- United States

- /

- Pharma

- /

- NasdaqGS:INDV

Indivior (INDV) Is Up 25.9% After Strong Q3 Results and Raised Revenue Guidance Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Indivior PLC recently reported strong third-quarter results, with net income doubling to US$42 million and sales reaching US$314 million, while also raising its full-year 2025 revenue guidance to between US$1.18 billion and US$1.22 billion.

- New real-world evidence presented at a leading pharmacy conference further highlighted the potential clinical and economic benefits of Indivior’s SUBLOCADE treatment for opioid use disorder across both Medicaid and commercially insured populations.

- We’ll explore how elevated SUBLOCADE performance and improved revenue guidance reinforce Indivior’s investment narrative following a 25.9% weekly share price gain.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Indivior's Investment Narrative?

Owning a piece of Indivior today means believing in the longer-term promise of SUBLOCADE and the company’s ability to turn emerging clinical validation and operational changes into real, profitable growth. The recent surge in revenue guidance and the momentum behind positive third-quarter results seem to directly echo the substance behind its eye-catching share price move, as real-world evidence points to significant clinical and economic benefits for SUBLOCADE in both Medicaid and commercially insured populations. These developments could sharpen near-term catalysts, like further market adoption and improved payer support, while also shifting focus to the now-heightened risk of execution as Indivior prepares its U.S. redomicile and manages a relatively new and inexperienced leadership team. At the same time, SUBLOCADE’s pace of uptake and pricing risk in a competitive environment may take center stage as the most important risks, especially with the stock trading well above both peer and industry price-to-earnings multiples after its rapid rally. All told, the latest news event does appear material, amplifying both short-term optimism and continuing risks around execution and valuation.

On the other hand, competition and market access remain critical issues investors should be aware of.

Exploring Other Perspectives

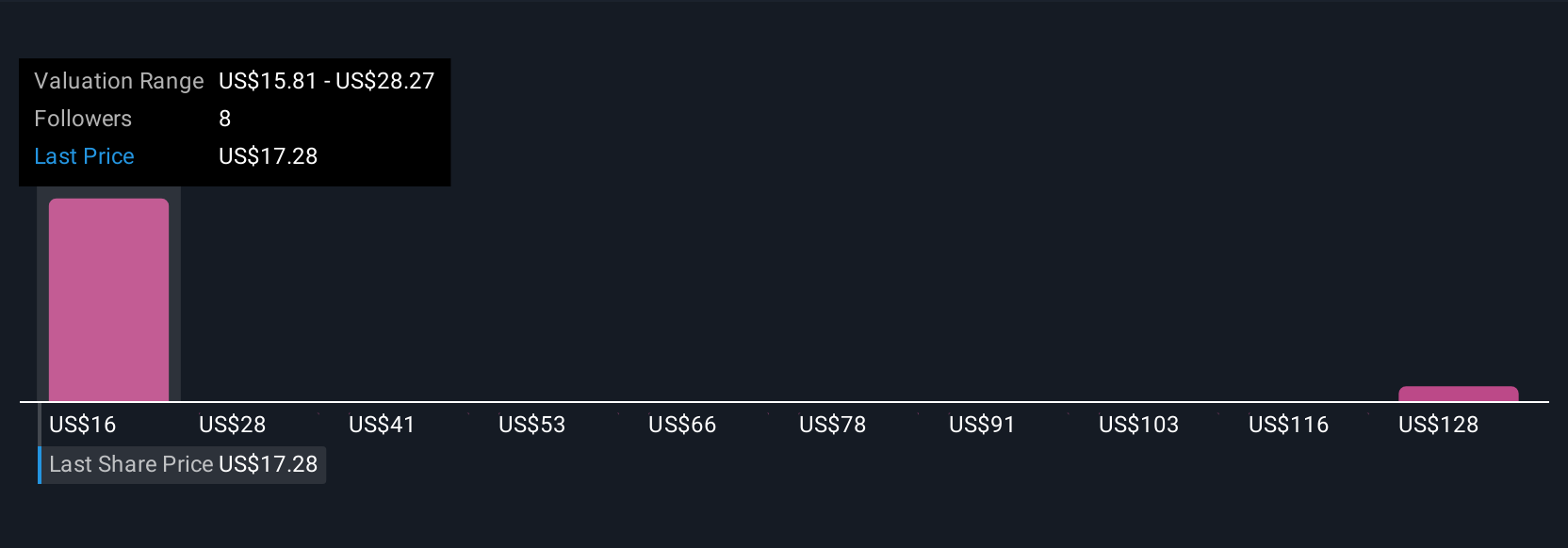

Explore 4 other fair value estimates on Indivior - why the stock might be worth just $32.35!

Build Your Own Indivior Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Indivior research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Indivior research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Indivior's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDV

Indivior

Develops, manufactures, and sells buprenorphine-based prescription drugs for the treatment of opioid dependence and related disorders in the United States, Europe, Canada, Australia, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives