- United States

- /

- Life Sciences

- /

- NasdaqCM:HYFT

ImmunoPrecise Antibodies Ltd. (NASDAQ:IPA) Stock's 45% Dive Might Signal An Opportunity But It Requires Some Scrutiny

ImmunoPrecise Antibodies Ltd. (NASDAQ:IPA) shareholders that were waiting for something to happen have been dealt a blow with a 45% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 71% loss during that time.

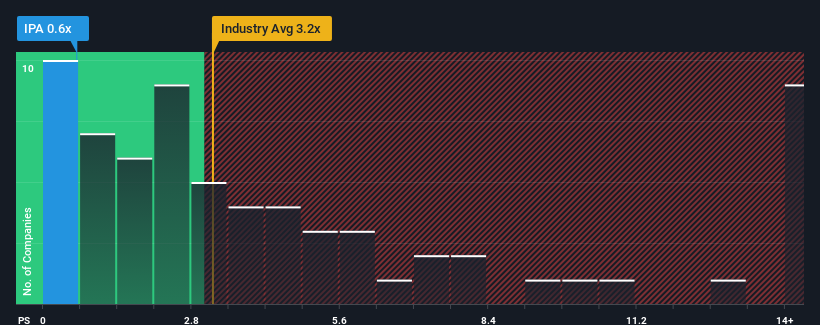

Following the heavy fall in price, ImmunoPrecise Antibodies may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Life Sciences industry in the United States have P/S ratios greater than 3.2x and even P/S higher than 6x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for ImmunoPrecise Antibodies

How ImmunoPrecise Antibodies Has Been Performing

Recent times have been advantageous for ImmunoPrecise Antibodies as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think ImmunoPrecise Antibodies' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like ImmunoPrecise Antibodies' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. The latest three year period has also seen a 29% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 22% per annum as estimated by the two analysts watching the company. With the industry only predicted to deliver 7.2% each year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that ImmunoPrecise Antibodies' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Having almost fallen off a cliff, ImmunoPrecise Antibodies' share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at ImmunoPrecise Antibodies' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It is also worth noting that we have found 4 warning signs for ImmunoPrecise Antibodies (1 can't be ignored!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HYFT

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives