- United States

- /

- Biotech

- /

- NasdaqGS:INCY

A Look at Incyte (INCY) Valuation as New Oncology Results Drive Investor Interest

Reviewed by Simply Wall St

Incyte (INCY) has caught investors’ attention following the release of early clinical results for its TGFbR2xPD-1 bispecific antibody in MSS colorectal cancer and a novel KRAS G12D inhibitor for pancreatic cancer at ESMO Congress 2025.

These updates help shine a light on Incyte’s drug development pipeline, coming just as the company heads into its third-quarter earnings announcement. The presentation offered new data on therapies targeting areas in oncology where effective treatments remain limited. This might encourage further interest in the company's approach and near-term prospects.

See our latest analysis for Incyte.

Incyte’s recent momentum has built steadily in the wake of its pipeline updates and strong product launches, with the share price up a robust 27% over the last 90 days and total shareholder return reaching nearly 37% for the past year. Investors seem energized by both the encouraging clinical data and plenty of buzz ahead of quarterly results, which suggests increased confidence around growth potential and the outlook for the company’s drug portfolio.

For those looking to expand their watchlist beyond biotech, this could be the perfect moment to explore other healthcare innovators making waves. See the full lineup with See the full list for free.

With shares already rallying and analyst targets now close to current prices, investors are left to wonder whether Incyte remains undervalued or if the optimistic growth story is already fully reflected in the stock.

Most Popular Narrative: 5.4% Overvalued

With Incyte last closing at $89.31 and the most widely followed narrative assigning fair value at $84.76, shares currently trade above the consensus estimate. This gap draws attention to the numbers and expectations shaping Incyte's perceived valuation and highlights debate about whether recent momentum has outpaced fundamentals.

The company's more disciplined capital allocation strategy, prioritizing internal late-stage pipeline assets, operating expense control, and targeted business development, suggests increasing operating leverage and net margin expansion. This is evidenced by guidance for operating expenses to grow more slowly than revenues.

Which levers are really driving this higher price? This narrative points to razor-sharp cost discipline and new drugs, but what’s the wildcard in their fair value math? Only a few key forecasts tip the scales. Ready to find out what’s under the hood?

Result: Fair Value of $84.76 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued dependence on Jakafi and the threat of pipeline setbacks could quickly challenge the optimistic outlook that currently drives valuations.

Find out about the key risks to this Incyte narrative.

Another View: Discounted Cash Flow Signals Big Upside

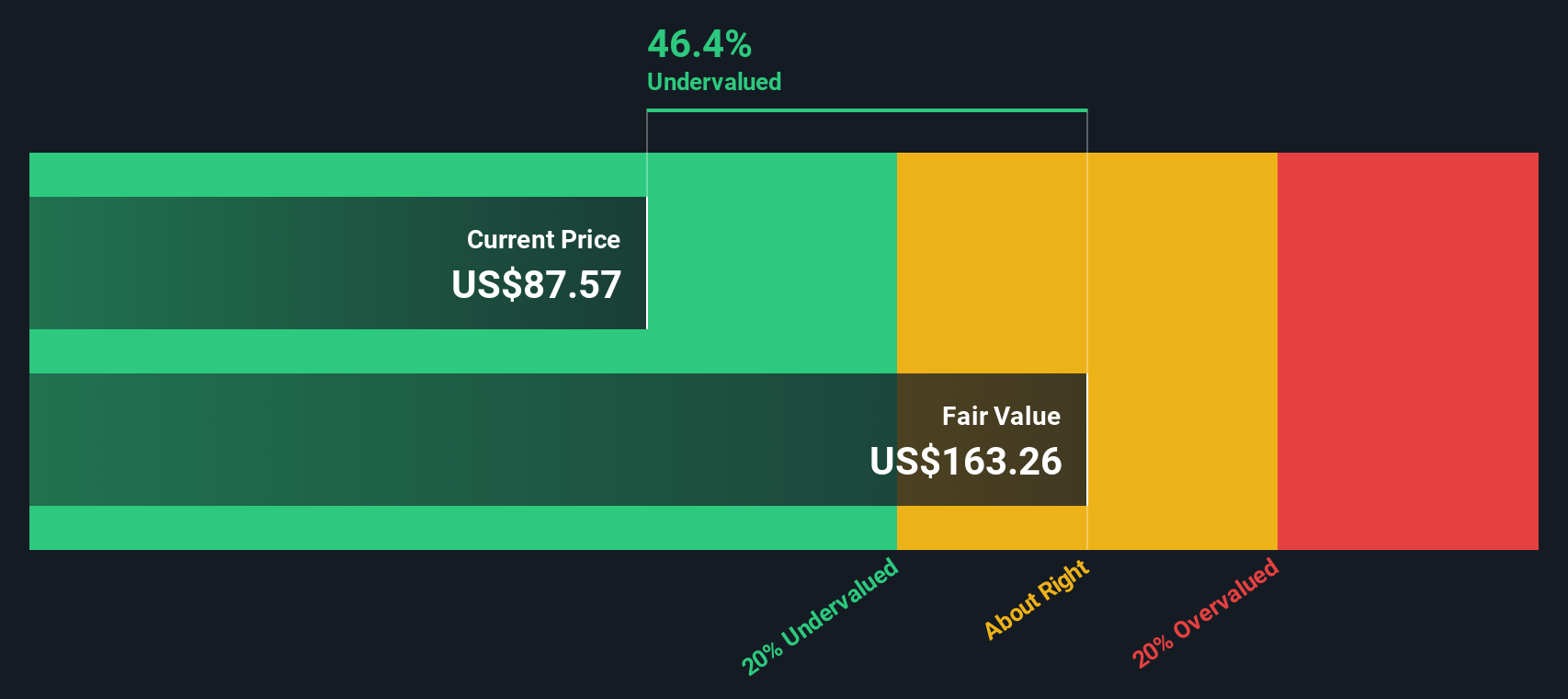

While market multiples suggest Incyte's shares are expensive, our SWS DCF model paints a more optimistic picture. By projecting future cash flows, it estimates the fair value at $163.43. This suggests the current price could be deeply discounted. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Incyte for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Incyte Narrative

If you want to see the story from your own angle or check the details for yourself, it's simple to build your perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Incyte.

Looking for more investment ideas?

Don't miss out on unique opportunities. Smart investors always keep their eyes open for the next market breakthrough. Now is your chance to find the trends others will talk about next year.

- Catch early movers making headlines by tracking these 3568 penny stocks with strong financials with robust financials and strong growth momentum.

- Capitalize on the artificial intelligence surge and see which innovators are already standing out using these 27 AI penny stocks.

- Secure your portfolio with income potential when you browse these 17 dividend stocks with yields > 3% that reliably deliver yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INCY

Incyte

A biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics in the United States, Europe, Canada, and Japan.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives