- United States

- /

- Biotech

- /

- NasdaqGS:INCY

A Look at Incyte’s Valuation Following Positive Early Data for New Cancer Therapies

Reviewed by Kshitija Bhandaru

Incyte (INCY) recently shared promising results from early-stage clinical trials of two potential therapies for advanced cancers, including colorectal and pancreatic ductal adenocarcinoma. These findings will be featured at the upcoming ESMO Congress 2025.

See our latest analysis for Incyte.

Incyte’s recent early-stage trial updates have added to a year of strong share price momentum. The stock has climbed 26.8% year-to-date and delivered a 33.2% total return over the past 12 months. This upward move is supported by upbeat developments and a key executive appointment, which indicates that investor confidence in the company's pipeline and leadership is rising.

If you’re watching the biotech space for fresh breakthroughs, it’s a great moment to discover See the full list for free.

But after a period of double-digit gains and new clinical milestones, is Incyte’s share price still undervalued, or have investors already priced in these growth prospects, leaving little room for a bargain?

Most Popular Narrative: 4% Overvalued

Incyte’s closing price of $88.15 edges above the most-followed narrative’s fair value estimate of $84.76, reflecting modest overvaluation based on analysts’ fundamental projections. The context is that analysts see resilient growth drivers and a robust portfolio, but foresee only limited further upside at current price levels.

Strengthened and diversified product portfolio momentum (with Jakafi, Opzelura, Niktimvo, Monjuvi, and Zynyz all delivering robust growth), together with an active business development pipeline, increases resilience against biosimilar and generic threats and potentially reduces risk for near- and mid-term revenue. This suggests the current valuation does not fully reflect future earnings stability or potential upside from new product successes.

Curious why the narrative values resilience over rapid growth? There is a bold shift behind the fair value as analysts focus on future margins and pipeline potential, not rapid revenue expansion. The real driver can be found by digging into the full narrative to uncover the financial assumptions that shaped this subtle verdict.

Result: Fair Value of $84.76 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the looming patent expiration for Jakafi and high R&D costs could challenge Incyte’s growth story if new launches fail to deliver swiftly.

Find out about the key risks to this Incyte narrative.

Another View: DCF Sheds Different Light

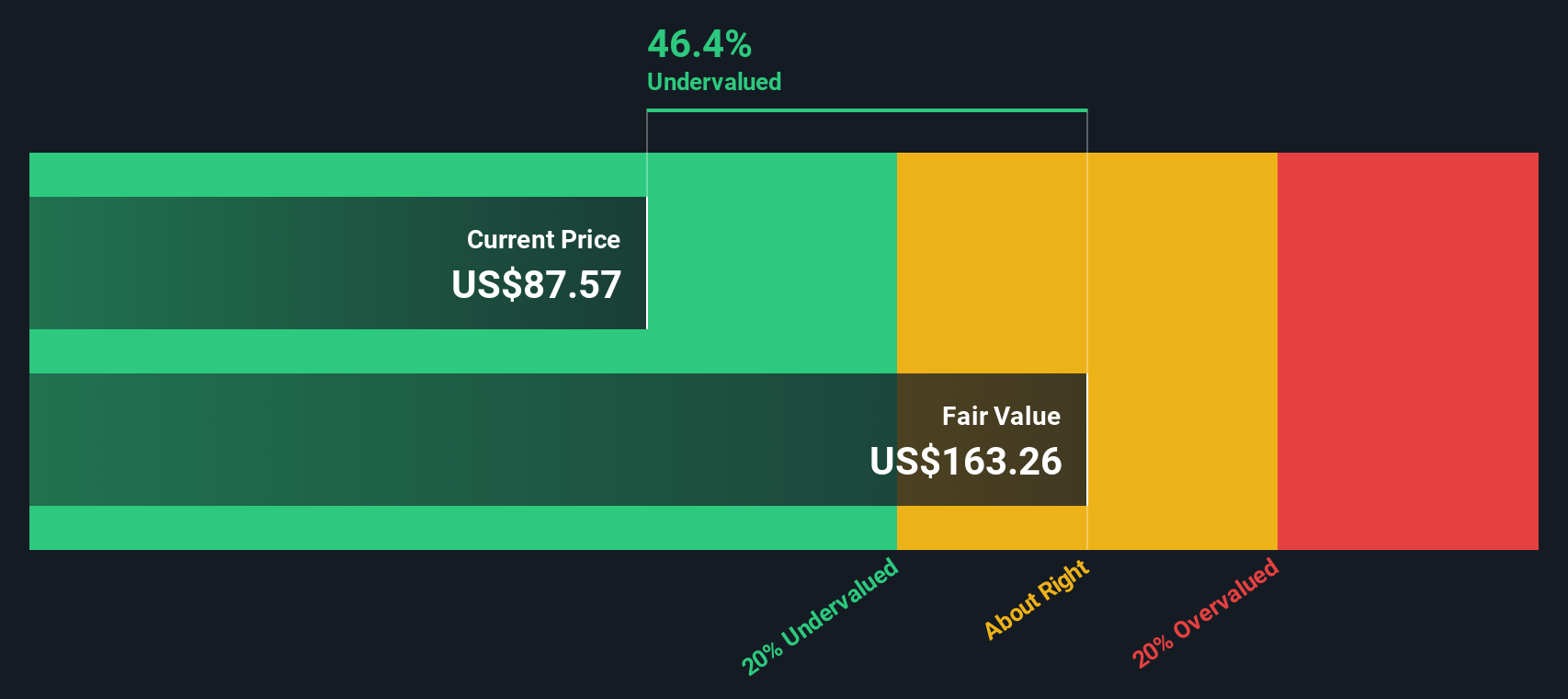

Looking at the SWS DCF model, Incyte’s stock appears strikingly undervalued, trading about 46% below its estimated fair value of $164.60. This offers a more optimistic perspective than the earlier approach and challenges the idea that upside is limited at today’s price. Which model tells the real story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Incyte Narrative

Prefer to reach your own conclusions or spot a different opportunity? You can craft your own interpretation of the numbers and story in under three minutes, so why not Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Incyte.

Looking for more investment ideas?

Smart investors never stop searching for their next win. Expand your strategy and uncover hidden gems or high-growth opportunities before everyone else does with Simply Wall Street’s powerful screeners:

- Target future tech breakthroughs by checking out these 26 quantum computing stocks, where rapid advancements could redefine what is possible in tomorrow's markets.

- Capture reliable income streams by adding these 18 dividend stocks with yields > 3%, which features leading companies offering robust dividend yields above 3%.

- Get ahead of Wall Street whispers and consider these 24 AI penny stocks, which are making waves with cutting-edge artificial intelligence innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INCY

Incyte

A biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics in the United States, Europe, Canada, and Japan.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives