- United States

- /

- Pharma

- /

- NasdaqGS:INDV

Indivior (INDV) Is Up 6.5% After Settling DOJ Liability and Ending Resolution Agreement – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Indivior PLC has fully settled a longstanding obligation with the U.S. Department of Justice by paying US$295 million, leading to the termination of the related resolution agreement.

- This payment removes a significant liability from Indivior’s balance sheet and simplifies its capital structure, marking a milestone in the company’s emphasis on compliance and transparency.

- We'll explore how the removal of this major legal liability may influence Indivior's investment narrative and future risk profile.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Indivior's Investment Narrative?

Being an Indivior shareholder comes down to confidence in the company’s ability to sustain earnings growth while balancing its commitment to innovation in opioid use disorder treatments. The recent US$295 million settlement with the Department of Justice removes a persistent legal overhang and is a real turning point. This event simplifies the company’s capital structure at a time when Indivior is posting improving net income, raising its revenue outlook, and highlighting promising clinical data on its core product, SUBLOCADE. By eliminating one of the largest liabilities from its books, Indivior appears to have reduced a key risk that previously clouded its short-term catalysts, particularly as it approaches its redomicile to the US and addresses upcoming shareholder and regulatory milestones. However, with growth forecasts already strong and the share price reflecting a very large year-to-date increase, the company’s highly valued earnings multiples and elevated debt remain central issues for investors monitoring future upside and risks.

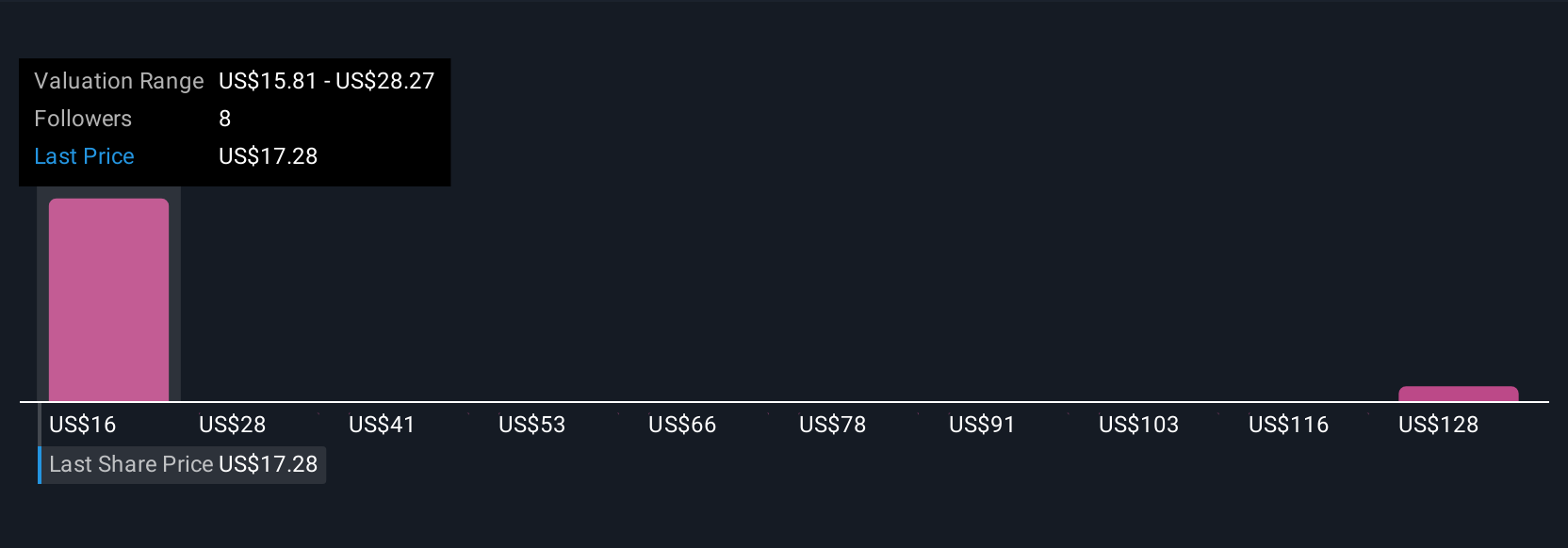

Yet, despite clearing a major legal hurdle, Indivior’s high price-to-earnings ratio calls for careful attention. Indivior's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Indivior - why the stock might be worth just $32.35!

Build Your Own Indivior Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Indivior research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Indivior research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Indivior's overall financial health at a glance.

No Opportunity In Indivior?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDV

Indivior

Develops, manufactures, and sells buprenorphine-based prescription drugs for the treatment of opioid dependence and related disorders in the United States, Europe, Canada, Australia, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives