- United States

- /

- Biotech

- /

- NasdaqGM:IOVA

Could Iovance (IOVA) Pipeline Expansion Reveal a New Strategic Focus for Its Future Portfolio?

Reviewed by Sasha Jovanovic

- Iovance Biotherapeutics recently provided updates on several ongoing clinical trials, including studies for advanced melanoma, non-small-cell lung cancer, and endometrial cancer using their novel tumor-infiltrating lymphocyte (TIL) therapies.

- This wave of announcements signals rapid pipeline progress in immunotherapy and hints at potential expansion beyond their current lead product, potentially reshaping the company's future treatment offerings.

- We'll assess how the company's extensive TIL clinical pipeline progress could influence its investment narrative and future market potential.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Iovance Biotherapeutics Investment Narrative Recap

Shareholders in Iovance Biotherapeutics need conviction that its next-generation immunotherapy pipeline, particularly in tumor-infiltrating lymphocytes (TIL), can drive meaningful product diversification beyond Amtagvi, ultimately lessening reliance on a single approved therapy. While the recent wave of positive clinical updates highlights ongoing pipeline momentum, this does not yet resolve the company’s immediate commercial concentration risk around Amtagvi or regulatory hurdles for global expansion, so the short-term outlook largely remains anchored by these unresolved issues.

Among the latest pipeline announcements, Iovance’s ongoing Phase 3 study evaluating lifileucel plus pembrolizumab versus monotherapy in advanced melanoma is especially relevant. This late-stage clinical effort supports one of Iovance’s key near-term catalysts, establishing lifileucel as a preferred treatment option and solidifying market share, while directly addressing concerns about expanding beyond their current product footprint.

But amid these advances, investors should not overlook how, despite promising updates, securing timely international regulatory approvals remains...

Read the full narrative on Iovance Biotherapeutics (it's free!)

Iovance Biotherapeutics' outlook anticipates $744.8 million in revenue and $35.6 million in earnings by 2028. This scenario is based on a yearly revenue growth rate of 45.6% and a $425.5 million increase in earnings from the current level of -$389.9 million.

Uncover how Iovance Biotherapeutics' forecasts yield a $9.10 fair value, a 367% upside to its current price.

Exploring Other Perspectives

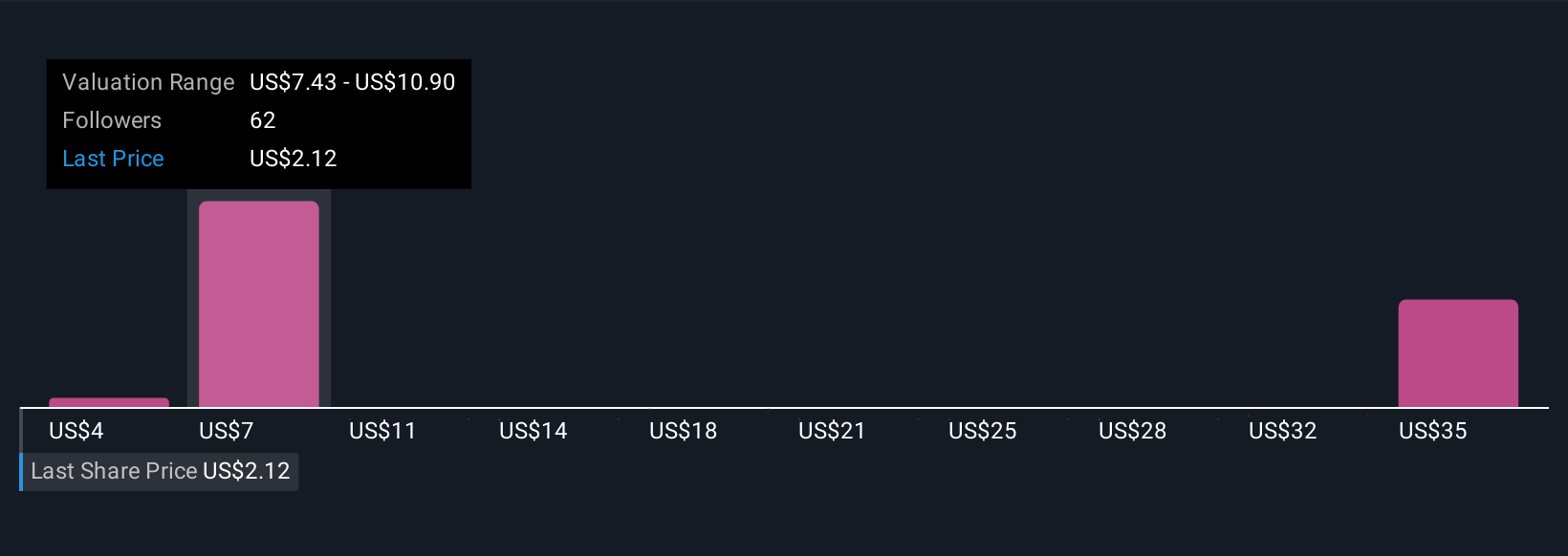

Fair value opinions from 12 Simply Wall St Community members for Iovance Biotherapeutics range from US$3.97 to US$38.12 per share. With the company still facing key regulatory challenges abroad, these divergent views reflect sharply different expectations about future performance, take time to compare several perspectives.

Explore 12 other fair value estimates on Iovance Biotherapeutics - why the stock might be a potential multi-bagger!

Build Your Own Iovance Biotherapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iovance Biotherapeutics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Iovance Biotherapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iovance Biotherapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IOVA

Iovance Biotherapeutics

A commercial-stage biopharmaceutical company, develops and commercializes cell therapies using autologous tumor infiltrating lymphocyte for the treatment of metastatic melanoma and other solid tumor cancers in the United States.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives