- United States

- /

- Biotech

- /

- NasdaqGS:IONS

Ionis Pharmaceuticals (IONS): Valuation Perspective Following FDA Breakthrough Therapy Milestone for Olezarsen

Reviewed by Simply Wall St

Ionis Pharmaceuticals (IONS) stock caught a fresh wave of attention after the FDA granted Breakthrough Therapy designation to its drug candidate olezarsen for severe hypertriglyceridemia. This regulatory milestone represents a key step for the company's pipeline.

See our latest analysis for Ionis Pharmaceuticals.

Ionis shares have surged amid a string of upbeat headlines, most notably the FDA's fast-track recognition for olezarsen and recent regulatory wins in Europe for their hereditary angioedema therapy. Momentum has been building, highlighted by a 138% share price return year-to-date and a one-year total shareholder return of 129%, which outpaces much of the sector.

If breakthrough therapies and biotech momentum are catching your eye, it is a great time to see the full list of innovators in our See the full list for free..

With shares up sharply and investors riding a wave of optimism, the question remains: is Ionis Pharmaceuticals still undervalued at these prices, or has the market already priced in all the coming growth potential?

Most Popular Narrative: 3.2% Undervalued

Ionis Pharmaceuticals' most popular narrative pegs its fair value at $85.47, just ahead of the last closing price of $82.73. This close alignment underscores the market’s rising expectations and hints at debate over how much future growth is already anticipated.

The rapid revenue growth and positive launch trajectory for Tryngolza in familial chylomicronemia syndrome (FCS), along with the imminent launch of Donidalorsen for HAE and multiple late-stage pipeline assets reading out or launching by 2027, are set to drive sustained, stepwise increases in top-line revenue and operating leverage as Ionis transitions from R&D-heavy to commercial-stage.

A blockbuster forecast, surging revenues, and a transition to commercial-stage growth set the tone for this eye-catching fair value call. What is the secret sauce behind such a bullish outlook? The narrative hinges on a blend of ambitious revenue assumptions and future profit margin leaps. The precise numbers driving this story might surprise you. Dive in for the full calculation and the crucial hidden levers behind the price target.

Result: Fair Value of $85.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty around drug pricing for larger patient groups, as well as execution risk on critical clinical trials, could challenge the current bullish narrative.

Find out about the key risks to this Ionis Pharmaceuticals narrative.

Another View: Price Ratios Paint a Cautious Picture

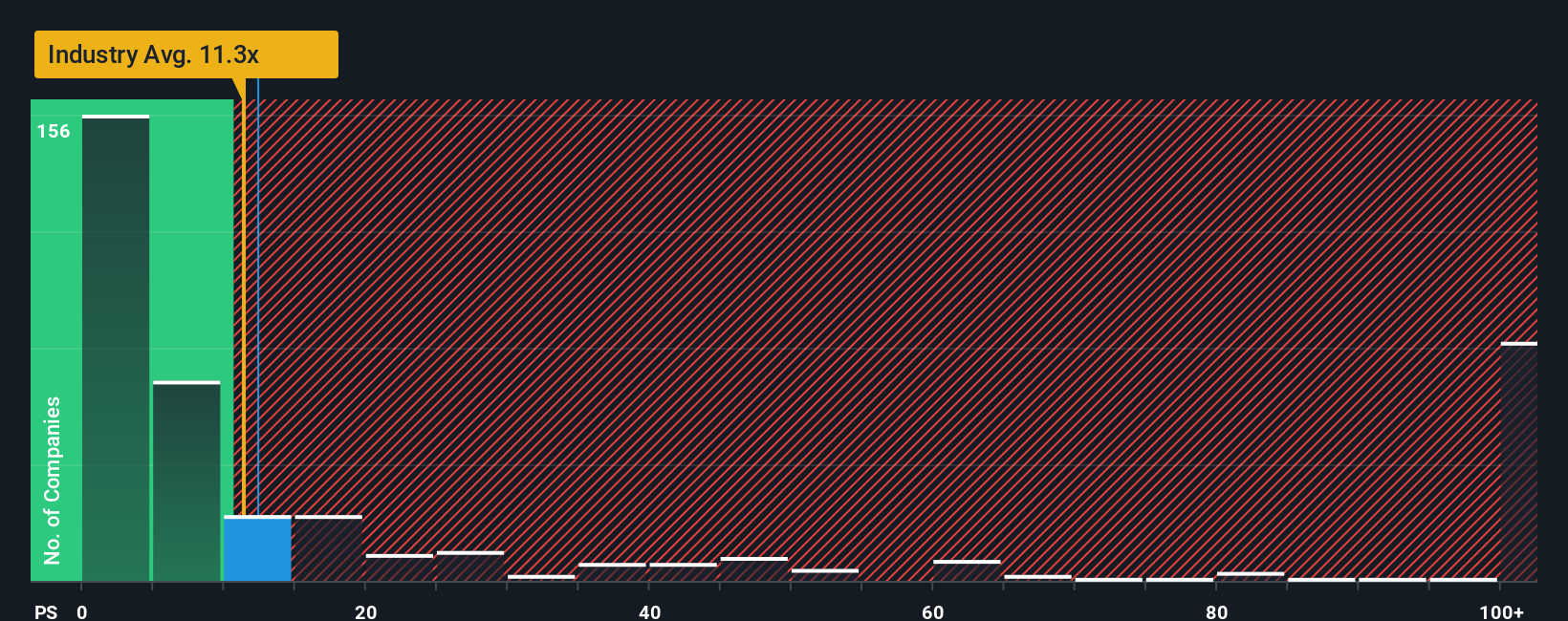

While narrative-driven fair value calls Ionis Pharmaceuticals undervalued, market price ratios tell a different story. The company trades at a 13.9x price-to-sales ratio, which is higher than both its peer average of 5.1x and the US Biotechs industry average of 12.8x. Even compared to its fair ratio of 4.8x, the current pricing looks stretched. This gap signals that, despite strong growth expectations, investors might be exposed to valuation risk if market sentiment shifts. Can such high multiples last, or will reality catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ionis Pharmaceuticals Narrative

If the current narrative does not fully reflect your perspective or you would rather crunch the numbers yourself, crafting your own custom analysis is quick and straightforward. In just a few minutes, you can create an analysis tailored to your needs. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ionis Pharmaceuticals.

Looking for More Investment Ideas?

Don’t let fresh growth potential slip by. Turn your curiosity into confidence by checking out other markets teeming with opportunity, tailored to your style.

- Discover the appeal of resilient returns when you check out these 15 dividend stocks with yields > 3%, which consistently offer yields above 3% and balance steady payouts with financial strength.

- Explore innovation and future-defining technology with these 25 AI penny stocks, where cutting-edge developments could spark your next standout investment.

- Gain a smart edge by reviewing these 915 undervalued stocks based on cash flows, spotlighting high-potential stocks trading below their cash-flow-based fair value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IONS

Ionis Pharmaceuticals

A commercial-stage biotechnology company, provides RNA-targeted medicines in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026