- United States

- /

- Biotech

- /

- NasdaqGM:IRON

Disc Medicine (IRON): Valuation Perspectives After FDA National Priority Voucher Spurs Investor Momentum

Reviewed by Kshitija Bhandaru

Disc Medicine has caught the attention of investors after it announced receipt of a Commissioner's National Priority Voucher from the FDA for its investigational drug bitopertin in erythropoietic protoporphyria, a rare and challenging condition.

See our latest analysis for Disc Medicine.

Disc Medicine’s shares have caught fire, jumping more than 40% in the past month alone and rising 77.89% on a one-year total return basis. The FDA voucher news has significantly boosted momentum, adding to previous gains from pipeline progress and regulatory updates, as investors recalibrate risk and growth expectations for this promising biotech.

If you’re looking to uncover more healthcare innovators making waves, be sure to explore See the full list for free..

Yet with shares on a tear and now trading just 18% below analyst price targets, the key question is whether Disc Medicine remains undervalued or if the market has already factored in the next wave of growth.

Price-to-Book Ratio of 5.1x: Is it justified?

Disc Medicine trades at a price-to-book ratio of 5.1x, significantly higher than the US Biotechs industry average of 2.5x. This indicates the market is assigning a premium to its assets relative to peers.

The price-to-book ratio compares a company's market value to its book value, providing insight into how much investors are willing to pay for each dollar of net assets. For early-stage biotech firms, a high price-to-book could reflect optimism about future breakthroughs or expected growth. However, it also highlights increased expectations built into the stock price.

While Disc Medicine appears expensive on this metric versus the broader biotech sector, it stands out as reasonable value when compared to peer companies with a higher average of 8.7x. The company is trading above the industry, but at a discount to its closest competitors. This suggests selective investor confidence tied to its pipeline progress and recent regulatory milestone.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 5.1x (OVERVALUED compared to industry, UNDERVALUED compared to peers)

However, risks remain if bitopertin’s clinical progress stalls or if positive expectations embedded in the stock price do not materialize.

Find out about the key risks to this Disc Medicine narrative.

Another View: DCF Suggests Modest Undervaluation

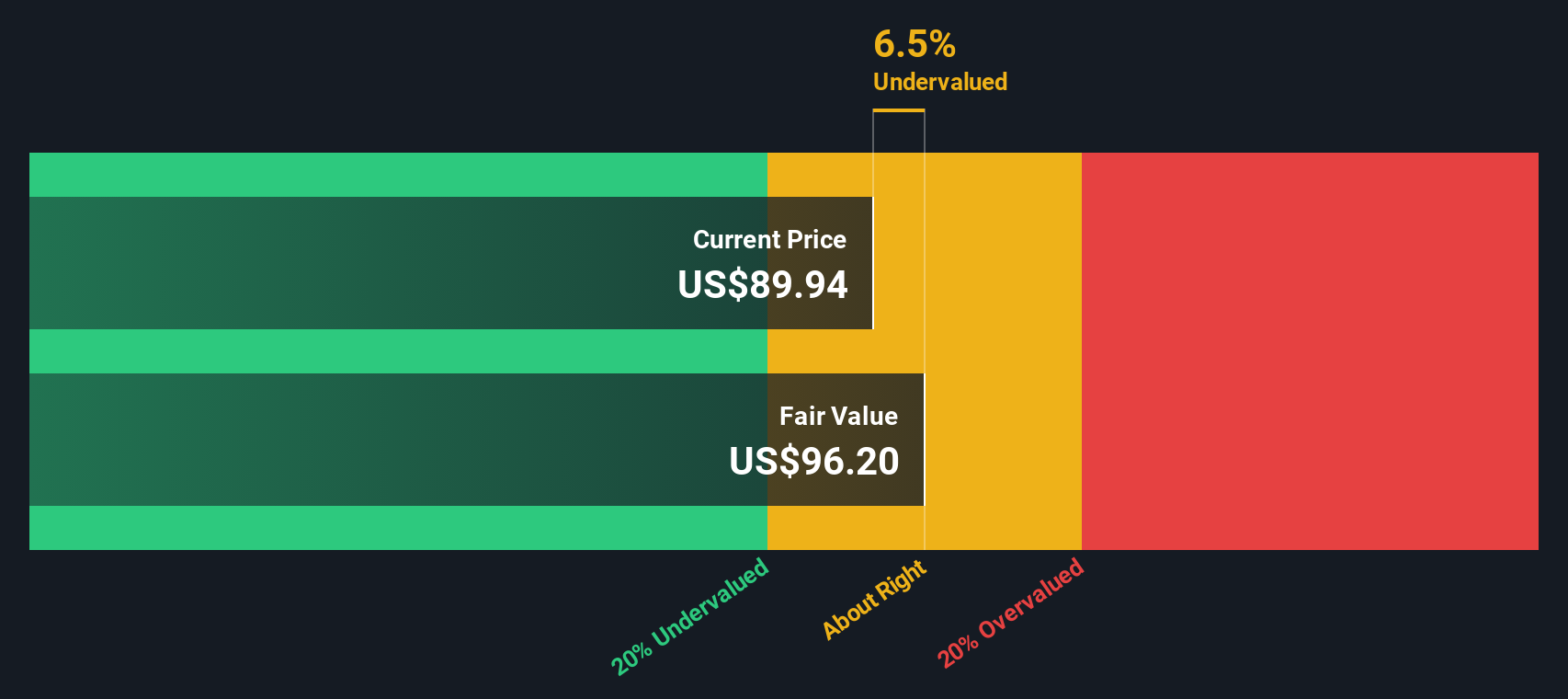

While the price-to-book ratio shows Disc Medicine as expensive against the industry, a different perspective comes from our SWS DCF model. This approach estimates the company is actually trading about 6.5% below its fair value, which signals modest undervaluation. Could the market be underestimating its long-term growth potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Disc Medicine for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Disc Medicine Narrative

If you’d like to test your own perspective, you can dive into the numbers and assemble your own take on Disc Medicine in just a few minutes. Do it your way.

A great starting point for your Disc Medicine research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your strategy to just one stock? Take charge and supercharge your watchlist by searching for unique opportunities across exciting market trends you might otherwise miss.

- Start building a portfolio of hidden gems with solid financials by reviewing these 3596 penny stocks with strong financials before they attract wider attention.

- Capture consistent income by checking out these 18 dividend stocks with yields > 3% featuring companies offering attractive yields above 3%.

- Ride the wave of artificial intelligence advancements and find your edge with these 24 AI penny stocks targeting innovation in this rapidly growing sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IRON

Disc Medicine

A clinical-stage biopharmaceutical company, engages in the discovery, development, and commercialization of novel treatments for patients suffering from serious hematologic diseases in the United States.

Adequate balance sheet with low risk.

Market Insights

Community Narratives