- United States

- /

- Biotech

- /

- NasdaqGS:ROIV

Exploring Three High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

As the U.S. stock market experiences notable turbulence with major indices like the Dow Jones and S&P 500 declining sharply, investors are keenly observing how tech stocks navigate this volatile landscape, especially with upcoming earnings reports from industry giants like Nvidia. Amidst these fluctuations, high-growth tech stocks in the U.S. market continue to capture attention for their potential to deliver robust returns by leveraging innovations and adapting to shifting economic conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.01% | 24.80% | ★★★★★☆ |

| Palantir Technologies | 26.95% | 29.36% | ★★★★★★ |

| Workday | 11.18% | 32.11% | ★★★★★☆ |

| Circle Internet Group | 26.05% | 83.98% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

| RenovoRx | 72.94% | 73.09% | ★★★★★☆ |

| Pelthos Therapeutics | 47.44% | 110.99% | ★★★★★☆ |

| Zscaler | 15.72% | 40.94% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

| Procore Technologies | 11.61% | 114.49% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Invivyd (IVVD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Invivyd, Inc. is a biopharmaceutical company specializing in antibody-based solutions for infectious diseases in the United States, with a market cap of $547.84 million.

Operations: The company generates revenue primarily from the discovery, development, and commercialization of antibody-based solutions for infectious diseases, amounting to $50.04 million.

Invivyd, Inc. is navigating a dynamic landscape in biotech innovation, particularly in the development of non-vaccine therapies for COVID-19. Recent financials reveal a significant reduction in net loss to $10.47 million from last year's $60.74 million for Q3, alongside a revenue jump to $13.13 million from $9.3 million, indicating robust growth and operational improvements. These figures are underscored by aggressive R&D pursuits as evidenced by their latest equity offerings amounting to nearly $125 million aimed at funding their clinical trials for VYD2311—a promising monoclonal antibody candidate. This strategic focus not only highlights Invivyd's commitment to addressing global health challenges but also positions it as a potential key player in the biotech sector’s shift towards specialized therapeutic alternatives.

- Click to explore a detailed breakdown of our findings in Invivyd's health report.

Gain insights into Invivyd's past trends and performance with our Past report.

Roivant Sciences (ROIV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Roivant Sciences Ltd. is a clinical-stage biopharmaceutical company dedicated to the discovery, development, and commercialization of medicines and technologies, with a market cap of $14.11 billion.

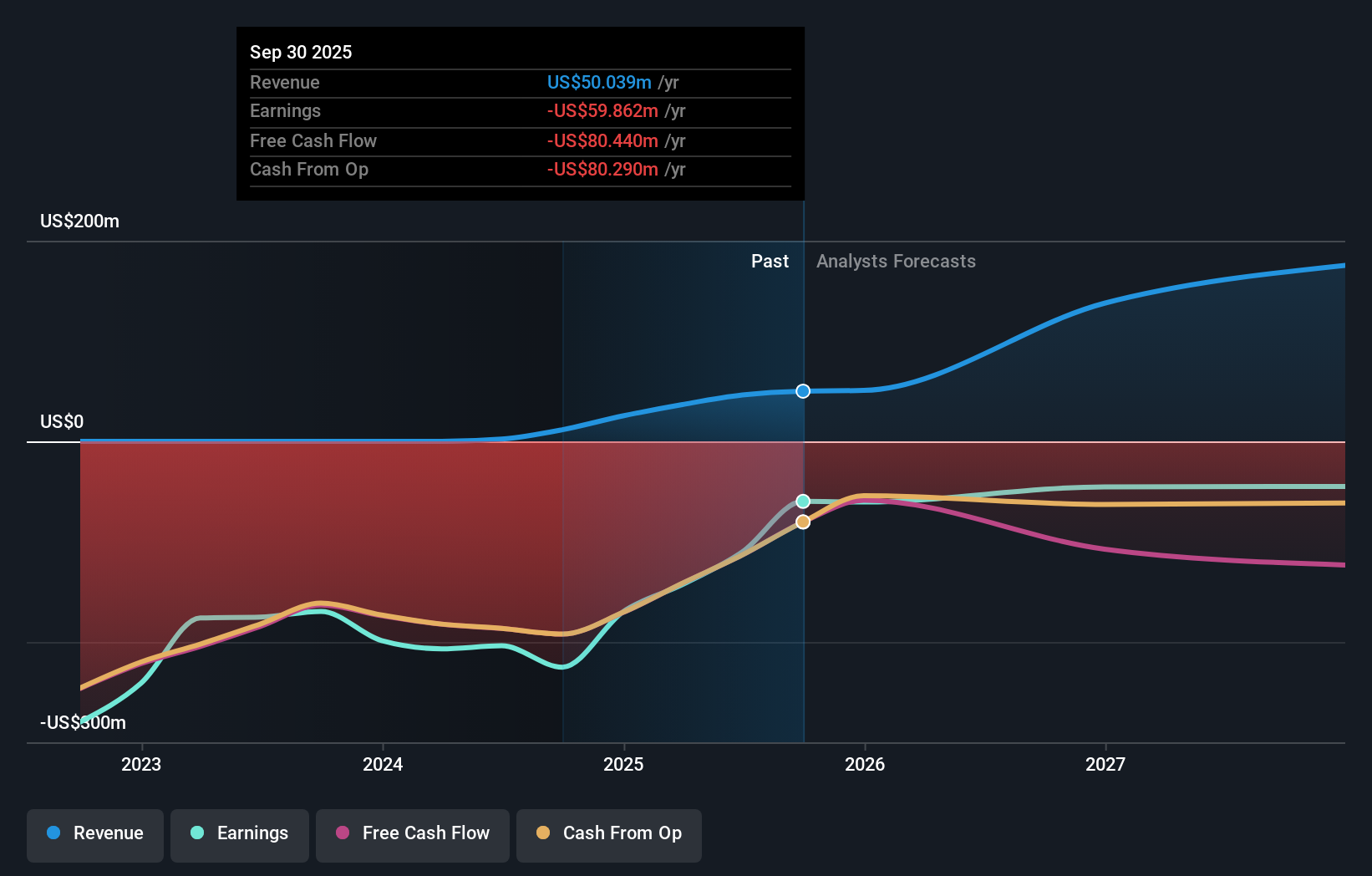

Operations: Roivant Sciences Ltd. generates revenue primarily from its activities in the discovery, development, and commercialization of medicines and technologies, amounting to $20.33 million.

Roivant Sciences has demonstrated a notable turnaround in its financial health, reducing its net loss significantly to $113.52 million from a previous $230.18 million, alongside modest sales of $1.57 million. This performance is underpinned by an aggressive R&D strategy, with expenses aimed at developing innovative treatments such as brepocitinib for dermatomyositis, showing promising Phase 3 results. The company's focus on specialized therapies could position it well within the biotech sector despite current unprofitability and a challenging growth trajectory compared to industry peers.

- Get an in-depth perspective on Roivant Sciences' performance by reading our health report here.

Examine Roivant Sciences' past performance report to understand how it has performed in the past.

Semrush Holdings (SEMR)

Simply Wall St Growth Rating: ★★★★★☆

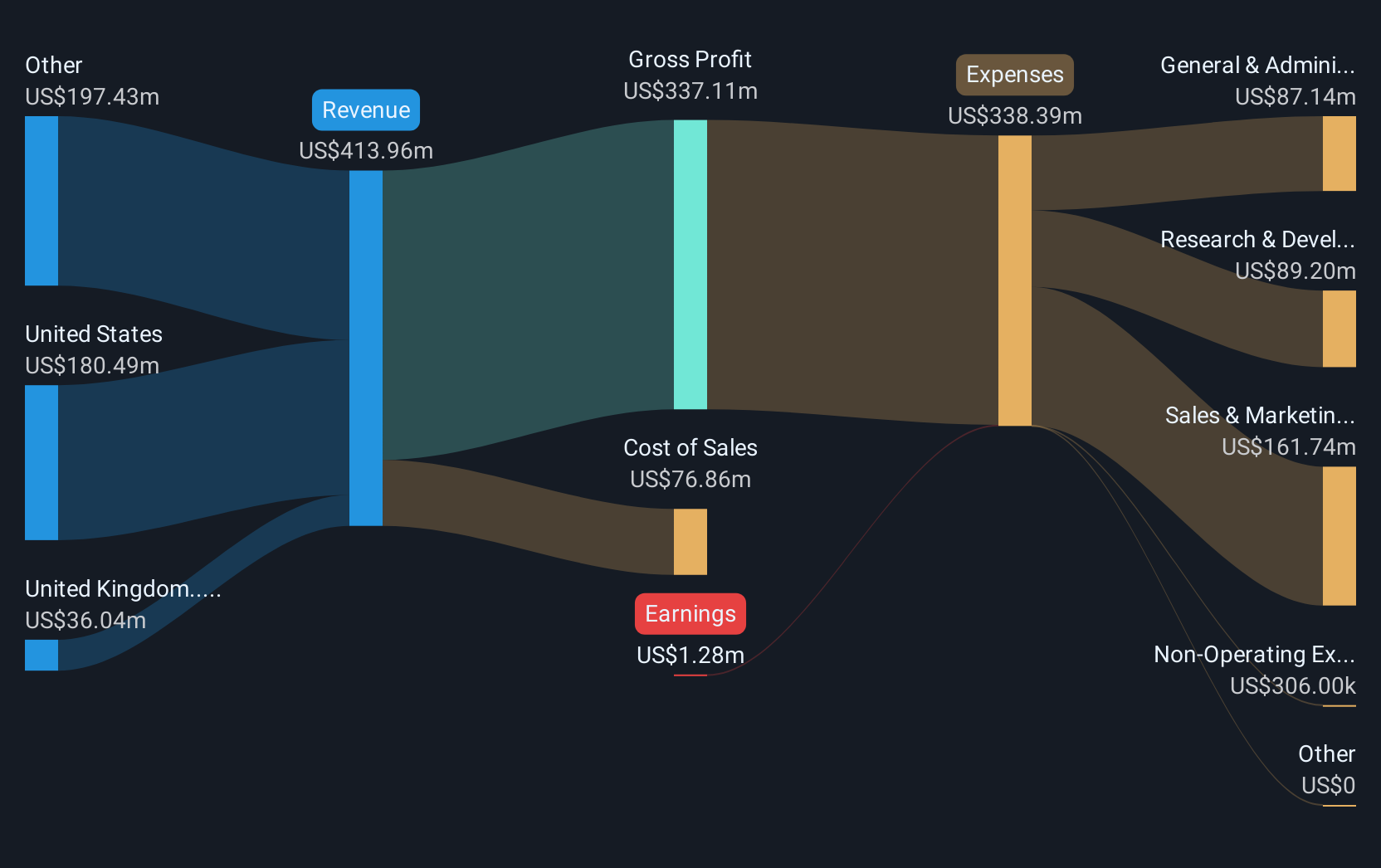

Overview: Semrush Holdings, Inc. provides an online visibility management software-as-a-service platform across the United States, the United Kingdom, and internationally, with a market cap of approximately $1.05 billion.

Operations: Semrush Holdings generates revenue primarily from its software and programming segment, totaling approximately $428.63 million. The company operates a software-as-a-service platform focused on online visibility management across various regions, including the U.S. and the U.K.

Semrush Holdings has pivoted adeptly in the tech landscape with its recent launch of Semrush One, integrating SEO and AI Search to enhance online visibility across diverse platforms. Despite a challenging Q3 with sales rising to $112.08 million but swinging to a net loss of $2.14 million from a prior profit, the company forecasts robust revenue growth between 15.5% and 18% for Q4 and the full year respectively. This strategic expansion into AI-driven tools not only broadens its product suite but also positions Semrush at the forefront of evolving search technologies, potentially catalyzing future profitability as indicated by an anticipated earnings growth of 118.22% annually.

- Navigate through the intricacies of Semrush Holdings with our comprehensive health report here.

Assess Semrush Holdings' past performance with our detailed historical performance reports.

Taking Advantage

- Unlock our comprehensive list of 74 US High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROIV

Roivant Sciences

A clinical-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines and technologies.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives