- United States

- /

- Biotech

- /

- NasdaqCM:IMTX

PRAME Oncology Advances Could Be a Game Changer for Immatics (IMTX)

Reviewed by Sasha Jovanovic

- Immatics recently reported third quarter earnings, revealing a wider net loss of €50.55 million amid a significant decline in revenue, alongside promising clinical updates in its PRAME oncology programs.

- Despite higher losses, the company’s clinical advancements, including a 30% confirmed overall response rate in early-stage trials for its IMA402 PRAME Bispecific and a cash reserve of US$505.8 million, signal continued momentum in its cancer therapy pipeline.

- We'll explore how Immatics’ progress in its PRAME franchise enhances its investment narrative through clinical proof-of-concept and pipeline strength.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Immatics' Investment Narrative?

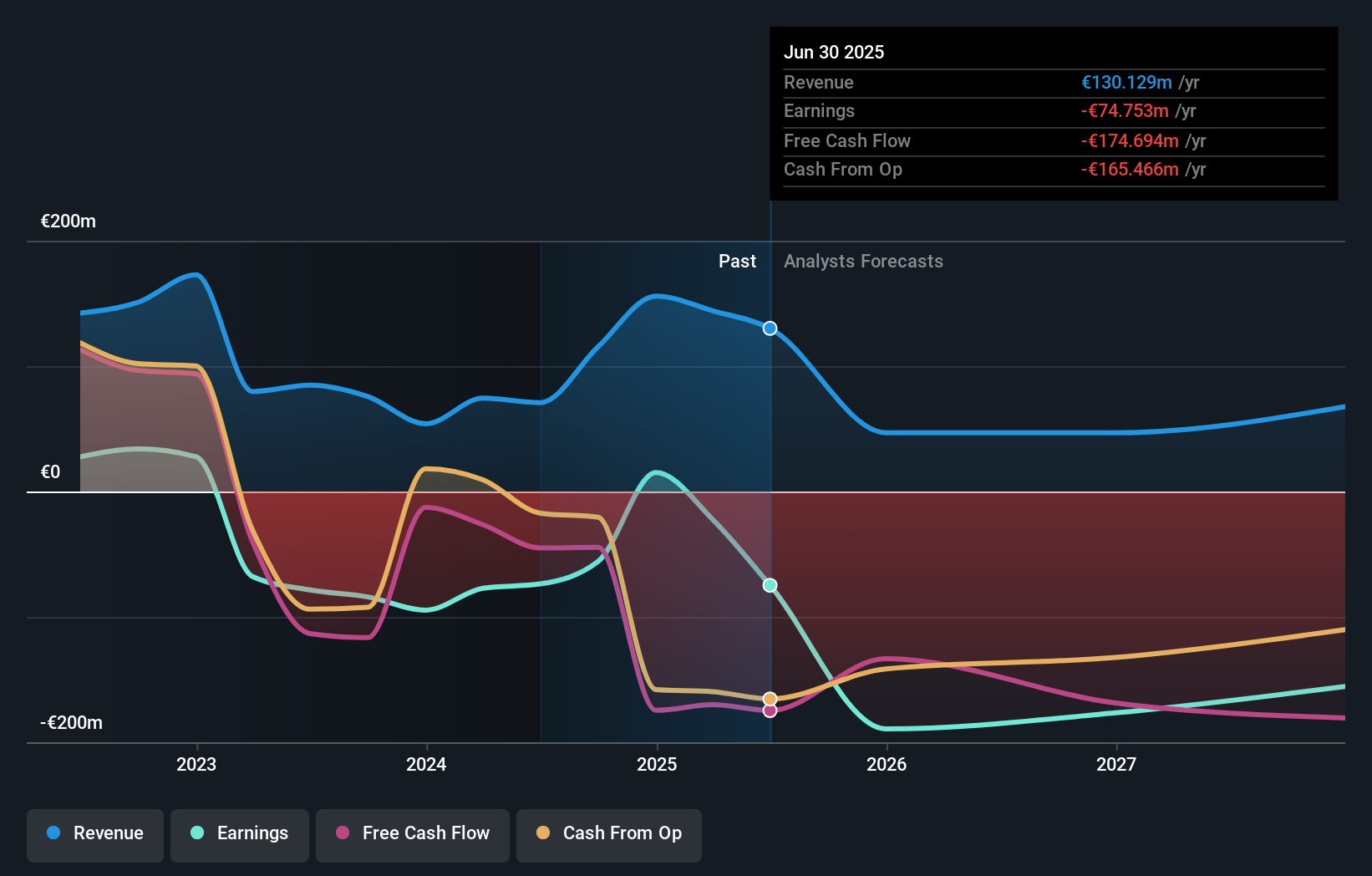

For investors considering Immatics, the core belief centers on the company’s potential to translate its cutting-edge PRAME oncology franchise into future therapies that can reshape cancer treatment. The recent news confirms that, despite a much wider quarterly loss and declining revenue, Immatics achieved meaningful clinical milestones, including a 30% confirmed overall response rate in early-stage PRAME trials and progress toward Phase 3 programs. These gains reinforce clinical proof-of-concept and keep the next major catalysts, like the Phase 3 SUPRAME trial and anticipated regulatory submissions, firmly in sight. However, the spike in losses does sharpen attention on cash burn and the pace of clinical development, especially as funding will need to support ongoing trials through 2027. The immediate impact of recent data largely maintains, rather than disrupts, the current risk-reward profile, but keeps execution risk front and center for shareholders.

However, rapid spending and unproven therapies remain challenges that could impact future outcomes.

Exploring Other Perspectives

Explore 4 other fair value estimates on Immatics - why the stock might be worth over 3x more than the current price!

Build Your Own Immatics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Immatics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Immatics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Immatics' overall financial health at a glance.

No Opportunity In Immatics?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:IMTX

Immatics

A clinical-stage biopharmaceutical company, focuses on the research and development of potential T cell redirecting immunotherapies for the treatment of cancer in the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives