- United States

- /

- Pharma

- /

- NasdaqGS:INVA

Innoviva’s Positive Zoliflodacin Data Might Change the Case for Investing in INVA

Reviewed by Sasha Jovanovic

- Innoviva Specialty Therapeutics, a subsidiary of Innoviva, Inc., recently presented new clinical data at IDWeek 2025 highlighting high cure rates for zoliflodacin, an oral antibiotic targeting antibiotic-resistant gonorrhea.

- This development addresses a significant unmet need in infectious disease treatment, as rising drug resistance continues to challenge existing therapies worldwide.

- We'll explore how Innoviva's promising antibiotic data could influence its investment narrative and showcase innovation in infectious disease solutions.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Innoviva's Investment Narrative?

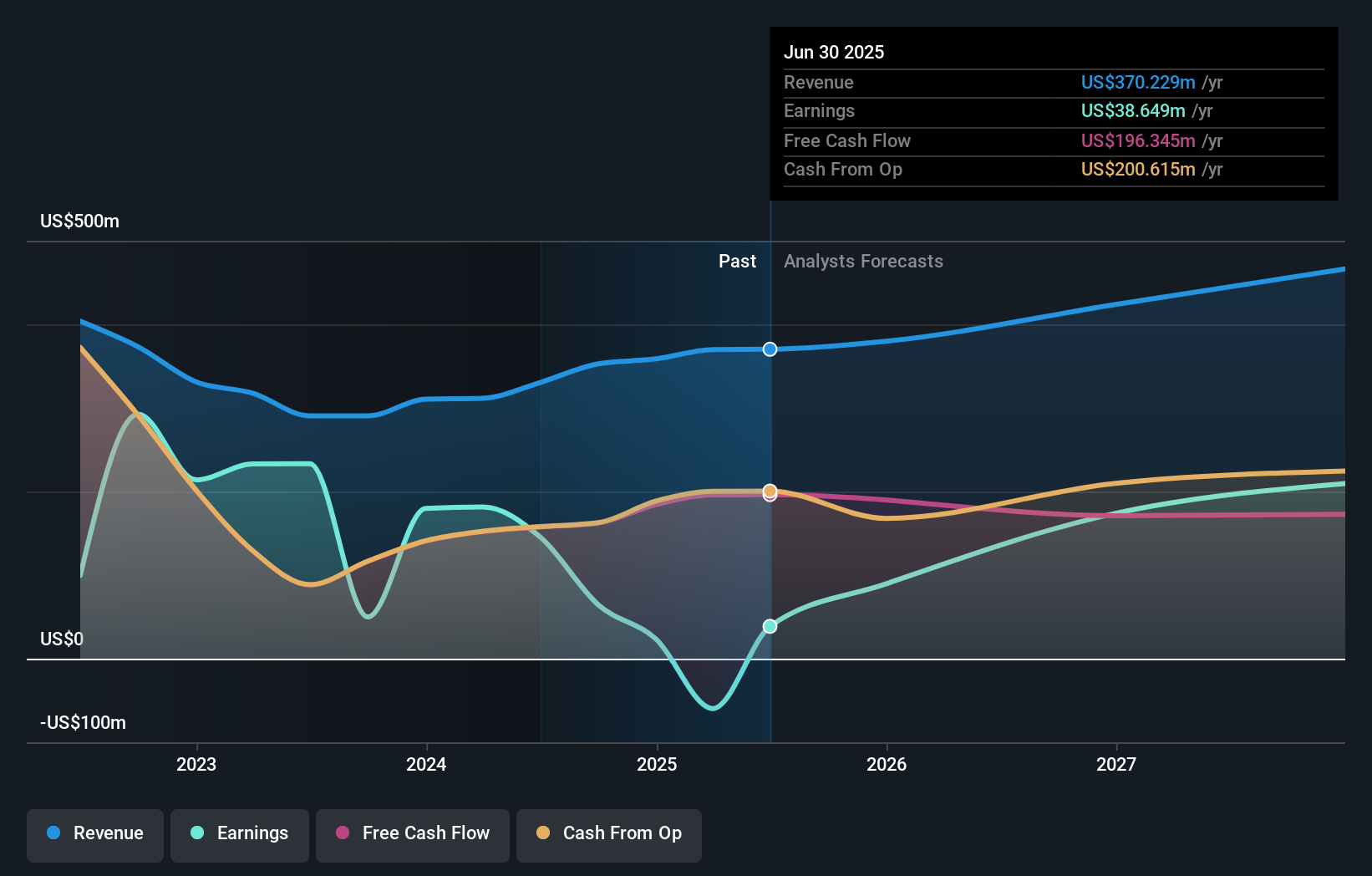

To be an Innoviva shareholder, it’s important to believe in the company’s ability to turn its growing pharmaceutical pipeline into meaningful earnings, despite recent volatility in profits and a valuation above its peer average. Innoviva’s presentation of new, high cure rate data for zoliflodacin at IDWeek 2025 could shift the short-term narrative by underscoring progress in antibiotic innovation precisely as drug resistance intensifies worldwide, a genuine medical need and clear pipeline catalyst. Before this news, risks centered on its inconsistent profitability, heavy reliance on existing therapies for revenue, and a management team still bedding in after several executive changes. The strong clinical results now give Innoviva a compelling “shot on goal,” potentially making upcoming regulatory and commercial milestones even more important near term. Still, price moves ahead of the event suggest market reaction may not yet be fully convinced, and the company’s premium price to earnings adds another layer of risk if momentum from new products does not continue building.

However, investors should keep in mind that inconsistent profitability remains a risk worth watching.

Exploring Other Perspectives

Explore another fair value estimate on Innoviva - why the stock might be worth over 2x more than the current price!

Build Your Own Innoviva Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innoviva research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Innoviva research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innoviva's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INVA

Innoviva

Engages in the development and commercialization of pharmaceutical products in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives