- United States

- /

- Biotech

- /

- NasdaqGS:INCY

Assessing Incyte’s Value After a 46.1% Stock Surge in 2025

Reviewed by Bailey Pemberton

- Wondering if now is the right time to consider Incyte as an investment? You're not alone. Plenty of investors are taking a close look at the company's value as its story evolves.

- In the past month, Incyte stock has surged 16.9%, pushing its year-to-date return to an impressive 46.1% and up 34.1% over the last year.

- Recent news highlights growing excitement around Incyte's pipeline progress and positive updates within the biotech sector, sparking renewed optimism among investors. This context has added momentum to the stock’s price, with discussions centering on strategic partnerships and promising results from ongoing clinical trials.

- When it comes to valuation, Incyte currently scores 5 out of 6 on our value checks, hinting that there may be substantial upside still to be uncovered. We will break down how these methods work in the next sections and, at the end, share a smarter way investors can keep tabs on a stock’s true value.

Approach 1: Incyte Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the true worth of a business by projecting its future cash flows and then discounting those projections back to today's value. This approach offers investors an objective look at what a company could be worth based on its capacity to generate cash over time.

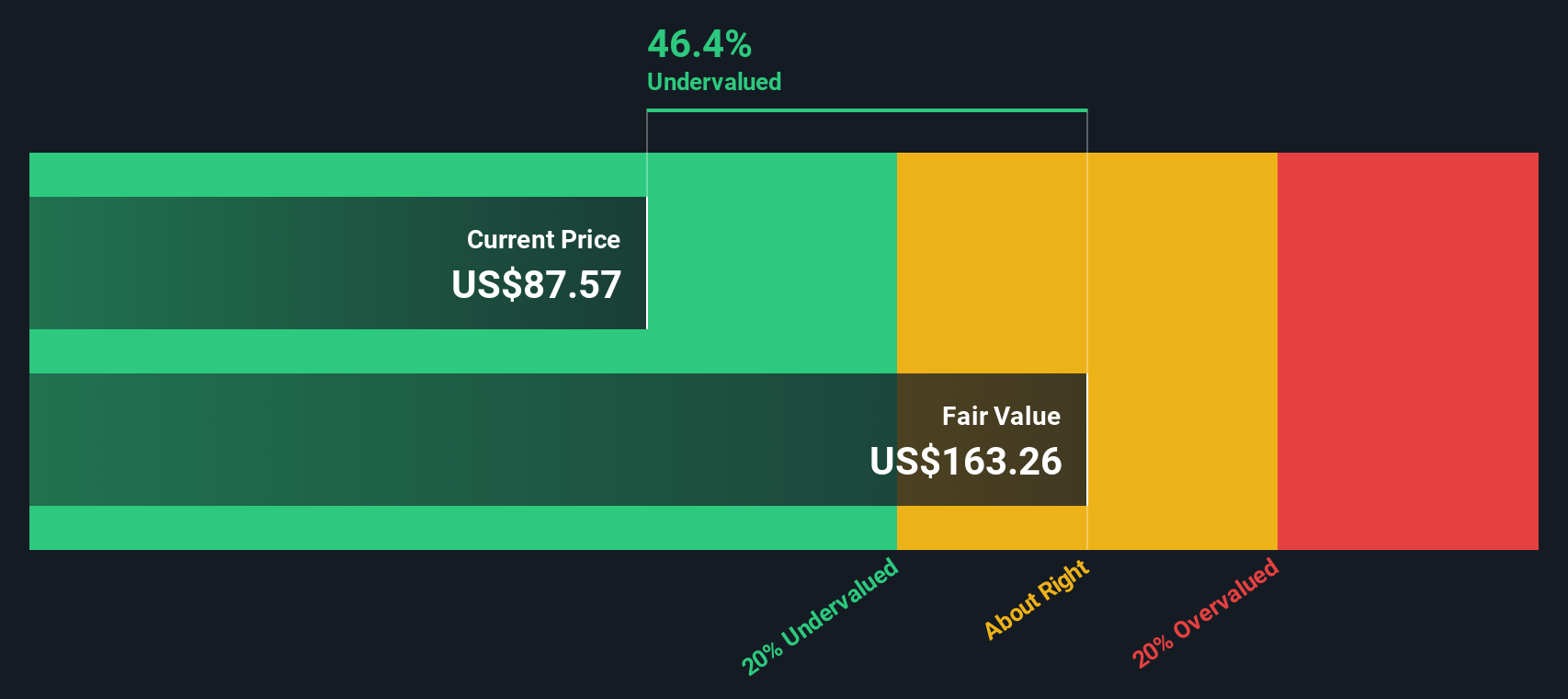

For Incyte, the current Free Cash Flow (FCF) sits at $1.16 billion. Industry analysts supply FCF estimates for the first five years, indicating a growth trend. After this period, Simply Wall St extrapolates projections to complete a 10-year view. By 2029, Incyte's FCF is expected to reach $1.42 billion. These healthy cash flows are then discounted to reflect their value in today's dollars using a risk-adjusted rate.

Based on these calculations, Incyte's intrinsic value comes out to $158.90 per share. With the stock trading at a 36.1% discount to this estimate, the DCF model suggests the stock is significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Incyte is undervalued by 36.1%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

Approach 2: Incyte Price vs Earnings

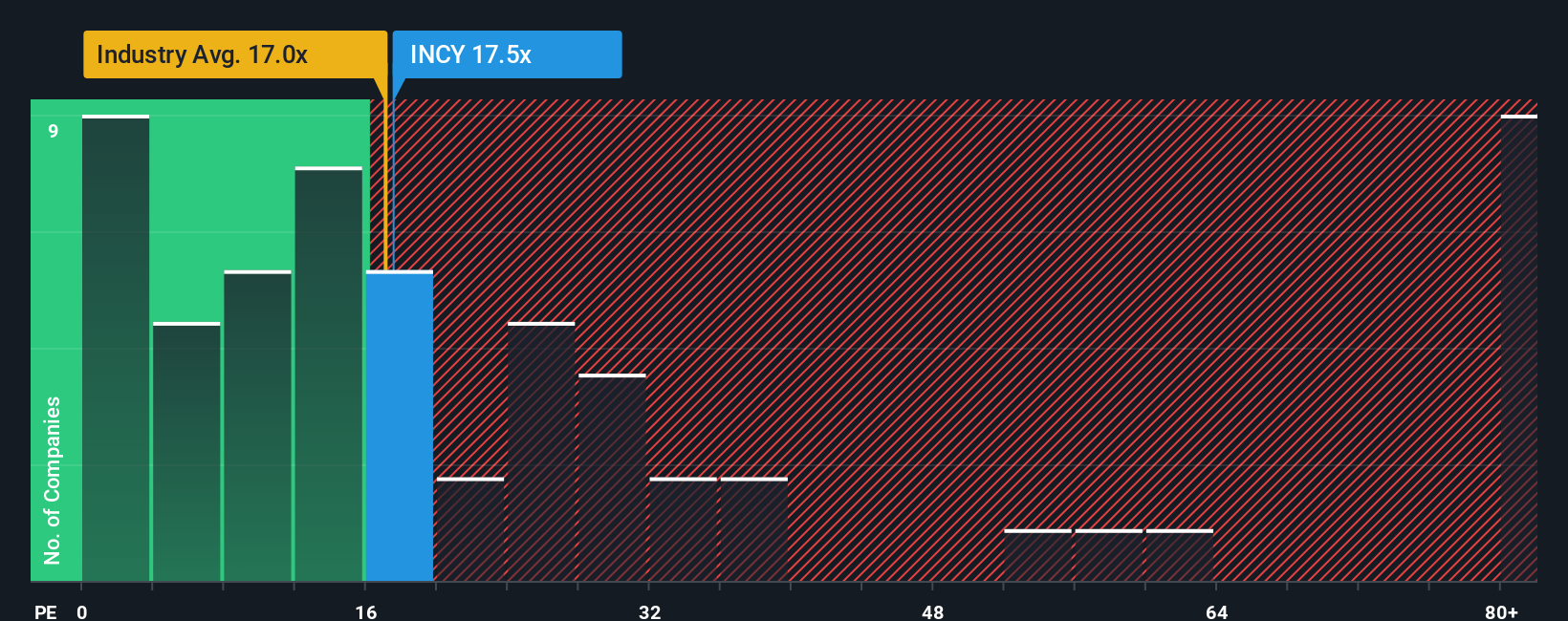

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Incyte because it links the share price directly to earnings, making it easy for investors to compare value across businesses. A company’s expected growth and risk profile influence what is considered a “normal” or “fair” PE ratio. Higher growth or lower risk generally justify a higher multiple, while lower growth or higher risk deserve a lower figure.

Currently, Incyte trades at a PE ratio of 16.8x. For context, the average PE across Biotechs stands at 17.7x, while close peers average 19.7x. Looking purely at these benchmarks, Incyte appears somewhat undervalued relative to its sector.

However, Simply Wall St’s proprietary “Fair Ratio” takes things a step further. This approach goes beyond simple comparisons by factoring in company-specific details like projected earnings growth, profit margins, risk levels, industry context, and market cap. Incyte’s Fair Ratio is calculated at 19.4x, suggesting what a reasonable market multiple should be based on its specific fundamentals.

Comparing Incyte’s actual PE of 16.8x to the Fair Ratio of 19.4x, the company looks undervalued on this measure as well, reinforcing what we saw with the DCF approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Incyte Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful tool that allows investors to attach a personal story or perspective to a company's numbers, reflecting your own view about fair value, expectations for future revenue, earnings, and profit margins. Narratives connect the dots between what you believe is happening in Incyte's business and the financial outlook, enabling you to create a dynamic fair value based on your assumptions.

On Simply Wall St’s Community page, millions of investors use Narratives to clarify when a stock is worth buying, trimming, or holding, by comparing their own Fair Value to the current price. Narratives are updated continuously as new earnings or industry news is released, making your assessment reactive to real-world events. For instance, one Incyte investor may build a bullish Narrative based on strong pipeline launches and forecast a fair value of $110, while a more cautious peer, weighing patent expiries and market headwinds, might set a fair value closer to $60.

By exploring and creating your own Narrative, you gain a tuned view of Incyte's potential and risks, and can make smarter investment decisions with confidence.

Do you think there's more to the story for Incyte? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INCY

Incyte

A biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics in the United States, Europe, Canada, and Japan.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives