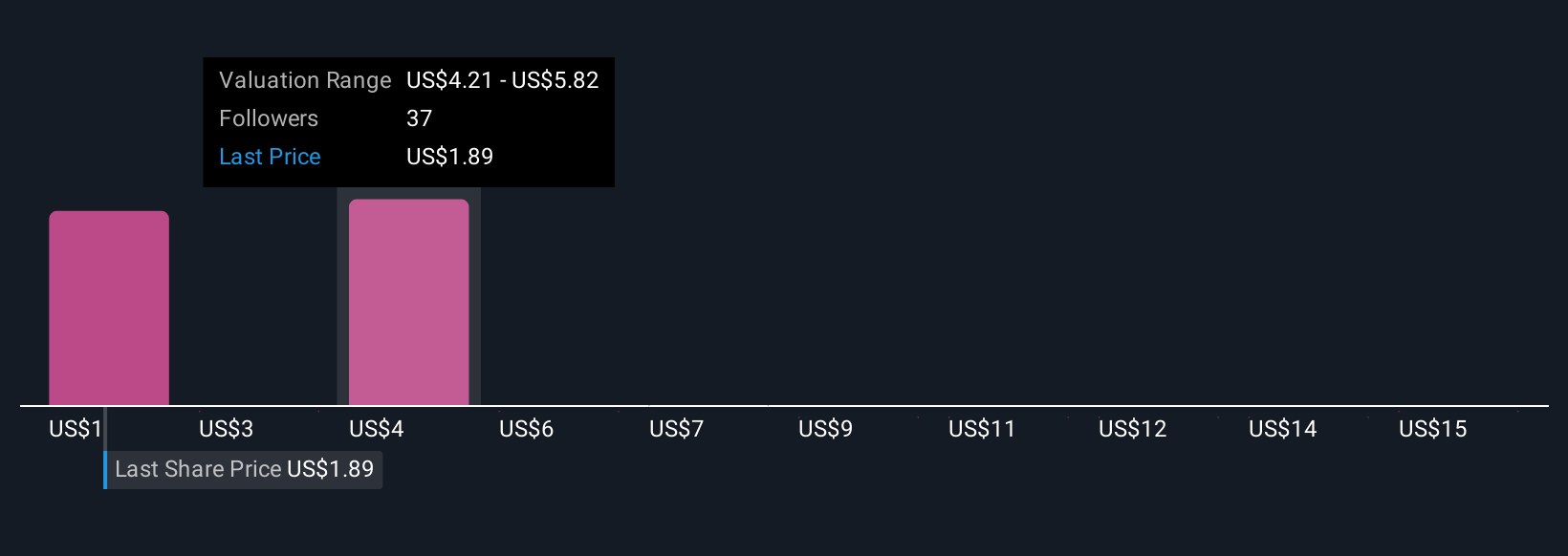

Fifteen retail investors in the Simply Wall St Community marked Invivyd's fair value estimates from just US$1.40 to over US$20.29 per share. While you weigh these contrasting views, keep in mind that regulatory decisions could affect the company’s ability to turn pipeline events into sustainable revenue, shaping different outcomes than consensus expects.

Explore 15 other fair value estimates on Invivyd - why the stock might be worth over 8x more than the current price!

Build Your Own Invivyd Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Invivyd research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Invivyd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Invivyd's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IVVD

Invivyd

A biopharmaceutical company, focuses on the discovery, development, and commercialization of antibody-based solutions for infectious diseases in the United States.

Excellent balance sheet and good value.

Market Insights

Community Narratives