- United States

- /

- Pharma

- /

- NasdaqGS:INVA

A Look at Innoviva's (INVA) Valuation Following Strong Earnings and New Share Buyback Program

Reviewed by Simply Wall St

Innoviva (INVA) grabbed attention after reporting a jump in both revenue and net income for the third quarter. The company also announced a $125 million share repurchase program that could impact shareholder value moving forward.

See our latest analysis for Innoviva.

Shares of Innoviva have shown renewed momentum lately, with a 28.8% 1-month share price return and the stock now trading at $22.25. This surge follows not only the strong earnings and fresh buyback announcement but also builds on longer-term strength. The company’s total shareholder return sits at 17.7% over the past year and an impressive 103.2% over five years, signaling meaningful compounding for patient investors.

If recent moves in INVA have you curious about other opportunities, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

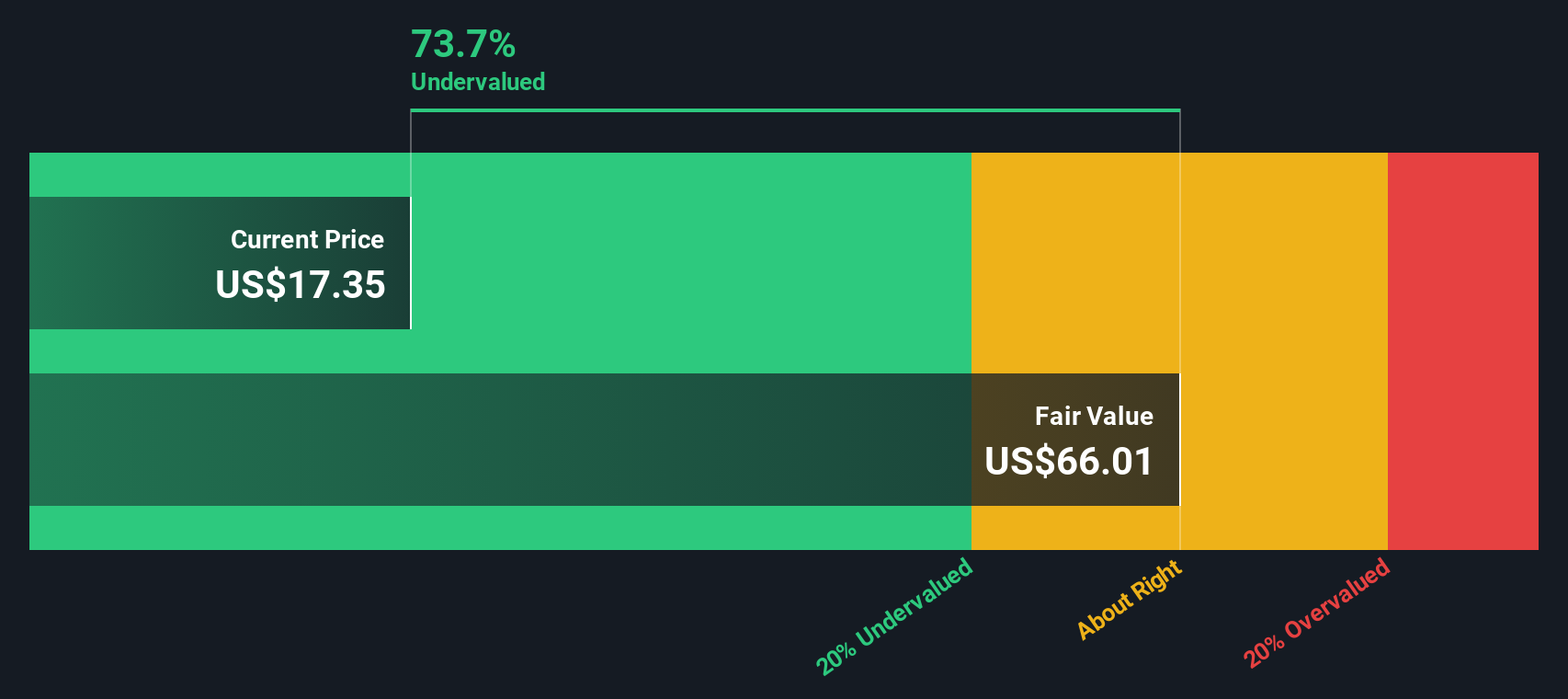

With the stock rallying and recent results looking robust, the key question is whether Innoviva’s shares remain undervalued based on future potential or if the market has already priced in all the good news. Is there still a buying opportunity here, or is anticipated growth already reflected in the current price?

Price-to-Earnings of 13.1x: Is it justified?

Innoviva's shares currently trade at a price-to-earnings (P/E) ratio of 13.1x, putting them below both peer and industry averages. With a last close of $22.25, this multiple suggests the stock may be undervalued relative to similar companies.

The P/E ratio measures the market's price tag on a company's earnings and is a critical benchmark for pharmaceutical and biotech stocks, where profit growth and margin resilience matter. A lower P/E can mean investors are discounting future growth or that the company is delivering more earnings per dollar than peers.

INVA’s P/E ratio of 13.1x compares favorably to a peer group average of 15.5x and the US Pharmaceuticals industry’s 18.8x. This means the market values Innoviva’s profits more conservatively, even though the company recently posted substantial earnings growth. Notably, the fair value P/E ratio for Innoviva is estimated at 16.8x, leaving significant room for the market to catch up if growth continues.

Explore the SWS fair ratio for Innoviva

Result: Price-to-Earnings of 13.1x (UNDERVALUED)

However, regulatory hurdles or weaker than expected drug sales could dampen momentum and challenge Innoviva’s current growth trajectory.

Find out about the key risks to this Innoviva narrative.

Another View: Discounted Cash Flow Suggests Deeper Value

While Innoviva's price-to-earnings ratio hints at undervaluation, our DCF model presents an even more dramatic story. The SWS DCF model estimates fair value at $100.82 per share, which is far above the recent trading price. Does this signal a rare bargain or are market doubts justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Innoviva for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Innoviva Narrative

If you have a different take or want to dig into the details on your own, building your personal narrative is quick and straightforward. Do it your way.

A great starting point for your Innoviva research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your opportunity set by staying ahead of the crowd with powerful stock picks that fit your strategy and financial goals. Don’t let exciting prospects pass you by; now is the perfect time to step up your search and strengthen your portfolio.

- Accelerate your income strategy and tap into steady returns with these 16 dividend stocks with yields > 3% offering over 3% yields from established companies.

- Boost your portfolio by targeting growth with these 25 AI penny stocks, giving you exposure to innovators shaping artificial intelligence and machine learning.

- Secure long-term value by uncovering potential bargains among these 897 undervalued stocks based on cash flows highlighted by strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INVA

Innoviva

Engages in the development and commercialization of pharmaceutical products in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives